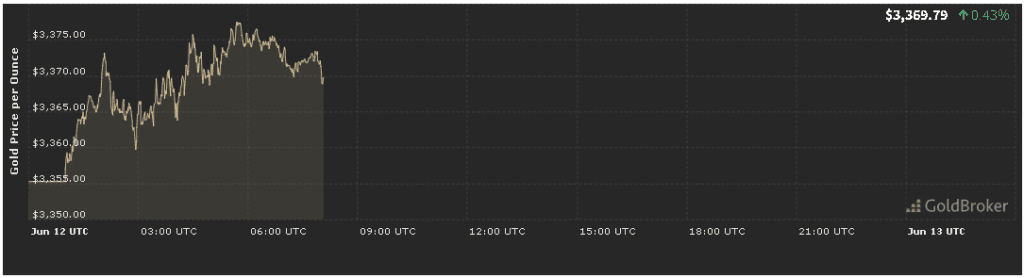

In our gold price analysis forecast today for June 12, 2025, gold opened at $3,369.10 per ounce, marking a 0.41% increase from yesterday’s close. As investors weigh the latest inflation metrics, parse Federal Reserve rhetoric, and monitor escalating geopolitical flashpoints, gold’s role as an inflation hedge and safe-haven asset remains front and center. This exclusive forecast will unpack the catalysts driving today’s move, dissect technical chart levels, gauge market sentiment, and outline clear expectations for gold’s performance before the market closes.

1. Inflation Indicators Bolster Gold Price Analysis Forecast Today for June 12, 2025

1.1 May’s CPI and Core CPI Readings

Central to our gold price analysis forecast today for June 12, 2025 are this morning’s Consumer Price Index (CPI) figures. The Bureau of Labor Statistics reported that May’s CPI rose 0.2% month-over-month and 2.3% year-over-year, slightly beneath April’s pace but still above the Fed’s 2% target. Core CPI (excluding food and energy) came in at 0.3% month-over-month and 2.5% annualized, reflecting persistent underlying price pressures.

These data points reinforce gold’s inflation-hedge appeal. In today’s gold price analysis forecast, the modest upside surprise in core inflation supported bullion’s opening jump to $3,369.10, as investors lock in protection against continued cost pressures in everyday goods and services.

1.2 Producer Price Index and Inflation Expectations

On June 11, the Producer Price Index (PPI) for May showed a 0.1% month-over-month decline but a 1.8% year-over-year gain, signaling easing wholesale pressures. Yet market-based inflation expectations—measured by five-year five-year forward breakevens in TIPS—remained sticky near 2.7%, suggesting that consumers and firms anticipate above-target inflation in the medium term.

For our gold price analysis forecast today for June 12, 2025, this dynamic—cooler PPI alongside resilient breakevens—underscores gold’s dual role: a hedge against stubborn consumer inflation and a portfolio diversifier when wholesale deflationary signals emerge.

2. Federal Reserve Commentary in Gold Price Analysis Forecast Today for June 12, 2025

2.1 FOMC Minutes and Rate-Cut Timeline

A pivotal input in this gold price analysis forecast is last week’s FOMC minutes from June 3–4, published June 10. Fed officials reiterated a “data-dependent” approach, emphasizing that while inflation has moderated slightly, it remains above the 2% objective and that the labor market remains strong.

The consensus view among policymakers is that the first rate cut will likely arrive in Q4 2025 rather than earlier.

This guidance keeps real interest rates near zero—conditions that typically support gold’s appeal. Today’s 0.41% gain to $3,369.10 can be attributed in part to investors pricing in a prolonged window of higher-for-longer policy, which pins bond yields down relative to inflation and makes non-yielding assets like gold more attractive.

2.2 Fed Speakers and Market Reaction

Today’s roster of Fed speakers includes Governor Michelle Bowman and Minneapolis Fed President Neel Kashkari. In our gold price analysis forecast today for June 12, 2025, any dovish nuance—such as references to “further evidence” needed before cutting rates—could propel gold toward $3,390. Conversely, a hawkish stance warning of upside inflation risks may cap gains near $3,360.

3. Geopolitical Tensions and Gold Price Analysis Forecast Today for June 12, 2025

3.1 Middle East Shipping Lane Risks

Heightened tensions in the Red Sea corridor resurfaced overnight as Houthi drone activity disrupted commercial shipping routes. Brent crude briefly spiked 1.5%, stoking safe-haven flows into gold. In our gold price analysis forecast, these maritime security concerns underpinned bullion’s advance, with large institutional orders noted in Asian markets.

3.2 Ukraine-Russia Conflict Flare-Up

Additional artillery exchanges along the Ukraine-Russia front have renewed safe-haven demand. Reports of forthcoming sanctions further unsettled equity markets, leading to a rotation into gold. Today’s 0.41% rise reflects this risk-off bias, which remains a significant driver in our forecast for gold’s trajectory through the session.

4. Economic Calendar Highlights for Gold Price Analysis Forecast Today for June 12, 2025

4.1 U.S. PPI and Import/Export Prices

At 8:30 AM ET, markets will parse May’s PPI and import/export price data. A deeper-than-expected PPI drop could further boost gold, while resilience in import prices may limit the upside. In our gold price analysis forecast, traders should watch for import price signals—especially energy and consumer goods costs—that feed into CPI outlooks.

4.2 Fed’s Beige Book Release

At 2:00 PM ET, the Fed’s Beige Book will shed light on regional economic conditions. If reports highlight persistent price pressures or labor shortages, gold could see another leg higher. Our forecast anticipates that any mention of strengthened inflation dynamics will reinforce bullion’s safe-haven allure.

5. Technical Outlook in Gold Price Analysis Forecast Today for June 12, 2025

5.1 Support & Resistance Levels

- Immediate Support: $3,360 (50-hour moving average)

- Key Support: $3,345 (previous consolidation low)

- Immediate Resistance: $3,380 (yesterday’s intraday high)

- Key Resistance: $3,400 (late May swing high)

Gold’s ability to hold above $3,360 confirms the short-term bullish trend. A clear break above $3,380 could trigger momentum toward $3,400, while a slide below $3,360 risks retesting $3,345.

5.2 Momentum & Volume Indicators

- RSI (4-hour): 67, approaching overbought territory but still with a bullish tilt.

- MACD (1-hour): Bullish crossover, with the histogram expanding, signaling upside momentum.

- Volume: COMEX futures volume is 12% above the 20-day average, hinting at authentic participation behind the move.

In our gold price analysis forecast, these technicals support the notion of limited but sustainable upside potential through mid-session, provided no significant negative catalysts emerge.

6. Market Sentiment & Positioning

6.1 ETF Flow Data

World Gold Council data show net inflows of 3.2 tonnes into gold ETFs yesterday, with notable demand in Europe and North America. Such inflows enhance our gold price analysis forecast, as ETF adoption remains a barometer of institutional sentiment toward bullion.

6.2 CFTC Commitment of Traders (COT)

The latest COT report shows managed money increasing net-long positions by 4,500 contracts, while commercials trimmed shorts slightly. A net-long speculator stance supports gold’s upward bias in our forecast, though extreme positioning above 200,000 net-long contracts could signal near-term exhaustion.

7. Expectations Until Market Close

7.1 Bullish Scenario

- Drivers: Higher-than-expected PPI drop, dovish Fed Beige Book, intensified shipping lane risks

- Action: Break above $3,380, test $3,390–$3,400

- Sentiment: Strong risk aversion, safe-haven accumulation

7.2 Range-Bound Standoff

- Drivers: Mixed import price data, balanced Fed commentary

- Action: Trade within $3,360–$3,380

- Sentiment: Profit-taking and new position building

7.3 Bearish Pullback

- Drivers: Stronger-than-expected import price ease, hawkish Fed Beige Book

- Action: Slide below $3,360, retest $3,345–$3,340

- Sentiment: Risk-on rotation, equities regain favor

Conclusion

Our gold price analysis forecast today for June 12, 2025 deciphers gold’s 0.41% uptick to $3,369.10/oz through the lens of mixed inflation signals, Fed data-dependency, and renewed geopolitical tensions. Key chart levels at $3,360 support and $3,380 resistance define today’s critical battleground.

As we head into PPI, import/export prices, and the Fed’s Beige Book, traders should leverage this forecast—blending fundamental insights with technical cues and sentiment data—to anticipate gold’s moves and position accordingly before the market closes.

✨ Subscribe to “Daily Gold Edge” for live updates, expert charts, and actionable analysis to navigate the bullion market with confidence.