Gold remains one of the world’s most sought-after assets, and its price movements serve as a key indicator of global economic health. On February 28, 2025, gold opened at $2,855.68 per ounce with a decrease of 0.63%, a figure that has set the stage for a dynamic trading day.

This exclusive Gold Price Analysis for February 28, 2025 examines the factors influencing this opening move, including inflation, geopolitical events, and broader economic developments. In addition, we will discuss what investors can expect for gold as the market approaches the close.

Market Overview: Gold Price Trends on February 28, 2025

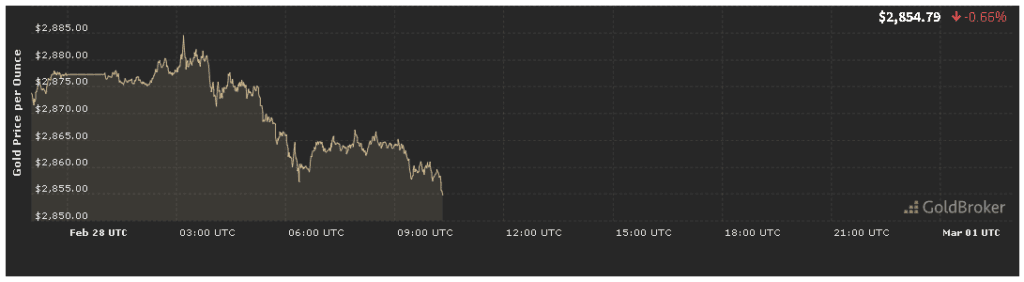

Gold’s performance on February 28, 2025 is particularly noteworthy. The opening price of $2,855.68 per ounce marked a slight decline of 0.63% compared to previous sessions. This drop may seem modest, but in the context of current global economic uncertainty, even small percentage changes can reflect significant shifts in investor sentiment.

Understanding the Opening Price

The opening price acts as a bellwether for the day’s trading activity. On February 28, 2025, traders noted that the modest decline suggested cautious optimism among market participants. A decrease of 0.63% indicates that while there is some downward pressure, the overall sentiment remains balanced. Investors are weighing the impact of various external factors—from inflation data to geopolitical tensions—before committing fully to bullish or bearish positions.

The Importance of Daily Price Movements

Daily price fluctuations in the gold market are influenced by myriad factors. In this analysis, the focus is on understanding how these factors converged to produce the opening price. By examining key economic indicators, market sentiment, and technical signals, investors can gain a clearer picture of the forces at work and better anticipate potential market movements throughout the day.

Economic and Inflation Indicators Affecting Gold Price

Economic data and inflation trends are major drivers behind gold’s price fluctuations. As a traditional hedge against inflation, gold tends to attract investors during times of economic uncertainty and rising prices.

Inflation’s Role in Gold Price Dynamics

Inflation erodes the purchasing power of money, prompting investors to look for assets that can preserve their wealth over time. On February 28, 2025, any upward pressure in inflation rates has likely contributed to gold’s appeal as a safe-haven asset. However, the slight decline at the open suggests that investors may be anticipating tighter monetary policy measures from central banks in the near term, which could counteract some of gold’s traditional appeal during inflationary periods.

How Inflation Impacts Investor Behavior

When inflation is high, the cost of living increases, and the value of fiat currencies diminishes. As a result, investors often pivot to gold because it historically retains its value during periods of high inflation. However, if central banks respond by increasing interest rates to combat inflation, the opportunity cost of holding non-yielding gold rises. This balancing act between the protective qualities of gold and the potential benefits of higher yields on other assets is critical in shaping market behavior on February 28, 2025.

Broader Economic Indicators

Other economic events, such as employment reports, GDP growth data, and manufacturing indices, also influence gold prices. Positive economic data might signal robust economic activity, encouraging investors to shift towards riskier assets like equities and away from gold. Conversely, any signs of economic slowdown can drive investors back to gold as a secure store of value.

Central Bank Policies and Their Impact

The expectations surrounding central bank policies, particularly those of the Federal Reserve, are pivotal. If market participants expect the Fed to tighten monetary policy in response to inflation, this could strengthen the U.S. dollar and put downward pressure on gold prices. On February 28, 2025, any signals from the Fed regarding future rate hikes or a change in policy direction are likely to have a direct impact on gold’s performance.

Geopolitical Events Influencing Gold Price

Geopolitical uncertainties often have a profound effect on the gold market. Investors traditionally turn to gold during times of global tension as a safe-haven asset.

Current Geopolitical Climate

On February 28, 2025, ongoing geopolitical tensions continue to create an environment of uncertainty. Whether stemming from regional conflicts, trade disputes, or broader international power struggles, these factors play a significant role in shaping investor sentiment. Even a slight escalation in global tensions can lead to a rapid inflow of capital into gold.

Impact of International Conflicts

Historically, conflicts and geopolitical strife have driven up the price of gold as investors seek refuge from instability in the equity and currency markets. For example, tensions in strategically significant regions or disputes between major global powers can result in heightened demand for gold. The market’s reaction on February 28, 2025, reflects this cautious approach as investors remain alert to any developments that might further destabilize the global landscape.

Trade Relations and Diplomatic Developments

Trade disputes and diplomatic negotiations also have a considerable influence on gold prices. Recent shifts in trade policies or unexpected diplomatic breakthroughs can lead to rapid market adjustments. On February 28, 2025, any changes in the global trade environment, whether improvements or setbacks, are likely to be factored into the price of gold.

Technical Analysis: Chart Patterns and Trading Volume

In addition to fundamental factors, technical analysis provides valuable insights into the short-term direction of gold prices. Traders use various tools, including chart patterns, resistance levels, and volume indicators, to make informed decisions.

Identifying Key Chart Patterns

Technical analysts have observed that gold’s price tends to form identifiable patterns that signal potential reversals or continuations in trend. On February 28, 2025, the opening price of $2,855.68 per ounce is being scrutinized in the context of previous trading sessions. If the price approaches significant resistance levels, it may indicate a pause or reversal in the current trend.

Support and Resistance Levels

Support and resistance levels are critical in the technical analysis of gold. Support levels indicate the price at which buyers are likely to enter the market, whereas resistance levels represent the price at which sellers are likely to dominate. Traders on February 28, 2025, are closely monitoring these levels to gauge whether the market will experience a bounce-back or continue to decline.

Volume Analysis and Momentum Indicators

Trading volume is another essential metric that helps confirm the strength of a price move. A decline of 0.63% might be accompanied by high trading volumes, suggesting strong selling pressure. Conversely, low volume during a decline could indicate that the move is more of a temporary correction.

Momentum Indicators in Play

Indicators such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) are routinely used to measure momentum. On February 28, 2025, if these indicators signal oversold conditions, traders might expect a potential rebound in gold prices, even if short-term sentiment appears bearish.

Market Expectations Until the Close

With gold opening at $2,855.68 per ounce and experiencing a decrease of 0.63%, the remainder of the trading day holds several possibilities. Market participants are focused on upcoming data releases and evolving market sentiment.

Anticipating a Rebound or Continued Decline

The initial price movement sets the stage for either a recovery or further decline. If new economic data or geopolitical events emerge during the day, they could either bolster investor confidence, leading to a rebound, or add to the prevailing bearish sentiment.

Impact of Mid-Day Economic Releases

Mid-day economic indicators—such as inflation reports, employment data, or manufacturing indices—will be crucial in shaping market sentiment. Positive reports might trigger a rally, while negative news could reinforce the downward trend. Investors on February 28, 2025, are particularly attentive to these releases as they provide real-time feedback on the health of the economy.

Short-Term Trading Strategies

For short-term traders, the focus is on capitalizing on intraday volatility. Technical indicators, such as moving averages and trend lines, will guide their trading decisions. A temporary oversold condition might present a buying opportunity for those expecting a bounce-back, whereas sustained selling pressure could signal further declines.

The Role of High-Frequency Trading

High-frequency traders, leveraging advanced algorithms, are also active in the gold market. Their rapid-fire trades based on real-time data can contribute to increased volatility. This dynamic environment means that even small movements can create significant trading opportunities or risks.

Expectations for Market Close

As the day progresses, the market is likely to settle into a more defined trend. By the close, if the underlying economic and geopolitical conditions remain unchanged, many analysts expect that the price of gold will stabilize near the opening level or slightly below it. However, if any major news breaks, we could witness a sharp reversal in sentiment.

Potential Scenarios for the Close

- Rebound Scenario: If positive economic data is released or if there is a calming of geopolitical tensions, we could see gold rebound from its early losses. Investors may view the dip as a temporary correction, leading to buying pressure that drives prices back up.

- Continued Decline: Conversely, if the bearish sentiment strengthens—due to disappointing economic data or escalating geopolitical risks—gold might continue its downward trend. A prolonged period of selling could push the price lower before the close.

- Stabilization: A third scenario is that the market consolidates, with trading volumes tapering off as investors await further news. In this case, the price may stabilize around the current level, reflecting a balance between buyers and sellers.

Broader Implications for Investors

Understanding the movements of gold on February 28, 2025, is not just about tracking a single day’s performance—it has broader implications for investment strategies across multiple asset classes.

Gold as a Hedge Against Uncertainty

Historically, gold has served as a reliable hedge against both inflation and geopolitical uncertainty. Its performance on February 28, 2025, is a testament to its enduring role as a safe-haven asset. For long-term investors, temporary fluctuations in price provide an opportunity to reallocate assets and protect wealth against broader economic risks.

Portfolio Diversification Strategies

Many financial advisors recommend including gold in diversified investment portfolios. Even if the short-term outlook appears volatile, gold’s historical performance during periods of economic stress makes it a valuable component of a balanced investment strategy.

Short-Term Versus Long-Term Perspectives

For day traders, the focus is on capitalizing on short-term volatility. In contrast, long-term investors view gold as a strategic asset that can preserve wealth over time. On February 28, 2025, while the opening decline of 0.63% might worry short-term traders, long-term investors are more likely to see it as an opportunity to acquire a historically resilient asset at a favorable price.

Conclusion

The Gold Price Analysis for February 28, 2025 reveals a nuanced picture of market sentiment. With gold opening at $2,855.68 per ounce and experiencing a 0.63% decline, the early trading activity suggests a cautious approach by investors in response to prevailing economic, inflationary, and geopolitical factors.

Throughout the day, key economic indicators, including inflation data and central bank policy signals, will play a decisive role in determining whether the market rebounds or continues to decline. Simultaneously, geopolitical events and technical trading signals will add further layers of complexity to the market dynamics. Whether you are a short-term trader looking to capitalize on intraday volatility or a long-term investor seeking a safe haven amid economic uncertainty, understanding these driving factors is essential.

As the market moves toward its close on February 28, 2025, expectations remain mixed. Should positive economic data emerge, we may see a rebound that reverses the initial decline. On the other hand, if negative news prevails, gold may continue its downward trend before stabilizing at a new equilibrium. For now, investors are advised to remain vigilant and adaptive, as the interplay between economic fundamentals and technical indicators will ultimately dictate the market’s trajectory.

In summary, this exclusive Gold Price Analysis for February 28, 2025 provides a comprehensive look into the factors influencing the gold market on a pivotal day. By monitoring inflation, geopolitical developments, and economic events, investors can better navigate the complexities of this volatile market. Whether you are adjusting your portfolio for long-term stability or planning short-term trades, staying informed about these critical factors will be key to making sound investment decisions.

By following these insights and keeping an eye on real-time market developments, you can position yourself to better respond to the evolving trends in the gold market. The performance of gold on February 28, 2025, is more than just a snapshot in time—it is a reflection of global economic forces at play. Stay tuned for further updates as the trading day unfolds, and use this analysis as a guide for your investment strategy in the ever-changing financial landscape.

Discover more from Dhbna

Subscribe to get the latest posts sent to your email.