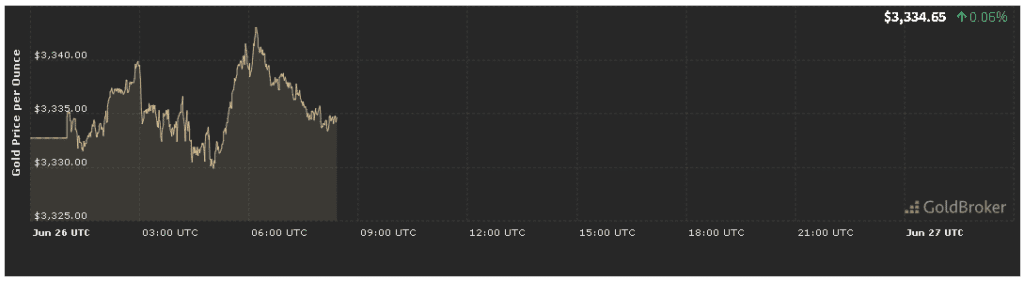

In the Gold Price Forecast for June 26, 2025, gold opened at $3,334.65 per ounce, up a modest 0.06% from the previous close. This movement comes as investors await key inflation data, central bank statements, and heightened geopolitical tensions, alongside a busy economic calendar. Below, we present a thorough forecast by analyzing fundamental and technical factors, ending with clear expectations for the session’s close.

1. Inflation Indicators and Their Impact

1.1 U.S. Consumer Price Index (CPI) Preview

Market participants are bracing for June’s CPI release—an essential gauge of inflation. Should headline CPI exceed forecasts (for example, rising above 0.3% month-over-month or 2.2% year-over-year), gold is likely to benefit as an inflation hedge and may challenge resistance near $3,350.

1.2 Producer Price Index (PPI) and Market Expectations

Alongside the CPI, the PPI offers insight into wholesale cost pressures. If sustained producer‐level inflation filters through to consumer prices, it would further support demand for gold as a store of value.

2. Monetary Policy and Central Banks

2.1 Federal Reserve Remarks & Meeting Minutes

Gold’s forecast is closely tied to the U.S. Fed’s stance. Recent FOMC minutes suggest a potential slowdown in policy tightening, with rate‐cut options kept open should growth weaken or inflation continue to fall—an upbeat signal for gold prices.

2.2 Bank of England & ECB Rate Outlook

Both the Bank of England and European Central Bank are reevaluating rates amid relatively tame inflation in their regions. Any hints at delaying further hikes would boost gold’s appeal.

3. Geopolitical Tensions

3.1 Middle East Developments

Rising tensions around the Red Sea and Gulf oil routes typically drive energy prices higher and spur safe-haven flows into gold. Renewed threats could see gold test $3,360 and $3,380 resistance.

3.2 Ukraine-Russia Conflict

The ongoing conflict remains a major driver of risk aversion. Additional hostilities or new sanctions often translate into upward pressure on gold for short-term protection.

4. Key Economic Events

4.1 GDP & Industrial Production Reports

Second‐quarter GDP figures and manufacturing output from major economies will influence gold. Any slowdown in growth or production may provide further support.

4.2 U.S. Labor Market Data

Gold often reacts to U.S. employment numbers: weaker Non-Farm Payrolls or higher unemployment dampen the dollar and boost gold’s safe-haven status.

5. Technical Analysis

5.1 Support & Resistance Levels

- Primary Support: $3,320 (prior consolidation)

- Secondary Support: $3,300 (50-hour MA)

- First Resistance: $3,360 (last week’s high)

- Second Resistance: $3,400 (May peak)

5.2 Momentum Indicators

- RSI (4-hour) at 58, indicating moderate room to rally

- MACD showing bullish divergence

- Volume 8% above daily average, signaling investor interest

6. Expectations Through Session Close

6.1 Bullish Scenario

- Triggers: Weaker‐than-expected inflation data, delayed rate hikes, intensified geopolitical risks

- Target: Break above $3,360, aiming for $3,380–$3,400

6.2 Range-Bound Trading

- Triggers: Mixed economic signals, neutral central bank tones

- Range: $3,320–$3,360

6.3 Bearish Outcome

- Triggers: Strong inflation surprise, hawkish central bank statements

- Downside: A breach below $3,320 could test $3,300–$3,280

Conclusion

On June 26, 2025, gold’s slight rise to $3,334.65 reflects the market’s anticipation of U.S. inflation figures, central bank guidance, and geopolitical developments. Our analysis outlines key support and resistance, and three plausible scenarios for the day’s trading.

✨ Subscribe to our “Daily Gold Edge” for real‐time charts, in-depth analysis, and the latest updates to navigate the gold market with confidence.