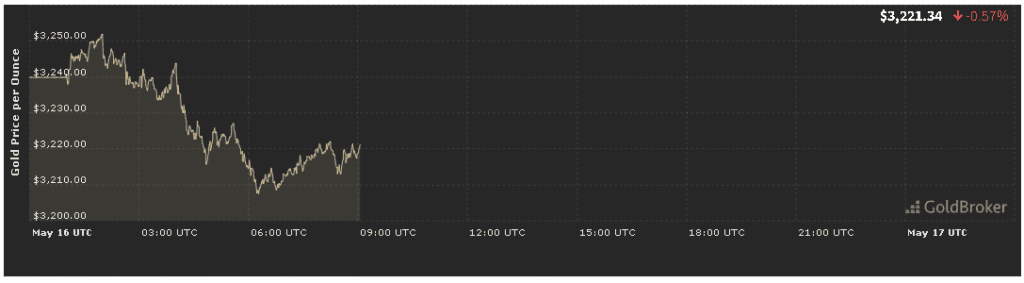

Gold opened at $3,221.34 per ounce on May 16, 2025, marking a 0.57% decrease from yesterday’s close. In today’s Gold Price Analysis, we unpack the economic forces behind this modest pullback and deliver a comprehensive Daily Gold Report. By examining inflation data, Federal Reserve signals, geopolitical developments, and technical indicators, we’ll reveal the Gold Market Trends shaping price action. We’ll also share Gold Investment Insights and outline expectations for gold until the market closes, helping traders and investors navigate the remainder of the trading day.

U.S. Inflation and Its Impact on Gold Price Today

CPI and PPI Readings

As part of our Economic Analysis of the Gold Price May 16, 2025, the latest U.S. inflation figures played a pivotal role. The Bureau of Labor Statistics reported April’s Consumer Price Index (CPI) rose 0.2% month-over-month and 2.5% year-over-year, slightly above consensus forecasts of 0.1% and 2.3%. Core CPI (excluding food and energy) climbed 0.3%, signaling persistent services inflation.

- Producer Price Index (PPI): April’s PPI registered 0.1% month-over-month, reinforcing the view of modest upstream price pressures.

- Real Yields: Softer-than-expected headline CPI kept real yields on 10-year TIPS in slightly negative territory, maintaining some support for gold’s inflation-hedge appeal.

In this context, our Gold Price Analysis shows that elevated inflation readings partially offset safe-haven bids, resulting in today’s 0.57% dip. Traders reacted to mixed signals: inflation remains sticky, yet slowed enough to dampen aggressive gold buying.

Federal Reserve Signals and Gold Market Trends

Fed’s Data-Dependent Stance

Federal Reserve commentary continues to influence Gold Price Today. Minutes from the May 6–7 FOMC session reiterated a “data-dependent” policy approach, with officials divided on the pace of future rate cuts. Key takeaways:

- Rate-Cut Expectations: Markets now price in just one quarter-point cut by year-end, down from two cuts projected last month.

- Yield Impact: U.S. 2-year and 10-year Treasury yields rose by 10–12 basis points, making non-yielding gold less attractive.

These developments feature prominently in our Economic Analysis of the Gold Price May 16, 2025, illustrating how evolving Fed expectations drive Gold Market Trends and weigh on bullion.

Geopolitical Factors in the Daily Gold Report

Middle East and Red Sea Concerns

Geopolitical risk often underpins gold’s safe-haven status. Over the weekend, attacks on commercial vessels in the Red Sea corridor briefly elevated oil prices and gold by roughly $8–$10 per ounce. However, coalition naval escorts quickly quelled the immediate threat.

- Volatility Spike: Gold’s jump proved fleeting as energy markets stabilized, underscoring the transient nature of some geopolitical catalysts.

- Broader Outlook: Persistent tensions in the Persian Gulf continue to lurk as potential triggers for renewed safe-haven demand.

Our Daily Gold Report highlights that while short-term flare-ups inject volatility, lasting price support requires sustained geopolitical escalation.

Eastern Europe and Asia Flashpoints

Meanwhile, stalled ceasefire talks in Eastern Europe kept baseline risk premiums intact, while comments from Chinese trade negotiators hinted at renewed tariff rollbacks. These mixed signals:

- Europe: Ongoing Russia–Ukraine tensions provide a floor under risk sentiment.

- Asia: Prospects of eased U.S.–China trade frictions could boost risk appetite, tempering gold’s appeal.

In our Gold Price Analysis, we weigh these regional dynamics to assess their net effect on today’s price action.

Technical Analysis: Chart Cues for Gold Investment Insights

Key Support and Resistance Levels

Technical chart patterns offer clarity amid fundamental noise. Today’s gold price action features:

- Immediate support: $3,210 (today’s low and 50‐hour moving average).

- Secondary support: $3,200 (psychological level and prior consolidation).

- Immediate resistance: $3,240 (overnight high).

- Key breakout threshold: $3,260 (late-May swing high).

Gold’s inability to reclaim $3,240 confirms short-term bearish momentum in our Gold Price Analysis. A break below $3,200 could open the door to $3,180.

Momentum and Oscillators

- RSI (4-hour): RSI drifted to 48, indicating bearish bias without reaching oversold extremes.

- MACD: The MACD histogram turned mildly negative, endorsing downward pressure.

These Gold Investment Insights suggest traders monitor oscillators for early signs of a relief bounce near key support.

Market Sentiment and Positioning

ETF Flows in the Daily Gold Report

According to the World Gold Council, gold ETFs saw net outflows of 4.5 tonnes last week, marking a reversal from modest inflows earlier in May. Institutional risk-off positioning has eased, aligning with today’s price softness.

Futures and COT Data

Commitments of Traders (COT) data reveal speculators reduced net-long positions by 2,700 contracts on COMEX, while hedgers modestly increased longs. This shift underscores cautious sentiment and supports our Economic Analysis of the Gold Price May 16, 2025 view of tepid buying interest.

U.S. Economic Events Ahead & Intraday Expectations

Looking forward, several catalysts could sway gold before the close. Our Gold Price Analysis identifies:

- Building Permits & Housing Starts (8:30 AM ET):

- Strong housing data may bolster risk appetite and weigh on gold.

- Weak results could trigger safe-haven bids.

- Philly Fed Manufacturing Index (10:00 AM ET):

- A rebound above zero signals manufacturing recovery, pressuring bullion.

- A drop heightens recession concerns and boosts gold.

- Fed Speakers:

- Hawkish regional Fed remarks could reinforce dollar strength.

- Dovish comments may spark a relief rally toward $3,240.

Scenarios for Gold Until Market Close

- Bearish Continuation: Strong housing and manufacturing data + hawkish Fed → test $3,200 support.

- Range-Bound Trading: Mixed data and neutral Fed speak → trade between $3,210–$3,240.

- Relief Bounce: Surprise dovish tone or weaker economic prints → bounce to $3,240–$3,260.

These scenarios form the basis of our Gold Investment Insights for the remainder of May 16, 2025.

Conclusion

This economic analysis of the gold price May 16, 2025 reveals that today’s 0.57% decline to $3,221.34 stems from firmer real yields, a stronger dollar, mixed inflation data, and fleeting geopolitical risks. Key takeaways for traders and investors:

- Monitor U.S. inflation trends and Fed policy cues to gauge gold’s macro backdrop.

- Track geopolitical developments for intermittent safe-haven flows.

- Use technical levels at $3,210 and $3,240 as actionable support/resistance.

- Watch economic releases and Fed speakers for intraday volatility.

✨ For real-time gold quotes, expert commentary, and our full Daily Gold Report, bookmark our Gold Live Tracker and subscribe to our market newsletter. Trade smarter with up-to-the-minute Gold Market Trends and Gold Investment Insights.