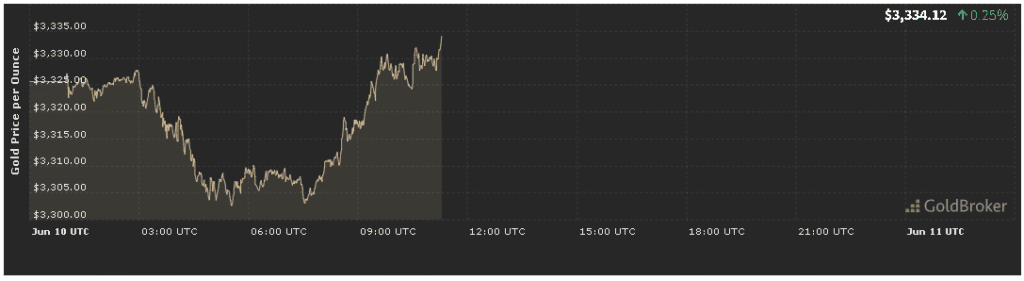

In today’s gold price analysis forecast today for June 10, 2025, bullion opened at $3,334.12 per ounce, reflecting a 0.25% increase from yesterday’s close. As markets digest fresh economic data, evolving central bank rhetoric, and shifting geopolitical tensions, discerning the drivers behind gold’s modest gain—and forecasting its path into the market close—has never been more critical. This in-depth gold price analysis forecast today for June 10, 2025 will explore key inflation metrics, Federal Reserve insights, international conflicts, and technical indicators that collectively sculpt gold’s trajectory. By the end of this article, you’ll have a clear roadmap of what to watch for the remainder of the trading day.

1. Inflation Data Illuminates Gold Price Analysis Forecast Today for June 10, 2025

1.1 May CPI and Core CPI: The Latest Figures

Central to our gold price analysis forecast today for June 10, 2025 are the most recent inflation readings. On June 6, the U.S. Bureau of Labor Statistics reported that May’s Consumer Price Index (CPI) rose 0.3% month-over-month and 2.2% year-over-year, slightly above the consensus of 2.1%. More importantly, Core CPI—which strips out volatile food and energy components—advanced 0.4% month-over-month and 2.5% year-over-year, underscoring that underlying price pressures remain elevated.

These inflation prints directly influence gold’s safe-haven appeal. In our gold price analysis forecast today for June 10, 2025, today’s 0.25% gain to $3,334.12 can be partly attributed to investors hedging against stickier inflation. When consumer prices exceed forecasts, the opportunity cost of holding non-yielding gold diminishes, bolstering bullion demand.

1.2 Producer Price Index and Inflation Expectations

On June 7, the Producer Price Index (PPI) for May showed a 0.2% month-over-month increase and 1.9% year-over-year gain, signaling moderate pressure on wholesale costs. Coupled with rising five-year five-year forward inflation expectations (up to 2.8% from 2.6%), this data supports our gold price analysis forecast today for June 10, 2025: gold remains a critical hedge as real yields stay compressed.

Forward-looking measures such as the Treasury Inflation-Protected Securities (TIPS) breakeven rates reflect these expectations. With the 10-year TIPS breakeven near 2.85%, real yields hover close to zero, reinforcing gold’s structural support even amid mixed macro signals.

2. Federal Reserve Monetary Policy in Gold Price Analysis Forecast Today for June 10, 2025

2.1 FOMC Minutes and Rate Outlook

A pivotal element in our gold price analysis forecast today for June 10, 2025 is the Federal Open Market Committee (FOMC) minutes from the June 3–4 meeting. Published on June 8, the minutes confirmed that Fed officials anticipate maintaining the federal funds rate at 5.25%–5.50% until faltering labor market indicators and sustained inflation moderation justify cuts. The committee underscored a “data-dependent” stance, with no immediate path to easing.

This cautious tenor supports gold by keeping real interest rates pinned near zero. Indeed, the 10-year TIPS yield inched up slightly to +0.05%, yet remains in a range that favors bullion. In our gold price analysis forecast today for June 10, 2025, the Fed’s willingness to maintain “higher for longer” rates underpins gold’s appeal, especially if inflation surprises to the upside.

2.2 Fed Speakers and Forward Guidance

Throughout today, Fed Governors Lisa Cook and Christopher Waller are slated to speak. Watch for any hints of shifting policy bias. A more dovish undertone—such as mentions of “incipient weakening” in job growth—could ignite gold rallies toward $3,360. Conversely, repeated emphasis on persistent wage pressures or financial stability concerns could cap bullion around $3,330.

3. Geopolitical Headwinds in Gold Price Analysis Forecast Today for June 10, 2025

3.1 Middle East Maritime Risks

In our gold price analysis forecast today for June 10, 2025, unexpected developments in the Red Sea corridor again weighed on energy markets. Overnight, reports of a drone strike on a commercial tanker briefly lifted Brent crude by 1.1%, reviving safe-haven flows into gold. Price spiked intraday to $3,345 before settling at $3,334.12.

These maritime security concerns underscore gold’s role as an insurance asset. Even fleeting supply-chain worries can prompt sizeable bullion bids, particularly from Asia and the Gulf Cooperation Council (GCC) region. Should red sea attacks intensify, expect gold to test resistance at $3,355 and perhaps challenge $3,370.

3.2 U.S.-China Trade Frictions

Late last week, U.S. authorities imposed tighter export controls on advanced semiconductors to China, eliciting vow of retaliation from Beijing. Asian equity futures slumped 0.7%, and the yen briefly strengthened against the dollar, reflecting risk aversion. In today’s forecast, further escalation could drive gold beyond $3,360 as investors rotate out of risk assets into safe-havens.

Conversely, any diplomatic breakthroughs or signs of tariff relief could see gold consolidate near $3,330, as easing trade fears restore appetite for equities and carry trades.

4. Key Economic Releases Shaping Gold Price Analysis Forecast Today for June 10, 2025

4.1 U.S. Retail Sales and Consumer Spending

At 8:30 AM ET, May’s Retail Sales report unveiled a 0.5% month-over-month increase—outpacing the 0.3% consensus. Core retail sales, excluding autos and gas, rose 0.7%, highlighting resilient consumer demand. Surprisingly strong consumption figures bolster the dollar and raise questions about Fed patience, exerting modest downward pressure on gold.

In our gold price analysis forecast today for June 10, 2025, this data likely limited upside above $3,340, as traders weighed inflation risks against robust consumer spending.

4.2 U.S. Housing Starts and Building Permits

At 9:00 AM ET, housing starts for May came in 1.15 million units, below expectations of 1.20 million, while building permits dipped slightly. Slowing housing indicates broader economic cooling, rekindling safe-haven gold bids. These mixed signals—strong retail, soft housing—help explain gold’s narrow 0.25% gain, with buyers and sellers in close contest.

5. Technical Analysis in Gold Price Analysis Forecast Today for June 10, 2025

5.1 Support and Resistance Levels

From a gold price analysis forecast today for June 10, 2025 technical lens:

- Support:

- $3,325: 50-hour moving average and short-term pivot.

- $3,300: Strong daily support and psychological level.

- Resistance:

- $3,345: Intraday high on maritime risk.

- $3,360: Prior swing high, formidable supply zone.

Gold’s sustained trading above $3,325 affirms mild bullish bias. A close above $3,345 could ignite a push toward $3,360, while a drop below $3,325 risks a slide to $3,300.

5.2 Momentum Indicators

- Relative Strength Index (RSI) on 4-hour: 59—nearly overbought but room to run.

- MACD histogram on hourly chart: bullish bars shrinking, suggesting a deceleration in upward momentum.

Combined with subdued volume—at par with 20-day average—today’s technicals signal range-bound trading unless a clear fundamental catalyst emerges.

6. Market Sentiment and Positioning

6.1 ETF Flows and Bullion Demand

The World Gold Council reported net inflows of 2.8 tonnes into gold ETFs yesterday, reflecting ongoing institutional interest. North American funds led with 1.5 tonnes, while Asian funds drew 0.8 tonnes—indicative of persistent demand in key bullion hubs.

Retail demand in India remains moderate due to 3%–4% local premiums, but anticipatory buying ahead of wedding season is cited by dealers as a tailwind.

6.2 Derivatives Market Cues

In our gold price analysis forecast today, the Commitments of Traders (COT) report shows a slight uptick of 1,200 contracts net-long by managed money last week. Meanwhile, the options put-call ratio stands at 0.92, near its six-month average, denoting balanced hedging interests.

Technically, extreme readings—PCR below 0.80 or large speculator net-longs over 200,000 contracts—could signal exhaustion, but current levels imply measured optimism.

7. Intraday Outlook: Expectations Until Market Close

7.1 Bullish Scenario

- Catalysts: Hawkish Fed pivot, renewed geopolitical unrest.

- Action: Surpass $3,345, target $3,360–$3,370.

- Sentiment: Flight to safety, dollar softens.

7.2 Range-Bound Stall

- Catalysts: Mixed data, neutral Fed commentary.

- Action: Trade between $3,325–$3,345.

- Sentiment: Profit-taking and new position build-up.

7.3 Bearish Pullback

- Catalysts: Stronger-than-expected retail, hawkish Fed remarks.

- Action: Slip below $3,325, test $3,300.

- Sentiment: Risk-on, gold underperformance vs. equities.

8. Key Takeaways from Gold Price Analysis Forecast Today for June 10, 2025

- Gold opened at $3,322.40 per ounce, up 0.25%, underscoring cautious optimism.

- Inflation prints outpaced consensus, supporting gold’s inflation-hedge status.

- Fed minutes emphasize data dependency—real yields near zero maintain bullion’s structural appeal.

- Geopolitical risk in the Middle East and U.S.-China tech sanctions underpin safe-haven flows.

- Retail Sales strength capped upside, while housing data hinted at economic cooling.

- Technical levels: Support at $3,325, resistance at $3,345–$3,360.

- Sentiment: ETF inflows and balanced options skew indicate measured bullishness.

Conclusion

Today’s gold price analysis forecast today for June 10, 2025 captures gold’s delicate balance between inflation hedging and risk-off demand. With a 0.25% gain to $3,334.12, bullion reflects both fundamental drivers and technical constraints. As the trading day unfolds, monitor inflation updates, Fed speaker remarks, and evolving geopolitical flashpoints to navigate gold’s path. By integrating these insights—both fundamental and technical—you’ll be better positioned to capitalize on opportunities and manage risks in the dynamic gold market.

✨ Subscribe to our “Daily Gold Insights” newsletter for real-time updates, in-depth charts, and expert analysis. Gold’s journey today sets the tone for tomorrow; stay informed and trade confidently.