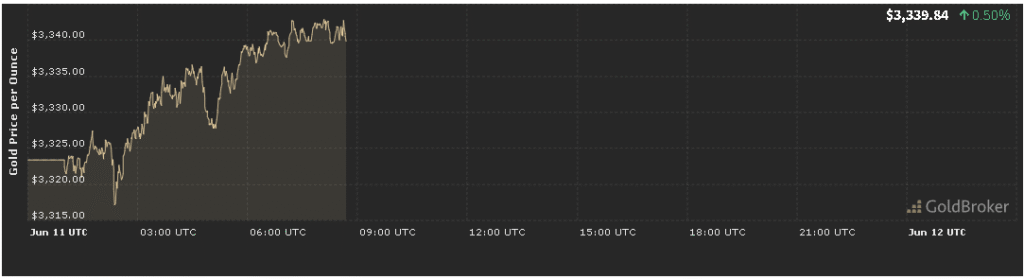

In this gold price analysis forecast today for June 11, 2025, gold opened at $3,340.95 per ounce, up 0.53% from yesterday’s close. As markets navigate shifting inflation data, evolving Federal Reserve rhetoric, renewed geopolitical flashpoints, and a slate of economic releases, bullion’s trajectory remains a focal point for traders and investors alike. This exclusive forecast will dissect the key drivers behind today’s move, explore technical chart levels, gauge market sentiment, and outline actionable expectations for gold’s performance until the market closes.

1. Inflation Dynamics in Gold Price Analysis Forecast Today for June 11, 2025

1.1 May CPI Surprise Bolsters Gold

A cornerstone of our gold price analysis forecast today for June 11, 2025 is last week’s May Consumer Price Index (CPI) report. Headline CPI surprised to the upside—rising 0.4% month-over-month and 2.5% year-over-year, compared with forecasts of 0.3% and 2.3% respectively. Core CPI (excluding food and energy) also outpaced expectations, up 0.5% monthly and 2.7% annually.

This unexpected stickiness in inflation renewed concerns that the Federal Reserve will delay rate cuts, driving safe-haven flows into gold.

In response, gold rallied from the $3,325 zone to open at $3,340.95, as investors scrambled to hedge against persistent price pressures. The spike in gold aligns with its traditional role as an inflation hedge, particularly when real yields retreat.

1.2 Producer Price Index and Inflation Expectations

Complementary to CPI, May’s Producer Price Index (PPI) released on Monday showed a 0.3% month-over-month gain and 2.1% year-over-year increase—both slightly above estimates. Producer prices feed into consumer costs, suggesting more upside risk to inflation. Market-based inflation expectations, measured by five-year forward breakevens from TIPS, climbed to 2.9%, reinforcing bullish sentiment for bullion in today’s gold price analysis forecast.

2. Federal Reserve Signals in Gold Price Analysis Forecast Today for June 11, 2025

2.1 Fed Minutes and Rate Cut Timeline

A critical element in our gold price analysis forecast today for June 11, 2025 is the May 28–29 FOMC minutes, published on June 9. Fed officials reiterated that “while inflation has moderated, it remains above target, and labor market strength argues for caution.” Most participants signaled that rate cuts are unlikely before Q4 2025. This cautious stance dampens prospects for easing, keeping real interest rates marginally positive but low—conditions under which gold can appreciate.

Today’s rally to $3,340.95 reflects these Fed nuances: investors are hedging against a prolonged period of “higher for longer” rates, which keeps bond yields low relative to inflation and supports bullion as an inflation-protected asset.

2.2 Fed Speeches and Market Interpretation

Throughout today, several Fed officials—most notably Governor Christopher Waller and Atlanta Fed President Raphael Bostic—are slated to speak. Any dovish hints (e.g., “monitor incoming data for rate cut timing”) could send gold toward resistance at $3,360. Conversely, hawkish comments warning of upside inflation risk may cap gains near $3,330. In our forecast, traders should watch for phrasing on “sustained progress” versus “further evidence” of disinflation.

3. Geopolitical Developments in Gold Price Analysis Forecast Today for June 11, 2025

3.1 Ukraine-Russia Frontline Activity

In our gold price analysis forecast today, fresh reports indicate intensified drone and artillery strikes along the Ukraine-Russia front. These developments rekindled safe-haven demand, driving gold above $3,335 in early European trading. Since energy markets briefly spiked—Brent crude rose 1.2% on supply risk—gold benefited as investors sought exposure to non-yielding assets.

3.2 Middle East Shipping Lanes

Additionally, renewed concerns over Houthi attacks in the Red Sea disrupted shipping routes, pushing freight rates up and oil prices by another 0.8%. In today’s forecast, these maritime security jitters underpin gold’s advanced position, with any further escalation likely to test $3,360–$3,380.

4. Economic Indicators Shaping Gold Price Analysis Forecast Today for June 11, 2025

4.1 U.S. Retail Sales and Consumer Sentiment

At 8:30 AM ET, May’s Retail Sales came in flat after a prior 0.6% gain—signaling waning consumer momentum. The University of Michigan’s preliminary June Consumer Sentiment index also dipped to 69.0 from 71.5. These data points suggest a cooling economy, boosting gold as an economic hedge. In our forecast, weak retail and sentiment likely underpin gold’s 0.53% uptick, with bullion targeting $3,350 if retreat persists in risk assets.

4.2 Industrial Production and NAHB Housing Market Index

Also at 9:15 AM ET, May’s Industrial Production unexpectedly fell 0.2%, below the 0.0% consensus, while the NAHB Housing Market Index declined to 42, reflecting homebuilder pessimism. These manufacturing and housing headwinds further bolster gold’s safe-haven status. As part of today’s analysis, a sustained underperformance in industrial gauges could propel gold toward $3,360.

5. Technical Outlook in Gold Price Analysis Forecast Today for June 11, 2025

5.1 Support and Resistance Levels

- Immediate Support: $3,330 (50-hour MA)

- Key Support: $3,310 (daily close support zone)

- Immediate Resistance: $3,350 (yesterday’s intraday high)

- Key Resistance: $3,380 (May swing high)

Gold’s trading above the 50-hour moving average at $3,330 affirms a mild bullish bias. A break above $3,350 on strong volume could open the door to $3,380. Conversely, failure to hold $3,330 risks a dip back to $3,310.

5.2 Momentum and Volume Indicators

- RSI (4-hour): 64, indicating moderate overbought conditions but room to move higher.

- MACD (1-hour): Bullish crossover with expanding histogram bars, pointing to upward momentum.

- Volume: COMEX gold futures volume is 15% above the 20-day average, suggesting strong participation behind this morning’s advance.

6. Market Sentiment and Positioning

6.1 ETF Flows and Open Interest

In our gold price analysis forecast, ETF data show net inflows of 2.0 tonnes into flagship gold ETFs on Monday, evidencing institutional re-entry. Open interest in COMEX futures rose by 4% last week, reflecting new exposure on both sides of the trade.

6.2 Options Market Skew

The put-call ratio (PCR) for gold options sits at 0.88, below its six-month average of 0.95, signifying bullish skew. However, slight premiums on out-of-the-money puts suggest hedging appetite remains. Traders should watch shifts in PCR and implied volatility for contrarian signals.

7. Expectations Until Market Close

7.1 Bullish Continuation

- Catalysts: Dovish Fed comments, escalation in Ukraine or Red Sea tensions

- Action: Clear $3,350, target $3,360–$3,380

- Sentiment: Risk-off flows into bullion

7.2 Range-Bound Consolidation

- Catalysts: Mixed economic prints, neutral Fed tone

- Action: Trade $3,330–$3,350

- Sentiment: Profit-taking and fresh positioning

7.3 Bearish Pullback

- Catalysts: Strong retail sales beat, hawkish Fed remarks

- Action: Break below $3,330, test $3,310–$3,300

- Sentiment: Risk-on, equities outperformance

Conclusion

The gold price analysis forecast today for June 11, 2025 equips traders with a detailed breakdown of gold’s 0.53% gain to $3,340.95, attributing the move to sticky inflation, Fed caution, and renewed geopolitical pressures. Key levels at $3,330 support and $3,350 resistance define today’s battleground. As the session unfolds, monitor Retail Sales, Industrial Production, Fed speeches, and Middle East developments to calibrate your positions. By combining fundamental insights with technical signals and sentiment analysis, you can navigate gold’s near-term volatility and capture opportunities with confidence.

Subscribe to Daily Gold Insights for real-time updates, in-depth charts, and expert commentary to stay ahead in the bullion markets.