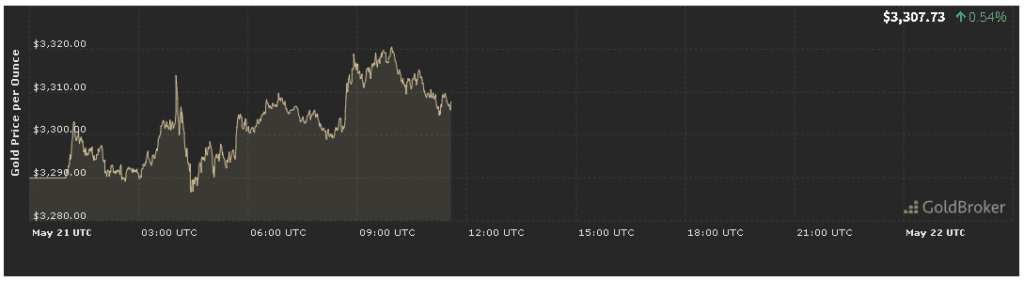

Gold opened at $3,305.79 per ounce on May 21, 2025, rising 0.48% from the prior close. In this economic analysis of the gold price May 21, 2025, we dissect the key drivers behind today’s modest rally—from fresh U.S. inflation readings and Federal Reserve comments to renewed geopolitical tensions, technical chart signals, and shifts in investor positioning. We’ll close with expectations for gold until the market closes, providing traders a roadmap for navigating Wednesday’s session.

U.S. Inflation Data and Its Impact on Gold Price Today

Headline & Core CPI Figures

A pivotal element in our economic analysis of the gold price May 21, 2025 is yesterday’s April Consumer Price Index (CPI). Headline CPI rose 0.2% month-over-month (matching expectations) and 2.4% year-over-year, a slight deceleration from March’s 2.6%. Core CPI (ex-food & energy) increased 0.1%, below forecasts of 0.2%, suggesting underlying inflation pressures may be easing.

- Gold Reaction: Softer core inflation bolstered gold’s appeal as an inflation hedge, helping underpin today’s 0.48% climb.

- Real Yields: With headline CPI moderating, real yields on 10-year TIPS fell 4 basis points, reducing gold’s opportunity cost and fueling demand.

Producer Price Index (PPI)

April’s Producer Price Index (PPI) for final demand also surprised to the downside at 0.1% month-over-month, reinforcing a narrative of easing wholesale pressures. This, in turn, fed into gold’s rebound in our economic analysis of the gold price May 21, 2025, as traders positioned for a potentially gentler Fed stance.

Federal Reserve Signals and Market Interpretation

Fed Officials’ Comments

Across Tuesday’s remarks, Fed speakers emphasized patience on rate cuts until “substantial further progress” on inflation is achieved. However, the sub-forecast core CPI softened those hawkish undertones:

- Rate Cut Odds: Markets now price in one 25bps cut by December, unchanged from yesterday but buoyed by the easing CPI data.

- Dollar Trajectory: The U.S. Dollar Index slipped 0.3%, removing a headwind for dollar-priced gold.

These shifting expectations play a central role in our economic analysis of the gold price May 21, 2025, mixing caution with optimism for bullion.

Upcoming FOMC Minutes

All eyes turn to Thursday’s release of the May 6–7 FOMC minutes. Any dovish nuance—such as concern about sticky service-sector inflation—could extend gold’s advance, while renewed hawkish language may cap gains. Traders should watch for these policy cues in our Daily Gold Report.

Geopolitical Developments and Safe-Haven Demand

Middle East Escalation

This morning, reports of renewed skirmishes in the Red Sea corridor added a fresh safe-haven bid for gold. Oil prices rose 1.2%, and gold spiked $12 intraday before settling into a 0.48% gain at open.

- Geopolitical Premium: The threat to shipping lanes and energy flows often translates into immediate support for bullion, as covered in our economic analysis of the gold price May 21, 2025.

Asian Political Unrest

Separately, political unrest in parts of Southeast Asia spurred short-lived demand for safe assets. While these factors alone didn’t drive gold, they contributed to an overall risk-off undertone supporting today’s rally.

Technical Analysis: Chart Signals and Key Levels

Support & Resistance

A structured economic analysis of the gold price May 21, 2025 must include technical levels:

- Immediate support: $3,280 (yesterday’s low).

- Secondary support: $3,260 (short-term consolidation).

- Immediate resistance: $3,320 (today’s high).

- Key pivot: $3,350 (May 1 swing top).

Holding above $3,280 confirms bullish bias, while a break above $3,320 opens the door to $3,350 and higher.

Momentum Indicators

- RSI (4-hour): Rallied to 55, signaling renewed buying interest without overbought extremes.

- MACD: The histogram turned positive, indicating upward momentum in line with our gold price analysis.

Market Sentiment and Positioning

ETF Flows

Data from the World Gold Council show net ETF inflows of 6.1 tonnes last week—the first inflow since early May. Institutional appetite for gold underpins today’s rebound, as noted in our gold investment insights.

COT Report

The Commitments of Traders report indicates:

- Large speculators added 3,400 net-long COMEX contracts.

- Commercial hedgers slightly reduced their short positions, suggesting growing comfort with higher gold prices.

These shifts in positioning support our economic analysis of the gold price May 21, 2025 and signal a potential for further gains.

Economic Events Ahead & Expectations Until Market Close

Key Catalysts

Traders should monitor:

- New Home Sales (10:00 AM ET):

- Stronger sales may weigh on gold via improved risk appetite.

- Weaker data can re-ignite safe-haven flows.

- Durable Goods Orders (10:00 AM ET):

- Disappointing orders bolster gold’s defensive case.

- Better-than-expected orders may limit gains.

- Fed Speakers:

- Hawkish nuance could cap gold near $3,320.

- Dovish hints may push prices toward $3,350.

Intraday Scenarios

- Bullish Continuation: Further Middle East flare-ups + dovish Fed signals → test $3,350.

- Sideways Range: Mixed data → trade between $3,280–$3,320.

- Profit-Taking Dip: Strong economic prints → retest $3,280 support.

Conclusion

Our economic analysis of the gold price May 21, 2025 shows that today’s 0.48% uptick to $3,305.79 was driven by moderating core inflation, softer PPI, slight Fed accommodation, and fresh geopolitical risks. Key takeaways:

- Watch April CPI/PPI for inflation clues.

- Track upcoming FOMC minutes for policy direction.

- Use $3,280 and $3,320 as tactical support/resistance.

- Monitor ETF flows and COT data for sentiment cues.

✨ For real-time updates, detailed charts, and our full Daily Gold Report, bookmark our live tracker and subscribe to expert alerts. Trade with precision in the dynamic gold market.