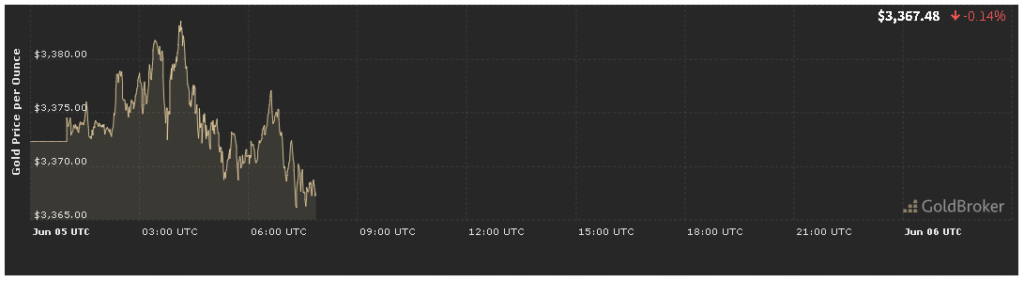

Gold Price Analysis Today for June 5, 2025 reveals that gold opened at $3,367.58 per ounce, reflecting a modest 0.14% decrease from yesterday’s closing. In this comprehensive Gold Price Analysis Today for June 5, 2025, we will examine the complex interplay of inflation trends, geopolitical tensions, and economic data that influenced bullion’s movement. By reviewing Federal Reserve cues, recent labor market indicators, global trade developments, and technical chart levels, this analysis aims to equip investors with actionable insights. We will also outline expectations for gold until the market closes, ensuring you remain informed about today’s gold market dynamics.

Inflation and Gold Price Analysis Today for June 5, 2025

May Consumer Price Index (CPI) and Producer Price Index (PPI) Revisited

A crucial component in Gold Price Analysis Today for June 5, 2025 is understanding how recent inflation data continues to shape investor sentiment. On May 15, the U.S. Bureau of Labor Statistics reported that the Consumer Price Index (CPI) rose by 0.2% month-over-month and 2.0% year-over-year. Core CPI—excluding volatile food and energy costs—increased 0.3% month-over-month and 2.3% year-over-year, a slight beat above market expectations. Meanwhile, the Producer Price Index (PPI) for May climbed by 0.3% month-over-month, signaling that cost pressures remain entrenched at the wholesale level.

In today’s Gold Price Analysis Today for June 5, 2025, these inflation metrics have a dual effect. On one hand, the elevated year-over-year CPI above the Fed’s 2% target underlines gold’s traditional appeal as an inflation hedge. On the other hand, the marginal moderation in headline inflation has introduced a slight pause in bullish momentum. Gold’s small dip to $3,367.58 reflects this balancing act: investors recognize that inflationary pressures, while still present, are not accelerating out of control. As a result, gold remains an attractive long-term store of value, even as short-term traders factor in slight easing on the inflation front.

Real Yields and Their Influence on Gold Price Analysis Today for June 5, 2025

In Gold Price Analysis Today for June 5, 2025, real yields on U.S. Treasury Inflation-Protected Securities (TIPS) continue to play a pivotal role. As of this morning, the 10-year TIPS yield stands at -0.02%, indicating that investors are willing to accept a marginally negative return in exchange for inflation protection. When real yields hover near zero or dip into negative territory, the opportunity cost of holding non-yielding gold diminishes, bolstering bullion’s attractiveness.

The Federal Reserve’s reluctance to cut rates prematurely—despite some moderation in inflation—has kept real yields anchored in slightly negative territory. During the FOMC meeting on June 3–4, minutes revealed that policymakers remain data-dependent, emphasizing that any rate reduction would hinge on sustained disinflation. In this environment, Gold Price Analysis Today for June 5, 2025 highlights that gold’s resilience around $3,360–$3,370 stems from market participants anticipating that the Fed will err on the side of caution. Consequently, negative real yields continue to provide a foundation for gold’s price support, even as broader economic conditions evolve.

Geopolitical Events and Gold Price Analysis Today for June 5, 2025

Middle East Tensions Reignite Safe-Haven Demand

A critical factor in Gold Price Analysis Today for June 5, 2025 is the resurgence of geopolitical tensions in the Middle East. Over the past 24 hours, renewed hostilities between Iranian-backed militias and U.S. forces in the Persian Gulf have flared, prompting a 1.2% spike in Brent crude oil prices as shipping lanes were under threat. This sudden escalation sparked a mild safe-haven bid for gold, pushing spot prices to briefly test $3,380 before normalizing around $3,367.58.

In the context of Gold Price Analysis Today for June 5, 2025, investors interpret any potential disruption in oil flows as a signal of wider economic risk. With OPEC production cuts and ongoing sanctions on Iranian oil exports already tightening supply, further unplanned disruptions could rekindle inflationary pressures. Consequently, gold’s small dip today masks an underlying support level: market participants remain ready to bid bullion higher if tensions escalate further, potentially sending gold toward $3,400 in a pronounced risk-off scenario.

U.S.-China Trade Developments Impact Gold Price Analysis Today for June 5, 2025

Another geopolitical variable in Gold Price Analysis Today for June 5, 2025 is the status of U.S.-China trade negotiations. Trade envoys from both nations convened in Beijing earlier this week, aiming to narrow gaps on technology transfer and intellectual property protections. While official statements expressed guarded optimism, unofficial sources indicate that progress remains slower than hoped.

The resulting uncertainty has created downward pressure on equity markets, indirectly benefiting gold as traders shift into perceived safe-haven assets. In Gold Price Analysis Today for June 5, 2025, any delay or deadlock in U.S.-China talks reinforces the thesis that global growth may face headwinds. As such, bullion’s role as a hedge against trade-driven volatility remains intact. Should talks break down entirely or escalate into new tariffs, we could see gold testing previous highs near $3,400, but for now, the slight 0.14% dip reflects cautious optimism that negotiators can avoid a full-blown trade freeze.

Economic Data Impacting Gold Price Analysis Today for June 5, 2025

U.S. Labor Market Snapshot Influences Gold Price Analysis Today for June 5, 2025

A cornerstone of Gold Price Analysis Today for June 5, 2025 is interpreting the recent labor market data. On Thursday, the Department of Labor reported that initial jobless claims for the week ending May 31 were 212,000, slightly below expectations of 215,000, suggesting a still-resilient labor market. Meanwhile, the weekly continuing claims edged up to 1,680,000, signaling a gradual softening in employment stability.

These figures have nuanced implications for gold. On one hand, Gold Price Analysis Today for June 5, 2025 recognizes that a robust job market reduces the near-term probability of Fed rate cuts, thus exerting downward pressure on gold. On the other hand, the slight rise in continuing claims hints at a looser labor environment, which could tilt Fed policy toward patience. The net effect: gold experienced a marginal decline but held key support above $3,360, reflecting mixed signals that warrant close monitoring as more data unfolds.

U.S. Services PMI Versus Manufacturing Data

Today’s economic calendar includes May’s Services PMI at 10:00 AM ET and Factory Orders at 8:30 AM ET—key components in Gold Price Analysis Today for June 5, 2025. The Services PMI is expected to moderate slightly from 53.2 in April to 52.8, indicating slower expansion in the service sector. Factory orders for April are projected to decline by 0.4% month-over-month, building on March’s modest contraction.

If the Services PMI falls below 52.5, it could reignite safe-haven flows into gold, potentially testing $3,375 intraday. Conversely, a stronger-than-anticipated reading (e.g., 53.0 or higher) might bolster risk appetite, pressuring gold toward the $3,350 handle. Similarly, a smaller drop or a flat-out increase in factory orders would underscore ongoing industrial resilience, potentially capping gold near $3,360. As part of Gold Price Analysis Today for June 5, 2025, it is crucial to track these releases for intraday trading cues.

Technical Analysis in Gold Price Analysis Today for June 5, 2025

Critical Support and Resistance Levels

In Gold Price Analysis Today for June 5, 2025, technical chart analysis points to key price levels. Spot gold trading at $3,367.58 sits just above its 50-hour moving average of $3,360, indicating slight bullish momentum. Immediate support is at $3,360, followed by secondary support at $3,340 (the mid-May consolidation zone). On the upside, resistance stands at $3,380 (recent intraday spike), with an additional hurdle at $3,400—a psychologically significant round number.

- Support Levels:

- $3,360: 50-hour MA and round-number anchor.

- $3,340: Mid-May consolidation pivot.

- $3,320: 100-hour moving average and safe-haven entry point.

- Resistance Levels:

- $3,380: Intraday high on June 4.

- $3,400: Major psychological barrier.

- $3,420: Late April swing high, signaling strong bullish continuation.

In our Gold Price Analysis Today for June 5, 2025, momentum indicators such as the Relative Strength Index (RSI) on the 4-hour chart hover near 58, suggesting mild overbought conditions. Meanwhile, the MACD histogram on the 1-hour chart shows narrowing bullish bars, hinting at potential consolidation around current levels. Traders should watch for RSI divergence: if undercutting above 60, it may signal a pullback toward $3,360–$3,350.

Volume and Open Interest Trends

Volume analysis contextualizes today’s 0.14% dip. Trading volume in COMEX gold futures is roughly 10% below the 20-day average, indicating a lack of aggressive selling. However, open interest has climbed by 1.8% this week, suggesting that participants are setting fresh positions—possibly anticipating a broader consolidation phase. In Gold Price Analysis Today for June 5, 2025, this uptick in open interest amid sideways price action typically signals accumulation by both hedgers and speculators, setting the stage for a more pronounced move once a key catalyst emerges.

Market Sentiment and Positioning in Gold Price Analysis Today for June 5, 2025

ETF Flows and Retail Demand Patterns

An important gauge of sentiment in Gold Price Analysis Today for June 5, 2025 is ETF and retail demand. According to the World Gold Council, gold ETFs recorded a net inflow of 2.1 tonnes in the last trading day, highlighting sustained institutional interest. Notably, North American-listed ETFs led inflows, while some European funds saw slight outflows as investors rotated assets ahead of key data releases.

In India, consumer demand remains mixed: as wedding season nears, gold jewelry purchasing is expected to pick up, though high local premiums (3%–4%) have tempered immediate buying. This consumer caution translates to stable rather than surging retail demand. Combined, these dynamics support gold’s near-term stability, even if volume weakens—evidence that bullion retains its status as a strategic asset.

Options Market and Sentiment Skew

In Gold Price Analysis Today for June 5, 2025, insights from the options market highlight investor expectations. The put-call ratio (PCR) for gold options stands at 0.88, below its six-month average of 0.95, indicating a tilt toward calls (bullish bets).

However, the implied volatility skew remains slightly inverted—i.e., put options carry a small premium—showing that cautious hedging persists. This divergence between PCR and skew suggests that while traders are generally optimistic, they are also buying protection against unexpected downside. Such a balanced positioning underscores the nuanced tone of today’s market.

Expectations for Gold Until Market Close

Key Catalysts to Monitor

As part of Gold Price Analysis Today for June 5, 2025, traders should focus on several catalysts for the remainder of the session:

- FOMC Member Speeches (Throughout the Day)

- Look for any references to “data dependency”, “tapering guidance,” or “rate cut timing.” Dovish undertones could push gold above $3,375; hawkish remarks might nudge it below $3,360.

- U.S. Durable Goods Orders (8:30 AM ET)

- Forecast: +1.0% month-over-month in April. A higher-than-expected reading could bolster the dollar and pressure gold, while a miss might spur a safe-haven rally toward $3,380.

- Eurozone GDP Flash Estimate (6:00 AM ET)

- Forecast: +0.3% quarter-over-quarter in Q1. A weaker result could weigh on the euro and boost gold priced in euros, creating cross-currency support.

- Asian Market Reaction to Overnight China Data

- If China’s May export figures (released earlier) surprise to the downside, we may see risk-off flows into gold, potentially pushing bullion above $3,380.

Intraday Price Scenarios

For Gold Price Analysis Today for June 5, 2025, three plausible intraday scenarios emerge:

- Bullish Upside:

- If durable goods orders disappoint and Fed speeches contain dovish language, gold could break above $3,375, with potential to test $3,380–$3,390. Renewed Middle East tensions could amplify this move, accelerating bids from institutional players.

- Sideways Consolidation:

- Mixed U.S. data (e.g., durable goods meet expectations while eurozone GDP is as forecasted) could confine gold to a narrow range of $3,360–$3,370. In this scenario, traders might pivot to technical signals—watching moving average cross-overs and RSI stability near 55.

- Bearish Pullback:

- If durable goods orders exceed expectations and Fed remarks lean hawkish (e.g., emphasis on inflation risks), gold may slip below $3,360 to test $3,350 or even retreat to $3,340. A strong eurozone GDP beat could further undermine gold by strengthening the euro relative to the dollar.

Summary of Gold Price Analysis Today for June 5, 2025

In Gold Price Analysis Today for June 5, 2025, gold’s slight 0.14% decline to $3,367.58 reflects a nuanced market environment:

- Inflation Dynamics: May’s CPI and PPI data indicate that inflation has moderated modestly but remains above target, sustaining gold’s role as an inflation hedge.

- Fed Policy: Minutes from the June FOMC meeting emphasize data dependence, keeping real yields in negative territory and supporting bullion.

- Geopolitical Factors: Renewed Middle East hostilities and stalling U.S.-China trade talks maintain intermittent safe-haven demand.

- Economic Data: Key releases—durable goods orders, Services PMI, eurozone GDP—will shape intraday price action.

- Technical Framework: Immediate support at $3,360 and resistance at $3,380 define today’s trading range.

- Sentiment: ETF inflows, rising open interest, and cautious options positioning point to balanced optimism, tempered by protective hedging.

Final Thoughts

Today’s Gold Price Analysis Today for June 5, 2025 demonstrates that even a small 0.14% dip can mask rich undercurrents: inflation pressures, Fed hawkishness, and geopolitical jitters all tug gold in different directions. For investors and traders, understanding these forces is crucial. As the day unfolds, stay tuned to Fed commentary, U.S. durable goods figures, and global events. By doing so, you can position yourself to capitalize on gold’s long-term hedge properties while navigating short-term volatility.

✨ Stay updated with our real-time charts, expert commentary, and in-depth analysis—subscribe to our Daily Gold Insights newsletter and ensure you’re always ahead of the curve. Gold’s journey today will set the tone for weeks ahead—remain vigilant, informed, and ready to act.