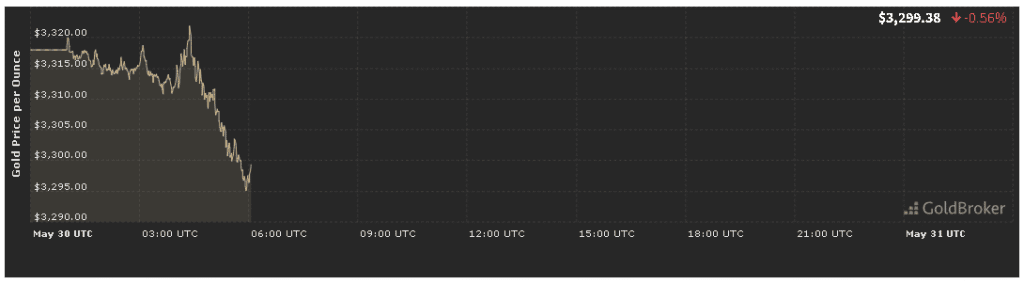

Gold opened at $3,298.22 per ounce on May 30, 2025, marking a 0.60% decline from the previous session’s close. In this economic analysis of the gold price May 30, 2025, we explore the confluence of factors driving bullion’s move—from fresh U.S. inflation and GDP data to Federal Reserve commentary, escalating geopolitical risks, and chart‐based signals. We also outline expectations for gold until the market closes, providing traders and investors with actionable insights for navigating the final hours of trading.

U.S. Macro Data: Inflation and Growth in Focus

GDP and Durable Goods Reports

Today’s U.S. GDP revision showed 1.8% annualized growth in Q1 (vs. 2.1% initial estimate), while durable goods orders for April fell 0.5% (against +0.2% forecast). Slower growth and weakening manufacturing demand raise questions about economic momentum.

- Gold Impact: In our economic analysis of the gold price May 30, 2025, slower GDP growth reinforced safe‑haven appeal, but the durable goods miss bolstered the dollar’s “risk off” bid, pressuring gold.

- Real Yields: U.S. 10‑year Treasury yields dipped 4 basis points, but real yields held firm near 0.75%, keeping the opportunity cost of gold elevated.

Pending CPI and PCE Inflation

Traders now shift focus to Thursday’s May CPI and PCE readings. The Fed’s favored PCE gauge is expected to show a 0.1% monthly rise, while CPI may tick down slightly.

- Gold’s Waiting Game: Gold’s 0.60% slide reflects traders’ caution ahead of these critical data points. A softer PCE could spark a relief rally; a hotter print would reinforce dollar strength.

Federal Reserve Positioning: Patience vs. Vigilance

Fed Speeches and Market Pricing

Fed officials over the week struck a balanced tone—acknowledging persistent inflation but highlighting vulnerabilities in growth. Markets now price in only one 25‑bp cut by year‑end, compared to two cuts earlier this month.

- Dollar Strength: A firmer Fed outlook has propelled the U.S. Dollar Index up 0.4%, as noted in our economic analysis of the gold price May 30, 2025, weighing on dollar‑priced gold.

- Gold Outlook: Without clear signs of imminent easing, gold remains under pressure, with investors seeking confirmation in upcoming Fed minutes.

FOMC Minutes and Forward Guidance

Thursday’s release of May 6–7 FOMC minutes will be pivotal. Any nuance of Fed hesitation or concerns over “sticky” services inflation could trigger gold’s next move.

Geopolitical Risk: Safe‑Haven Dynamics

Middle East Tensions Escalate

A flare‑up in Red Sea shipping attacks overnight sent oil prices 1.8% higher and triggered a brief gold spike of 0.7%. As security measures restored calm, bullion relinquished gains.

- Analysis Insight: Gold’s fleeting reaction underscores its dual role as an inflation hedge and geopolitical insurance—key themes in our economic analysis.

Asia‑Pacific Trade Strains

News of renewed export restrictions between major Asia‑Pacific economies added to a risk‑off tone. While not enough to reverse today’s fall, these developments underpin a defensive bid for gold if hostilities escalate further.

Technical Analysis: Chart Levels to Watch

Support & Resistance

In any robust economic analysis of the gold price May 30, 2025, chart thresholds guide tactical plays:

- Immediate Support: $3,290 (today’s low & 50‐hour MA)

- Secondary Support: $3,270 (late‐May consolidation floor)

- Immediate Resistance: $3,315 (yesterday’s high)

- Key Pivot: $3,350 (May 23 swing top)

Holding above $3,290 is crucial to avoid testing $3,270, while reclaiming $3,315 would signal short‐term stabilization.

Momentum Indicators

- RSI (4‐hour): 42, indicating bearish momentum without being oversold.

- MACD: Below its signal line, confirming today’s downside bias.

Market Sentiment & Positioning

ETF Flows

World Gold Council data shows net outflows of 1.2 tonnes from gold ETFs this week, consistent with profit‐taking and tempered demand.

COT Report Highlights

As of May 20, CFTC’s COT report noted:

- Large speculators cut net‐long positions by 2,000 COMEX contracts.

- Commercial hedgers increased shorts, reflecting cautious risk management.

These shifts align with the measured pullback in gold seen today.

Economic Events Ahead & Intraday Outlook

Key Catalysts

- Pending CPI/PCE (Thursday):

- Weaker than expected: spark relief rally back to $3,315–$3,330.

- Stronger than expected: pressure gold toward $3,290–$3,270.

- Fed Speakers & U.S. Weekly Claims:

- Dovish nuance or rising jobless claims: boost gold.

- Hawkish tone or low claims: weigh on gold.

Intraday Scenarios

- Bearish Continuation: Soft durable goods + hawkish Fed hints → test $3,290 and $3,270.

- Range‐bound Chop: Mixed domestic + geopolitical signals → trade between $3,290–$3,315.

- Relief Rally: Soft inflation data or renewed maritime risk → rebound to $3,350.

These scenarios outline expectations for gold until the market closes, guiding risk management and target adjustments.

Conclusion

Our economic analysis of the gold price May 30, 2025 shows that today’s 0.60% drop to $3,298.22 was driven by mixed U.S. growth data, guarded Fed positioning, temporary geopolitical safe‐haven bids, and modest ETF outflows. Key takeaways:

- Monitor GDP & durable goods for growth cues.

- Track CPI/PCE & Fed minutes for policy direction.

- Use $3,290 and $3,315 as tactical support/resistance.

- Follow ETF flows & COT data to gauge sentiment.

✨ For live updates, detailed charts, and our full Daily Gold Report, bookmark our platform and subscribe to expert alerts. Navigate today’s gold market with confidence and precision!