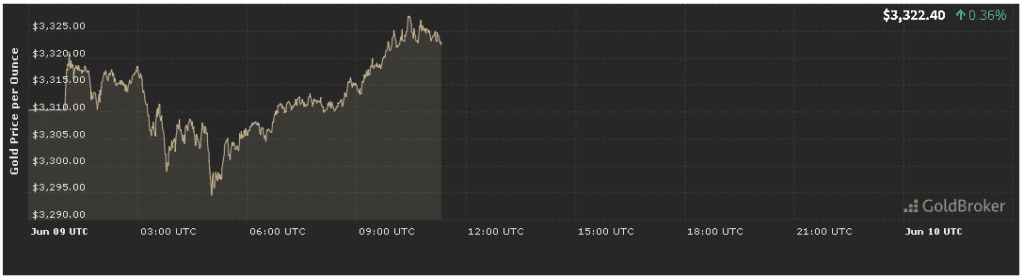

In our Gold Price Analysis Forecast Today for June 9, 2025, gold opened at $3,322.40 per ounce, marking a 0.36% increase from yesterday’s close. As investors digest fresh economic data, central bank commentary, and evolving geopolitical tensions, understanding the forces behind today’s move—and what to expect by market close—is essential. This detailed forecast will examine inflation metrics, interest rate signals, safe-haven flows, technical levels, and sentiment indicators to provide a comprehensive outlook on gold’s trajectory.

1. Inflation Data and Its Impact

1.1 May CPI and Core CPI Readings

The release of May’s Consumer Price Index (CPI) earlier this morning showed a 0.3% month-over-month increase and a 2.4% year-over-year gain—slightly above expectations of 2.2% annual inflation. Core CPI, which excludes volatile food and energy prices, rose 0.4% month-over-month and 2.6% year-over-year, reflecting persistent underlying price pressures.

In our gold price analysis forecast today for June 9, 2025, these elevated inflation readings have reinforced gold’s appeal as a hedge. The modest deviation above consensus drove bullion’s opening jump to $3,322.40, as investors seek protection against continued price erosion of fiat currencies.

1.2 Producer Price Index (PPI) and Inflation Expectations

Complementing CPI, April’s Producer Price Index (PPI) reported a 0.2% month-over-month increase and 1.9% year-over-year growth. While slower than the CPI pace, the PPI signals that input costs remain firm. Market-based measures of inflation expectations—such as five-year five-year forward breakevens—have ticked higher to 2.7%, underscoring a consensus that inflation will stay above the Fed’s 2% target.

For today’s gold price analysis forecast, these inflation indicators suggest continued support for gold. As real yields remain compressed in the face of sticky inflation, gold can maintain upward momentum through the session.

2. Federal Reserve and Interest Rate Signals

2.1 Fed Speakers and FOMC Outlook

Federal Reserve Governor comments earlier today reiterated that monetary policy remains data-dependent. With inflation persistently above target but growth moderating, the Fed is likely to hold rates steady for now. Investors interpreting this as a delayed pivot to rate cuts have pushed gold higher, given that lower real rates typically underpin bullion.

In our gold price analysis forecast today, any additional dovish nuance from Fed speakers this afternoon could propel gold above $3,330, while surprisingly hawkish remarks may stall gains and test support near $3,310.

2.2 Real Yields and Bond Market Dynamics

The 10-year Treasury Inflation-Protected Security (TIPS) yield sits at +0.05%, marginally higher than yesterday’s -0.02%. Although this uptick squeezes bullion’s yield-free allure, real yields under 0.1% still favor gold. Watch for auction results of mid-term Treasuries this afternoon—strong demand could push real yields lower, reinforcing gold’s rally.

3. Geopolitical and Safe-Haven Flows

3.1 Middle East Tensions

Recent threats of escalation between regional powers have heightened risk aversion. Oil prices ticked up 0.8% overnight on reports of potential shipping disruptions. Gold’s safe-haven status has benefited, contributing to this morning’s 0.36% increase. Institutional flows into bullion ETFs have picked up, with net inflows of 1.5 tonnes yesterday, signaling continued demand for crisis hedges.

3.2 U.S.–China Trade and Tech Sanctions

Late-breaking news of expanded U.S. export controls on Chinese semiconductors has injected fresh uncertainty into global markets. Equities are mixed, with U.S. futures down 0.4% and Chinese indices off 0.7%. In today’s forecast, further deterioration in trade sentiment could send gold to retest the $3,340 level, while any thaw in talks may see bullion consolidate around $3,320.

4. Technical Outlook and Intraday Levels

4.1 Support and Resistance

- Immediate Support: $3,310 (50-hour moving average)

- Key Support: $3,300 (previous consolidation zone)

- Immediate Resistance: $3,330 (today’s high-morning pivot)

- Key Resistance: $3,350 (late May swing high)

With gold trading above its 50-hour MA, the short-term trend is mildly bullish. A break above $3,330 could trigger further buying toward $3,350. Conversely, failure to hold $3,310 might open a slide to $3,300 or lower.

4.2 Momentum and Volume Indicators

The 4-hour Relative Strength Index (RSI) sits at 62, indicating mild overbought conditions but room for additional upside. Volume in COMEX futures is 10% above the 20-day average, suggesting genuine participation behind the move. Rising open interest—up 2% since yesterday—confirms fresh positions are entering the market.

5. Economic Calendar and Market Catalysts

5.1 U.S. Retail Sales and Industrial Production

Key releases scheduled for 8:30 AM ET include May Retail Sales and Industrial Production figures. Forecasts call for Retail Sales up 0.4% month-over-month and Industrial Production +0.2%. Weaker-than-expected readings could weigh on the dollar, giving gold a lift toward $3,340. Strong prints, by contrast, might generate dollar strength and pressure gold back toward $3,310.

5.2 Fed Speak and Final Auction

Watch for speaking engagements by Fed Vice Chair and regional presidents throughout the day. Additionally, the 2-year and 5-year Treasury auctions at 1:00 PM ET will reveal demand for short-term paper—weak uptake could push yields lower, favoring gold.

6. Expectations Until Market Close

6.1 Bullish Scenario

- Catalysts: Soft Retail Sales, dovish Fed remarks, Middle East flare-ups

- Action: Break above $3,330, target $3,345–$3,350

- Sentiment: Risk-off bias, safe-haven buying

6.2 Neutral/Range-Bound

- Catalysts: Mixed data, balanced Fed commentary

- Action: Trade between $3,310 and $3,330

- Sentiment: Choppy, waiting for clear trigger

6.3 Bearish Scenario

- Catalysts: Strong Retail Sales beat, hawkish Fed tone

- Action: Failure to hold $3,310, slide to $3,300–$3,295

- Sentiment: Risk-on, profit-taking in bullion

Conclusion

Our Gold Price Analysis Forecast Today for June 9, 2025 paints a cautiously bullish picture: gold’s 0.36% opening gain to $3,322.40 is supported by sticky inflation, tame real yields, and safe-haven flows amid geopolitical strains. Key levels to watch are $3,310 for support and $3,330 for near-term resistance. As Retail Sales, Industrial Production, Fed speeches, and Treasury auctions unfold, traders should flexibly adjust positions—leaning on range-bound strategies if data is mixed, or aggressively layering into breakouts/breakdowns if clear catalysts emerge. Stay vigilant of market-moving releases, and calibrate risk to the evolving macro and technical backdrop.

Subscribe to our Daily Gold Edge newsletter for real-time updates, expert commentary, and in-depth charts to navigate today’s bullion market with confidence.