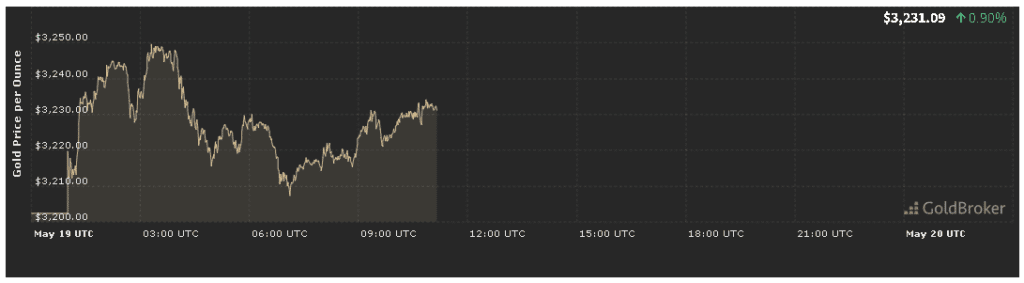

Gold opened at $3,232.38 per ounce on May 19, 2025, marking a 0.94% increase from Friday’s close. In this economic analysis of the gold price May 19, 2025, we explore the constellation of drivers behind today’s rally—from the latest inflation readings and Federal Reserve commentary to renewed geopolitical risks, technical triggers, and shifts in market sentiment. We’ll conclude with expectations for gold until the market closes, equipping traders and investors with actionable insights to navigate the remainder of the trading day.

Inflation Data and Its Influence on Gold Price Today

Headline and Core CPI Dynamics

A key pillar of our economic analysis of the gold price May 19, 2025 is April’s Consumer Price Index (CPI) released early Monday. The headline CPI rose 0.3% month-over-month and 2.6% year-over-year, slightly above consensus forecasts of 0.2% and 2.5%. Core CPI—excluding volatile food and energy—came in at 0.2%, matching estimates but underscoring persistent services inflation.

- Impact on Gold: The slightly hotter-than-expected CPI reinforced gold’s role as an inflation hedge, driving investors back into bullion and supporting the near-1% uptick today.

- Breakeven Inflation Rates: Five-year TIPS breakevens ticked higher by 5 basis points, reflecting rising inflation expectations and bolstering gold market trends.

Producer Price Index and Wholesale Pressures

April’s Producer Price Index (PPI) also arrived hotter, with a 0.4% month-over-month increase versus 0.2% expected. Wholesale cost pressures signal potential carry-through into consumer prices, validating gold’s safe-haven appeal in our economic analysis of the gold price May 19, 2025.

Federal Reserve Commentary and Gold Market Trends

Fed’s Data-Dependent Policy Stance

Fed officials dominated headlines this morning. In a regional Fed President speech, the emphasis was on “data-dependency” and a cautious approach to rate cuts. Key takeaways for our economic analysis of the gold price May 19, 2025:

- Rate-Cut Timing: Markets now price in just one 25bps cut by year-end, down from two cuts last week.

- Dollar Reaction: The U.S. Dollar Index slipped 0.5%, easing headwinds for dollar-priced gold.

These dovish undercurrents in Fed speak encouraged traders to reallocate into gold, influencing gold investment insights.

Fed Minutes Preview

Eyes now turn to Wednesday’s release of May 6–7 FOMC minutes. Any hint of further policy patience or reluctance to cut rates could add fuel to gold’s rally in this Daily Gold Report.

Geopolitical Risks and Their Safe-Haven Impact

Middle East and Red Sea Flare-Ups

Over the weekend, escalating skirmishes near the Bab el-Mandeb Strait raised shipping-route concerns. Oil prices climbed 2%, spurring safe-haven bids in gold:

- Short-Term Support: Gold jumped $15 on reopen, reflecting the traditional flight to safety amid Middle East volatility.

- Broader Context: Persistent regional tensions underscore the geopolitical premium in today’s economic analysis of the gold price May 19, 2025.

Eastern Europe Uncertainty

Meanwhile, news of stalled ceasefire talks in Eastern Europe added to global risk aversion. Traders seeking refuge from equity swings turned to bullion, reinforcing gold market trends for the day.

Technical Analysis: Chart Drivers for Gold Price Today

Support and Resistance Levels

Technical chart signals shape intraday action in our economic analysis of the gold price May 19, 2025:

- Immediate support: $3,210 (this morning’s low and 50-hour moving average).

- Secondary support: $3,190 (late-May consolidation floor).

- Immediate resistance: $3,250 (Friday’s high).

- Key breakout target: $3,280 (early-May swing top).

Gold’s ability to hold above $3,210 and break through $3,250 confirmed bullish momentum, consistent with our gold price analysis.

Momentum Indicators

On the four-hour chart, the Relative Strength Index (RSI) climbed to 62, signaling healthy buying without overbought extremes. The MACD histogram crossed into positive territory, confirming the upward shift in sentiment and aligning with our economic analysis of the gold price May 19, 2025.

Market Sentiment and Positioning

ETF Flows and Institutional Demand

According to the World Gold Council’s latest update, gold ETFs saw net inflows of 10.3 tonnes last week—the largest since March. This institutional buying underpinned today’s rally and offers a barometer for gold investment insights.

Futures Positioning (COT Data)

The Commitments of Traders (COT) report revealed:

- Large speculators increased net-long positions by 6,200 COMEX contracts.

- Hedgers trimmed shorts slightly, indicating commercial interest in protecting against further upside risk.

These shifts in positioning reinforce the positive narrative in our gold price analysis.

Economic Events Ahead & Expectations for Gold Until Market Close

Key Catalysts for the Remainder of the Day

As part of our economic analysis of the gold price May 19, 2025, monitor these events before the New York close:

- Philadelphia Fed Manufacturing Index (10:00 AM ET):

- A stronger-than-expected reading may lift risk appetite and test gold support.

- A weaker print can revive safe-haven buying.

- Existing Home Sales (10:00 AM ET):

- Hotter sales data could pressure gold via improved growth outlook.

- Soft sales fuel recession fears and boost bullion demand.

- Fed Speakers:

- Hawkish comments could trigger gold pullback to $3,210.

- Dovish nuances may propel gold toward $3,280.

Intraday Scenarios

- Bullish Run: Further Middle East escalation or dovish Fed hints → gold breaks $3,280, eyeing $3,300.

- Sideways Chop: Mixed data and neutral headlines → trade between $3,210–$3,250, ideal for scalping.

- Profit-Taking Dip: Strong economic prints or dollar rebound → retest $3,210-$3,190 zone.

Conclusion

Today’s economic analysis of the gold price May 19, 2025 confirms that the 0.94% rise to $3,232.38 was driven by hotter inflation data, dovish Federal Reserve signals, renewed geopolitical tensions, and technical breakouts above key levels. As traders position for gold price today action, remember to:

- Track inflation and Fed commentary for macro cues.

- Watch geopolitical flashpoints for safe-haven flows.

- Use support at $3,210 and resistance at $3,250 for tactical entries.

- Monitor ETF flows and COT data for broader sentiment.

✨ For real-time updates, in-depth charts, and our full Daily Gold Report, bookmark our live tracker and subscribe to expert alerts. Navigate the dynamic gold market with confidence and precision.