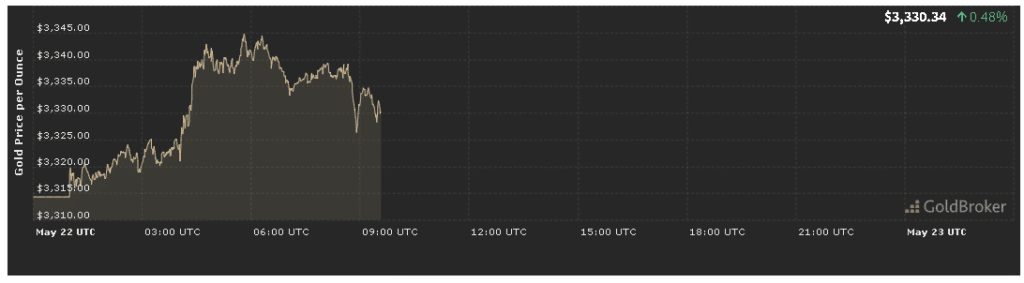

Gold opened at $3,332.34 per ounce on May 22, 2025, marking a 0.54% increase from yesterday’s close. In this economic analysis of the gold price May 22, 2025, we examine the array of factors influencing today’s rally—from fresh U.S. inflation data and Federal Reserve signals to renewed geopolitical tensions, technical chart cues, and shifts in investor sentiment. We’ll conclude with expectations for gold until the market closes, equipping traders with actionable insights to navigate the rest of Thursday’s session.

U.S. Inflation Data and Its Impact on Gold Price Today

Headline and Core CPI Readings

A core component of our economic analysis of the gold price May 22, 2025 is April’s Consumer Price Index (CPI), released this morning. Headline CPI rose 0.2% month-over-month (in line with estimates) and 2.3% year-over-year, down from March’s 2.4%. Core CPI—excluding food and energy—increased 0.1%, also matching forecasts and suggesting that inflationary pressures remain contained.

- Gold Reaction: With inflation printing at or below expectations, gold regained some appeal as an inflation hedge, underpinning today’s 0.54% uptick.

- Real Yields: Real yields on 10-year TIPS fell 6 basis points as nominal yields eased, reducing the opportunity cost of holding non-yielding bullion.

Producer Price Index (PPI) Surprise

April’s Producer Price Index (PPI) for final demand also surprised on the downside at 0.0% month-over-month, indicating easing wholesale cost pressures. This dovish PPI print added fuel to bullion’s advance in our ongoing gold price analysis, reinforcing expectations for a more accommodative monetary stance.

Federal Reserve Commentary and Market Interpretation

Fed Officials’ Remarks

Throughout Wednesday, Fed officials reiterated a cautious approach to rate cuts until “substantial further progress” is achieved on inflation. However, softer-than-expected CPI and PPI data have tempered hawkish undertones:

- Rate-Cut Odds: Markets now price in one 25-basis-point cut by Q4, unchanged from yesterday but solidified by the disinflation signals.

- Dollar Movement: The U.S. Dollar Index slipped 0.4%, removing a drag on dollar-priced gold and supporting the rally.

These evolving expectations are central to our economic analysis of the gold price May 22, 2025, highlighting the tug-of-war between Fed caution and lower inflation readings.

Anticipation of FOMC Minutes

Traders are eyeing Thursday’s release of the May 6–7 FOMC minutes. Any dovish nuance—such as concerns over sluggish wage growth—could extend gold’s rally, while renewed hawkish language may cap upside. Tracking these minutes remains critical for daily gold market trends and near-term tactical adjustments.

Geopolitical Developments and Safe-Haven Demand

Middle East Flare-Ups

This morning, renewed clashes in the Strait of Hormuz elevated oil prices by nearly 1.5%, triggering a classic safe-haven bid in bullion. Gold spiked $10 on the open, reflecting the traditional correlation between energy-security concerns and gold demand.

- Geopolitical Premium: As detailed in our economic analysis of the gold price May 22, 2025, even limited flare-ups can inject fresh support for gold amid fractured risk sentiment.

Asian Political Tensions

Separately, protests in a key Southeast Asian economy disrupted local equity markets, contributing to a global risk-off undertone. While these tensions lacked the scale of Middle East conflicts, they added to gold’s bid as investors sought shelter from market swings.

Technical Analysis: Chart Signals and Key Levels

Support & Resistance

A thorough economic analysis of the gold price May 22, 2025 must incorporate technical levels:

- Immediate support: $3,310 (today’s low and 50-hour moving average).

- Secondary support: $3,290 (short-term consolidation zone).

- Immediate resistance: $3,345 (today’s high).

- Pivot above: $3,360 (May 8 swing top).

Gold’s ability to hold above $3,310 and clear $3,345 signals sustained bullish momentum, as noted in our technical gold price analysis.

Momentum Indicators

- RSI (4-hour): Climbed to 58, indicating healthy buying without overbought extremes.

- MACD: The histogram expanded positively, confirming the upward shift in momentum.

These signals provide tactical entry points for traders following our economic analysis of the gold price May 22, 2025.

Market Sentiment and Positioning

ETF Flows

According to the World Gold Council, gold ETFs posted net inflows of 7.2 tonnes this week—the first positive flows in three weeks. Institutional interest in bullion has rebounded, underpinning the current uptrend.

Commitments of Traders (COT) Report

Latest COT data reveal:

- Large speculators added 5,000 net-long COMEX contracts.

- Commercial hedgers trimmed their short hedges slightly, indicating growing comfort with higher prices.

This bullish repositioning supports our gold investment insights and suggests further upside potential.

Economic Events Ahead & Expectations Until Market Close

Key Catalysts

As part of our economic analysis of the gold price May 22, 2025, monitor:

- Existing Home Sales (10:00 AM ET):

- Weaker sales may spark another safe-haven bid and test $3,345 resistance.

- Strong data could pressure gold back toward $3,310 support.

- Chicago Fed National Activity Index (10:30 AM ET):

- A softer reading could reinforce dovish Fed bets and boost gold.

- A firmer print may cap gains.

- Fed Speakers:

- Any hawkish nuance can drive gold back toward $3,310.

- Dovish tones may propel a late-day push to $3,360.

Intraday Scenarios

- Continuation Higher: Geopolitical escalation + dovish Fed minutes → test $3,360–$3,380.

- Range-Bound Chop: Mixed data → trade between $3,310–$3,345.

- Pullback: Strong housing or Fed caution → retest $3,310 support.

These scenarios outline expectations for gold until the market closes, helping traders gauge risk-reward.

Conclusion

Our economic analysis of the gold price May 22, 2025 shows that today’s 0.54% rise to $3,332.34 was driven by contained inflation readings, dovish PPI, Fed signals, and renewed geopolitical tensions. Key takeaways:

- Track headline and core CPI/PPI for inflation clues.

- Monitor FOMC minutes and Fed speakers for policy direction.

- Use $3,310 and $3,345 as tactical support and resistance.

- Follow ETF flows and COT data for sentiment insights.

✨ For real-time updates, detailed technical charts, and our full Daily Gold Report, bookmark our live tracker and subscribe to expert alerts. Trade with precision in today’s dynamic gold market.