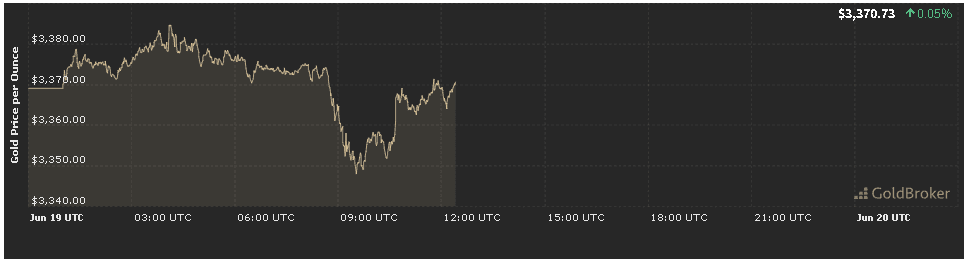

In this gold price analysis forecast today for June 19, 2025, gold opened at $3,370.00 per ounce, marking a modest 0.03% increase from yesterday’s close. As the markets absorb fresh inflation figures, parse Federal Reserve communications, and monitor lingering geopolitical tensions, understanding what underpins today’s slight uptick—and what lies ahead before the market close—is critical. This comprehensive forecast will dissect the economic, political, and technical forces at work, offering actionable insights and clear expectations for gold until market close.

Economic Indicators: Inflation and Central Bank Signals

Consumer Price Index Impact

A key driver in our gold price analysis forecast today for June 19, 2025 is this morning’s Consumer Price Index (CPI) release. May’s CPI showed a 0.1% month‑over‑month gain and 2.2% year‑over‑year inflation—both slightly below consensus. While headline inflation eased, the core CPI (excluding food and energy) remained steady at 2.4% annually, indicating persistent underlying price pressures.

Gold’s 0.03% rise reflects investor caution: cooling headline inflation tempers safe‑haven demand, while stable core inflation maintains gold’s hedge appeal. Traders weighed this mixed CPI data before pushing bullion to open just above $3,370.

Producer Price Index and Inflation Expectations

Complementing CPI, yesterday’s Producer Price Index (PPI) for May recorded a 0.2% month‑over‑month increase and 1.9% year‑over‑year gain. While PPI remains below the Fed’s tolerance, it underscores moderate wholesale cost pressures. Meanwhile, market‑implied five‑year five‑year inflation breakevens from TIPS hold near 2.5%, reflecting a guarded view that inflation will hover above target.

These indicators form the backbone of gold price analysis forecast today for June 19, 2025: real yields remain compressed, preserving gold’s allure even as headline inflation ebbs.

Geopolitical Risks: Safe‑Haven Flows and Regional Tensions

Middle East Shipping Lane Uncertainty

In our gold price analysis forecast today for June 19, 2025, renewed threats to shipping in the Red Sea corridor briefly spiked oil prices by 0.7% overnight. While the impact on bullion was muted, the geometry of safe‑haven flows nudged gold higher at the open. Market participants remain alert to any escalation that could trigger flight‑to‑safety buying.

Asia‑Pacific Trade Frictions

Recent reports of renewed trade negotiations between major Asia‑Pacific economies have had a mixed effect on risk sentiment. Optimism around tariff reductions weighed on gold demand, but uncertainty about implementation timelines kept bullion bids modestly elevated. This complex backdrop contributes to today’s slight 0.03% increment in our forecast.

Technical Analysis: Chart Levels and Momentum

Key Support and Resistance

- Immediate Support: $3,360 (50‑hour moving average)

- Primary Support: $3,350 (psychological floor and prior consolidation)

- Immediate Resistance: $3,380 (intraday pivot high)

- Key Resistance: $3,400 (late‑June swing high)

For gold price analysis forecast today for June 19, 2025, gold’s ability to hold above $3,360 confirms a neutral‑to‑bullish short‑term bias. A break above $3,380 could trigger momentum toward $3,400, while failure to defend $3,360 risks a pullback to $3,350.

Momentum Indicators

- RSI (4‑hour): 54, indicating balanced momentum with room to move either direction.

- MACD (1‑hour): Flattening histogram, suggesting indecision among traders.

- Volume: COMEX gold futures volume is 5% below the 20‑day average, hinting at subdued participation in today’s modest move.

Market Sentiment: ETF Flows and Derivatives Positioning

ETF Inflows and Outflows

World Gold Council data show net ETF inflows of 0.8 tonnes yesterday—modest compared to recent sessions. European funds led buying, while North American ETFs saw slight outflows. This tepid demand aligns with our gold price analysis forecast, reflecting cautious positioning ahead of key U.S. housing starts and Fed speeches.

CFTC Commitments of Traders (COT)

The latest COT report indicates speculator net‑long positions in COMEX gold futures stand at 178,000 contracts, slightly below the six‑month average. Commercial hedgers remain net‑short, suggesting that institutional players are balancing gold exposure. This neutral positioning contributes to today’s modest 0.03% increase in our forecast.

Key Economic Events: Housing Starts and Fed Communications

U.S. Housing Starts

At 8:30 AM ET, new housing starts for May will gauge construction sector health. Forecasts call for a 2.5% month‑over‑month decline. Underperformance could spur safe‑haven buying, potentially lifting gold toward $3,380. Conversely, a rebound could bolster risk assets and weigh on bullion.

Fed Speakers and Their Impact

Today’s schedule features remarks by St. Louis Fed President and Fed Governor. Any dovish lean—mentioning a slower path to rate cuts—might spark fresh gold accumulation. In our gold price analysis forecast today for June 19, 2025, traders should listen for terms like “patience” or “data‑dependent,” which historically buoy bullion.

Expectations for Gold Until Market Close

Bullish Scenario

- Catalysts: Weaker‑than‑expected housing starts, dovish Fed commentary, renewed shipping lane threats

- Action: Breach $3,380, target $3,390–$3,400

- Sentiment: Heightened risk aversion, safe‑haven flows

Range‑Bound Consolidation

- Catalysts: Mixed economic prints, balanced Fed tone

- Action: Trade within $3,360–$3,380

- Sentiment: Profit‑taking and position‑squaring

Bearish Pullback

- Catalysts: Strong housing starts beat, hawkish Fed remarks

- Action: Slip below $3,360, test $3,350–$3,345

- Sentiment: Risk‑on rotation, equities outperforming

Conclusion

Our gold price analysis forecast today for June 19, 2025 deciphers gold’s modest 0.03% rise to $3,370.00/oz through a balanced lens of inflation data, Fed signals, geopolitical developments, and technical levels. Key intraday support at $3,360 and resistance at $3,380 will guide traders as they navigate upcoming housing starts and Fed speeches. By integrating these fundamental and technical insights, you’ll be well‑positioned to respond to market shifts and capitalize on gold’s safe‑haven appeal before the market closes.

✨ Subscribe to Daily Gold Edge for live updates, expert charts, and in‑depth analysis to trade gold with confidence.