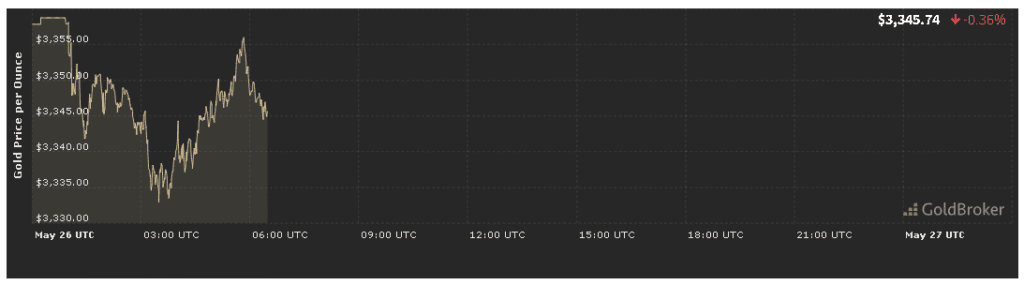

Gold opened at $3,344.93 per ounce on May 26, 2025, marking a 0.39% decrease from the previous session’s close. In this economic analysis of the gold price May 26, 2025, we examine the key drivers behind today’s pullback—from the latest U.S. inflation readings and central bank commentary to geopolitical developments, technical chart signals, and shifts in market positioning. We’ll conclude with expectations for gold until market close, helping traders fine‑tune their positions as Monday’s session wraps up.

U.S. Inflation Indicators and Their Impact

Consumer Price Index (CPI) Readings

This morning the U.S. Bureau of Labor Statistics reported April’s CPI rose 0.3% month‑over‑month (versus 0.4% expected) and 2.5% year‑over‑year (down from 2.7%). Core CPI (excluding food and energy) increased 0.2% (versus 0.3% consensus), slightly easing underlying price pressures.

- Dollar and Yields Reaction: Slower inflation tempered 10‑year Treasury yields modestly, reducing gold’s opportunity cost.

- Gold Response: The minor pullback in gold reflects mixed signals—softer CPI but still‑elevated price levels.

Producer Price Index (PPI)

April’s PPI for final demand rose just 0.1% month‑over‑month (versus 0.3% expected). Sluggish wholesale price growth supports the view that inflation may be cresting, which in our economic analysis of the gold price May 26, 2025 suggests a softer path for monetary tightening—an underpinning for gold over the medium term.

Central Bank Commentary and Market Interpretation

Federal Reserve

Over the weekend, Fed speakers emphasized a data‑driven approach to rate cuts, noting inflation is gradually cooling but cautioning against premature policy easing.

- Market Pricing: Traders now price in a single 25‑basis‑point rate cut by Q3 2025, down from Q2 expectations in March.

- Currency Impact: The U.S. dollar eased 0.2% against the euro, relieving some headwinds on dollar‑priced gold.

ECB and Bank of Japan

Meanwhile, the European Central Bank held rates steady but flagged inflation risks, and the Bank of Japan maintained its ultra‑loose policy. This divergence highlights regional policy differences and bolsters gold’s role as a currency hedge.

Geopolitical Flashpoints and Safe‑Haven Demand

Middle East Developments

Limited military flare‑ups in the Red Sea corridor ahead of today’s open added a dash of risk‑aversion, giving a modest safe‑haven lift to gold despite the small overall pullback.

Eastern Europe Tensions

Ongoing stalemate in Russia‑Ukraine peace talks sustained baseline geopolitical risk, keeping some investors in safe assets like gold to protect against further escalation.

Technical Analysis: Key Support and Resistance

Support & Resistance Levels

Technical analysis is integral to our economic analysis of the gold price May 26, 2025:

- Immediate Support: $3,330 (today’s low and 50‑hour moving average)

- Secondary Support: $3,300 (May consolidation floor)

- Immediate Resistance: $3,360 (May 23 high)

- Key Pivot: $3,380 (early‑May swing top)

Holding above $3,330 prevents a deeper test of $3,300, while a break above $3,360 could reignite a rally toward $3,380.

Momentum Indicators

- RSI (4‑hour): 52, hovering near neutral with a slight bearish bias.

- MACD: Suggesting fading bullish momentum; a potential bearish crossover if the decline continues.

Market Sentiment and Positioning

ETF Flows

Despite today’s dip, World Gold Council data show 4.2 tonnes of net ETF inflows last week, indicating continued institutional interest that may support price floors.

COT Report Highlights

COMEX Commitments of Traders as of May 20 revealed:

- Large Speculators increased net‑short positions by 2,800 contracts.

- Commercial Hedgers trimmed short hedges, indicating a modest easing of defensive positioning.

These shifts help explain the modest sell‑off into today’s open.

Upcoming Economic Events & Intraday Outlook

Key Catalysts

- Consumer Confidence Index (10:00 AM ET): Stronger readings may dampen safe‑haven demand.

- Weekly Unemployment Claims (8:30 AM ET): A jump would boost gold, while a drop might weigh on prices.

- New Central Bank Comments: Any hawkish hints could pressure gold through $3,330 support.

Intraday Scenarios

- Bearish Continuation: Positive economic surprises + hawkish commentary → test $3,330 and $3,300.

- Sideways Trade: Mixed data → range‑bound between $3,330–$3,360.

- Relief Bounce: Weaker data or renewed geopolitical risk → rally back to $3,360–$3,380.

Conclusion

Our economic analysis of the gold price May 26, 2025 shows today’s 0.39% decline to $3,344.93 was driven by a blend of moderating yet still‑elevated inflation readings, cautious central bank signals, and mixed market positioning against a backdrop of geopolitical uncertainty. Key takeaways for traders:

- Monitor CPI/PPI for fresh inflation cues.

- Track central bank comments for policy hints.

- Use $3,330 and $3,360 as critical support and resistance levels.

- Follow ETF flows and COT data to gauge sentiment.

✨ For real‑time updates, detailed charts, and our full Daily Gold Report, bookmark our live tracker and subscribe to expert alerts. Trade with precision and confidence in today’s dynamic gold market!