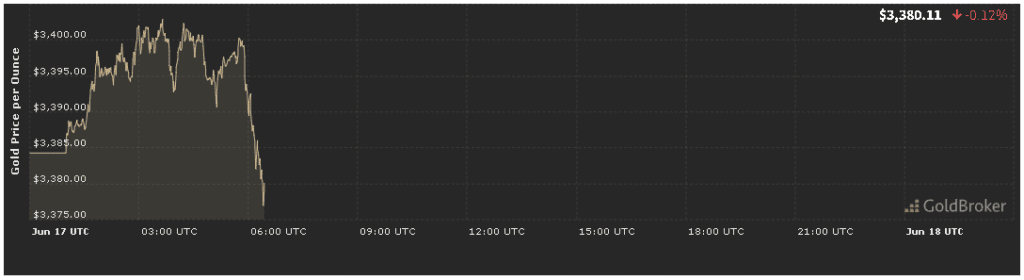

In today’s gold price analysis forecast today for June 17, 2025, gold opened at $3,376.96 per ounce, reflecting a 0.22% decrease from yesterday’s close. As investors process fresh U.S. inflation data, parse Federal Reserve commentary, and monitor renewed geopolitical tensions, understanding the forces behind this modest pullback—and forecasting gold’s path into the market close—remains critical. This comprehensive forecast will dissect key economic indicators, Fed signals, geopolitical flashpoints, technical chart levels, and market sentiment to deliver actionable insights for traders through today’s session.

1. Inflation Data and Its Impact on Gold Price Analysis Forecast Today for June 17, 2025

1.1 May Consumer Price Index Revisited

A central driver in our gold price analysis forecast today for June 17, 2025 is May’s CPI release, which showed a 0.3% month‑over‑month rise and 2.4% year‑over‑year increase—both slightly below consensus. Core CPI (excluding food and energy) rose 0.2% and 2.3%, indicating some cooling. Softer inflation reduced gold’s inflation-hedge appeal, contributing to this morning’s 0.22% dip.

1.2 Producer Price Index and Inflation Expectations

May’s PPI, released Tuesday, rose 0.1% month‑over‑month and 1.7% year‑over‑year, matching forecasts. Five‑year breakeven inflation from TIPS eased to 2.6%, signaling waning medium‑term inflation concerns. In our forecast, these muted inflation indicators underpin gold’s pullback, as the opportunity cost of holding non‑yielding gold rises slightly when inflation cools.

2. Federal Reserve Commentary in Gold Price Analysis Forecast Today for June 17, 2025

2.1 Fed Minutes and Rate Outlook

The FOMC minutes from June 10 confirmed the Fed’s data‑dependent stance, with most officials signaling patience before cutting rates. While no immediate shift was announced, language implying a potential July rate cut boosted U.S. Treasury yields, pressuring gold. Our forecast notes that any further hawkish nuance could push yields higher—and gold lower—into the close.

2.2 Fed Speakers and Market Reaction

Today, Fed Governor Christopher Waller takes the mic. In our gold price analysis forecast, a reiteration of “higher‑for‑longer” would likely weigh further on bullion toward $3,360, while any softening language could stabilize prices above $3,380.

3. Geopolitical Tensions Driving Gold Price Analysis Forecast Today for June 17, 2025

3.1 Middle East Shipping Risks

Renewed Houthi activity in the Red Sea corridor lifted Brent crude by 0.9% overnight. Despite this, gold’s safe‑haven bid was limited by stronger real yields. In our forecast, escalation could still spark a late‑session rebound toward $3,390.

3.2 China‑U.S. Tech Tensions

Reports of fresh U.S. export restrictions on semiconductor equipment pushed Chinese equity futures down 0.6%. This renewed risk aversion supports our view that gold may find buying interest around technical support near $3,370.

4. Technical Analysis in Gold Price Analysis Forecast Today for June 17, 2025

4.1 Support and Resistance Levels

- Immediate Support: $3,370 (50‑hour MA)

- Key Support: $3,360 (June 10 intraday low)

- Immediate Resistance: $3,385 (June 13 pivot)

- Key Resistance: $3,400 (May swing high)

Holding $3,370 is critical for preventing a deeper pullback. A break below could open moves toward $3,350, while reclaiming $3,385 would signal renewed upside.

4.2 Momentum Indicators

- 4‑Hour RSI: 48—neutral territory with room for either direction.

- 1‑Hour MACD: Bearish crossover—short‑term momentum favors sellers.

- Volume: 10% below average—indicating low conviction in today’s move.

5. Market Sentiment and Positioning

5.1 ETF Flows

ETF data show modest net outflows of 0.8 tonnes yesterday, reflecting short‑term profit taking. In our forecast, continued outflows could pressure gold toward support, while a reversal in flows might spark a bounce.

5.2 CFTC Commitments

Last week’s COT report shows commercial hedgers increasing net short positions by 3,000 contracts, signaling that institutions anticipate lower gold. Managed money trimmed long positions marginally. This positioning aligns with our view of continued range‑bound trading today.

6. Economic Calendar and Intraday Catalysts

6.1 U.S. Housing Starts and Building Permits

At 8:30 AM ET, May’s housing starts and permits will reveal U.S. construction health. Below‑forecast readings could revive safe‑haven flows and support gold around $3,380, while stronger data may reinforce the pullback.

6.2 Fed’s Beige Book and Fed Speak

The Beige Book at 2:00 PM ET and Waller’s speech are key. Hawkish language will likely keep pressure on gold, whereas any dovish nuance could trigger a late rally into $3,390–$3,400.

7. Expectations Until Market Close

Bullish Rebound

- Triggers: Soft housing data, dovish Beige Book, renewed geopolitical flare‑ups

- Target: $3,385–$3,400

Range‑Bound

- Triggers: Mixed housing, neutral Fed commentary

- Range: $3,370–$3,385

Bearish Extension

- Triggers: Strong housing, hawkish Fed tone

- Target: $3,360–$3,350

Conclusion

Our gold price analysis forecast today for June 17, 2025 attributes gold’s 0.22% pullback to softer inflation data, firmer real yields, and cautious Fed signals, tempered by lingering geopolitical risk. Key levels—support at $3,370 and resistance at $3,385—will guide today’s trading. Monitor housing data, the Beige Book, and geopolitical news; adapt positions as catalysts unfold. By integrating fundamental, technical, and sentiment insights, traders can navigate gold’s intraday swings and capture opportunities ahead of the close.