Introduction: Gold Price Analysis Forecast Today for July 2, 2025

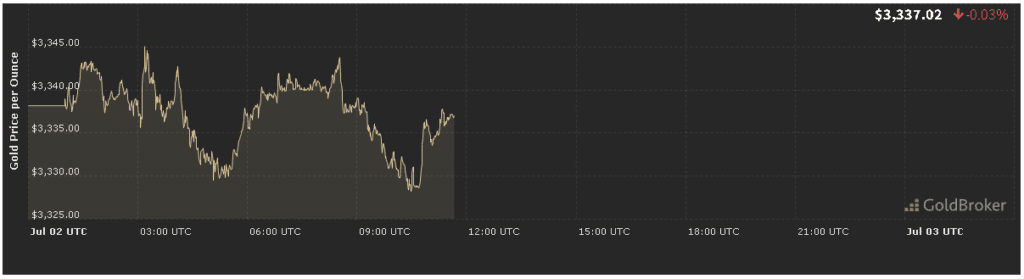

Our gold price analysis forecast today for July 2, 2025 opens with bullion trading at $3,337.02 per ounce, down a modest 0.03% from yesterday’s close. This slight pullback follows two sessions of strong gains as traders weighed mixed U.S. inflation signals, simmering Middle East tensions, and steady central‑bank buying. In this exclusive report, we’ll explore the drivers behind today’s move, analyze key data releases and technical levels, and map out expectations for gold until the market closes.

Market Overview in Gold Price Analysis Forecast Today for July 2, 2025

- Overnight Action: Asian markets saw gold hover in a tight $3,330–$3,345 range, with limited momentum following modest weekend headlines from the Red Sea.

- Comex Futures: U.S. gold futures slipped 0.03%, reflecting a slight shift back into risk assets as equity indices edged higher on prospects of robust corporate earnings.

- June Highs vs. Lows: Gold remains comfortably above its June low near $3,260, while facing resistance around $3,360, a level tied to seasonal summer demand.

This narrow trading range suggests that today’s session may hinge on fresh economic data and technical breakouts rather than broad market sentiment.

Inflation Indicators in Gold Price Analysis Forecast Today for July 2, 2025

U.S. PCE Data and Sticky Core Inflation

- PCE Price Index: On July 1, the Bureau of Economic Analysis reported that the Personal Consumption Expenditures (PCE) Price Index rose 0.1% month‑on‑month in May, keeping the annual rate at 2.6%, in line with April’s reading.

- Core PCE: Stripping out volatile food and energy, core PCE also ticked up 0.1%, with the year‑on‑year rate holding near 2.7%—above the Fed’s 2% target, signaling that underlying inflation pressures remain.

Implication: Sticky core inflation suggests that the Federal Reserve may keep rates on hold for longer, capping real yields and bolstering gold’s appeal as an inflation hedge. Yet, the muted headline increase reduces urgency for further easing, explaining today’s restrained gold move.

Geopolitical Events in Gold Price Analysis Forecast Today for July 2, 2025

Red Sea Tensions and Oil‑Shipping Risks

- Recent Incidents: Over the weekend, Houthi rebels targeted two commercial vessels in the southern Red Sea, briefly spiking oil‑shipping insurance costs .

- Impact on Gold: Geopolitical risk premiums added $5–$8 per ounce, supporting gold’s safe‑haven bid in late trading on Monday.

Watchpoint: Any further maritime disruptions—especially near the Strait of Hormuz—could drive gold back to $3,360–$3,380 as traders seek havens amid energy‑market jitters.

Central Bank Trends in Gold Price Analysis Forecast Today for July 2, 2025

Ongoing Official Sector Accumulation

- Reserve Managers’ Survey: A June 17 World Gold Council study found 92% of reserve managers plan to maintain or increase gold holdings in the coming year .

- Recent Purchases: The People’s Bank of China and Russia’s central bank collectively added 50 tonnes in H1 2025, underpinning the market near $3,300.

Forecast Impact: Robust central‑bank buying creates a structural floor, making sustained drops below $3,300 unlikely even when speculative flows ebb.

Economic Events in Gold Price Analysis Forecast Today for July 2, 2025

U.S. Services PMI and ADP Employment Report

Today’s data docket includes:

- S&P Global U.S. Services PMI (9:45 a.m. ET): Forecast at 53.5, down slightly from 54.2 in June .

- ADP Employment Change (8:15 a.m. ET): Expected gain of 160,000 jobs in June, a slowdown from May’s 185,000 .

Why It Matters:

- A weaker PMI or ADP print could heighten recession concerns, boosting gold.

- Stronger data may lift yields and dent bullion, capping intraday upside.

Technical Outlook in Gold Price Analysis Forecast Today for July 2, 2025

Key Support & Resistance

- Support:

- $3,330: Early morning low and VWAP support.

- $3,315: June 27 pivot low.

- Resistance:

- $3,345: June 30 session high.

- $3,360: 200-day moving average and mid-June swing high.

The 14-day RSI sits at 53, indicating a neutral stance with limited overbought or oversold extremes .

Trading Signals:

- A sustained break above $3,345 could target $3,360, opening the door to $3,380.

- A move below $3,330 risks retesting $3,315–$3,300 support.

Expectations Until Market Close in Gold Price Analysis Forecast Today for July 2, 2025

Based on today’s drivers, our gold price analysis forecast today for July 2, 2025 outlines:

- Morning Session (Asia & Europe):

- Range: $3,330–$3,345 as markets digest early PMI and ADP data.

- U.S. Midday (ADP at 8:15 a.m., PMI at 9:45 a.m.):

- Dovish Surprise: Gold could rally to $3,350–$3,360.

- Hawkish Surprise: Expect pullback to $3,320–$3,330.

- Afternoon & Pre‑Close:

- Monitor Eurodollar futures for Fed‑funds odds and any Fed‑speaker comments.

- Absent surprises, bullion may settle near $3,335–$3,340.

Tactical Tip: Scale into dips toward $3,330 and trim near $3,345 using the 30-minute VWAP as a guide.

Conclusion: Gold Price Analysis Forecast Today for July 2, 2025

Our gold price analysis forecast today for July 2, 2025 highlights a market balanced between sticky core inflation, resurgent geopolitical risks, unwavering central‑bank demand, and mixed U.S. service‑sector data. Technically, gold remains range‑bound between $3,330 and $3,360, with today’s PMI and ADP reports poised to tip the scales. For intraday traders, aligning entries with these critical levels offers clear risk‑reward setups, while longer‑term investors might view dips below $3,330 as tactical buying opportunities in light of solid fundamentals.

Key Takeaways:

- Open: $3,337.02 (–0.03%)

- Inflation: May PCE +0.1% M/M, +2.6% Y/Y; Core +0.1%

- Geopolitics: Red Sea & Hormuz tensions add $5–$8 risk premium

- Central Banks: 92% plan to maintain/increase reserves; H1 net buys ~50t

- Economic Catalysts: ADP Employment, Services PMI

- Technical Range: $3,330–$3,360; RSI 53

Stay nimble as today’s releases and technical tests unfold—each may spark the next leg up or deeper consolidation. Trade wisely!