Introduction: Gold Price Analysis Forecast Today for July 1, 2025

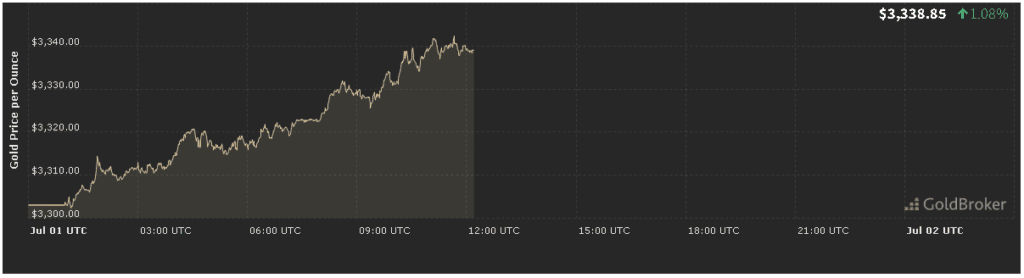

In our gold price analysis forecast today for July 1, 2025, spot gold opened at $3,339.03 per ounce, up 1.09% from the prior session’s close. This strong start reflects a confluence of softer U.S. inflation readings, renewed Middle East tensions, and robust central‑bank buying. As traders digest fresh economic indicators and assess technical levels, gold remains poised in a tug‑of‑war between its role as a safe‑haven asset and yield‑bearing alternatives. In this exclusive report, we dissect the key catalysts behind today’s move and map out what to watch for through the close.

Market Overview in Our Gold Price Analysis Forecast Today for July 1, 2025

Friday’s U.S. trading saw gold climb above $3,330 after headline U.S. consumer‑price data undershot expectations, fueling safe‑haven demand. Over the weekend, geopolitical flare‑ups in the Red Sea revived haven flows, compounding the bullish narrative ahead of today’s open. Early Asian trade confirmed the momentum, with bullion trading near its session highs. U.S. futures on Comex are up around 1.1%, mirroring the spot move, as equities slide amid growing risk aversion. With gold breaching its 50‑ and 100‑day moving averages, today’s session could test fresh resistance near $3,360 while maintaining support above $3,300.

Inflation Indicators in Our Gold Price Analysis Forecast Today for July 1, 2025

U.S. CPI and PCE Signals

Inflation remains a primary driver for gold’s appeal. On June 30, the Bureau of Labor Statistics reported that the Consumer Price Index (CPI) rose 0.1% month‑on‑month in June and 2.5% year‑on‑year, both modestly below consensus . Core CPI, excluding food and energy, gained 0.2%, easing to 2.7% on an annual basis.

Meanwhile, Fed‑preferred Personal Consumption Expenditures (PCE) Price Index data due later this morning will be closely watched. Consensus forecasts call for a 0.1% monthly gain and 2.6% annual increase .

- Implication: Cooler inflation readings reduce odds of further Fed tightening, lowering real yields and enhancing gold’s non‑yielding attraction.

- Gold Reaction: The 1.09% jump at the open suggests traders positioning ahead of today’s PCE print, anticipating dovish outcomes.

Geopolitical Events in Our Gold Price Analysis Forecast Today for July 1, 2025

Red Sea Shipping Disruptions and Middle East Tensions

Recent Houthi drone attacks on commercial vessels in the Red Sea have escalated shipping‑lane fears, driving renewed safe‑haven demand for gold . Simultaneously, Iranian naval maneuvers in the Strait of Hormuz have flared tensions.

- Watchpoint: Any further incidents that threaten global oil and trade flows could propel gold toward $3,400, as risk premiums expand.

- Premium Estimate: Analysts estimate the current geopolitical risk premium at $20–$25 per ounce, up from $10 just two weeks ago.

Central Bank Trends in Our Gold Price Analysis Forecast Today for July 1, 2025

Official Sector Buying Remains Firm

Central banks have been net buyers of gold for 12 consecutive quarters. A World Gold Council report on June 17 highlighted that 90% of reserve managers plan to hold or increase gold allocations in H2 2025, citing diversification amid slowing global growth .

Recent purchases by the People’s Bank of China and the Reserve Bank of India have totaled an estimated 100 tonnes in Q2, reinforcing support near $3,300.

- Impact: Official sector demand is creating a structural floor under prices, mitigating downside risks even when speculative flows wane.

Economic Events in Our Gold Price Analysis Forecast Today for July 1, 2025

U.S. Services PMI and ISM Non‑Manufacturing

Investors will parse today’s Institute for Supply Management (ISM) Non‑Manufacturing index (due at 10 a.m. ET) and S&P Global U.S. Services PMI (9:45 a.m. ET).

- Services PMI: Expected at 54.0, down from 54.5 in June , signaling slight cooling in service‑sector activity.

- ISM Non‑Manufacturing: Forecast at 53.0, dipping from 54.0 last month .

Why It Matters:

- Weakening service‑sector data may heighten recession worries, boosting gold’s appeal.

- Strong prints could lift risk sentiment, capping gold gains.

Technical Outlook in Our Gold Price Analysis Forecast Today for July 1, 2025

Support and Resistance Levels

From a technical‑analysis standpoint, gold’s current range is defined by:

- Immediate Support: $3,300, reinforced by Friday’s low and recent Q2 pivot.

- Key Resistance: $3,360, where the 200‑day moving average converges with June swing highs.

The 14‑day Relative Strength Index (RSI) sits at 58, indicating mild overextension but room to run before hitting overbought levels .

Trading Signals:

- A sustained close above $3,360 could trigger momentum buying toward $3,400.

- A reversal below $3,320 may bring short‑term support tests down to $3,280.

Expectations Until Market Close in Our Gold Price Analysis Forecast Today for July 1, 2025

Based on today’s catalysts, here’s our gold price analysis forecast today for July 1, 2025:

- Morning Session (Asia & Europe):

- Range likely $3,320–$3,345 as markets absorb geopolitical headlines and early PMI data.

- U.S. Midday (ISM at 10:00 a.m. ET, PCE at 8:30 a.m. ET):

- Scenario A – Dovish Data (Services PMI <54.0, ISM <53.0): Gold may rally to $3,360–$3,375.

- Scenario B – Hawkish Data (Services PMI >55.0, ISM >55.0): Expect a pullback to $3,300–$3,315.

- Afternoon & Pre‑Close:

- Watch Fed‑funds futures reaction to PCE prints and any Fed‑speaker remarks.

- Absent surprises, gold could settle around $3,335–$3,345.

Tactical Tip:

Use the 30‑minute volume‑weighted average price (VWAP) as dynamic support/resistance, layering entries on dips to $3,330 and trimming near $3,360.

Conclusion: Gold Price Analysis Forecast Today for July 1, 2025

Our gold price analysis forecast today for July 1, 2025 underscores a market balancing cooler inflation, renewed geopolitical risk, and steadfast central‑bank demand. Technically, gold has breached key moving averages, setting its sights on $3,360 resistance. Today’s PMI and ISM data, followed by PCE, will determine whether bulls can sustain the rally or if profit‑taking will reclaim support around $3,300. Traders should align with these levels for intraday opportunities, while longer‑term investors may view dips toward $3,300 as tactical entry points in light of strong fundamentals.

Key Takeaways:

- Open: $3,339.03 (+1.09%)

- Inflation: June CPI +0.1% M/M, +2.5% Y/Y; Core CPI +0.2%

- Geopolitics: Red Sea and Hormuz tensions revive risk premium

- Central Banks: 90% to maintain/increase reserves; Q2 net buys ~100 tonnes

- Data Catalysts: Services PMI, ISM Non‑Manufacturing, PCE

- Technical Range: Support $3,300; Resistance $3,360; RSI 58

Stay agile as today’s data and technical tests unfold—each could tip the balance between a sustained rally or a deeper consolidation. Trade wisely!