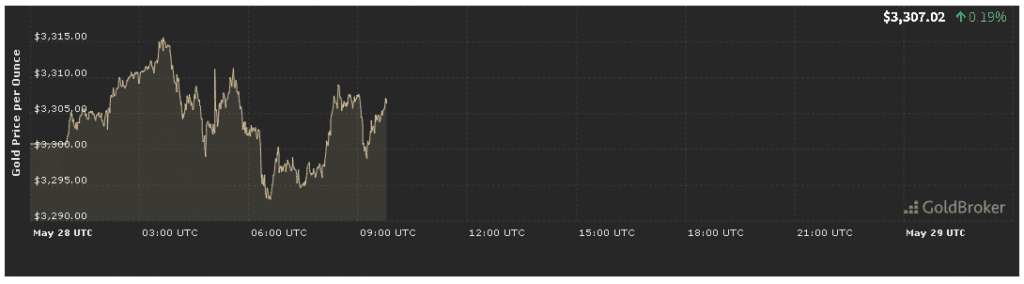

Gold opened at $3,305.44 per ounce on May 28, 2025, registering a modest 0.14% decline from yesterday’s close. In this economic analysis of the gold price May 28, 2025, we dive into the forces shaping bullion’s performance—examining the latest U.S. inflation readings, Federal Reserve rhetoric, geopolitical developments, and chart-based signals. We then translate these insights into expectations for gold until the market closes, equipping active traders and long‑term holders with the clarity needed to navigate a complex trading day.

U.S. Inflation Data: Subdued but Unsteady

May Consumer Price Index (CPI) Preview

Investors began the day anticipating the release of May’s CPI numbers later this week, which could confirm whether inflation remains on a downward trajectory. Preliminary surveys suggest a 0.2% month‑over‑month rise, with the year‑over‑year rate expected to tick down to 2.3% from 2.4%.

- Gold Impact: In our economic analysis of the gold price May 28, 2025, gold’s slight pullback reflects caution as markets await firmer inflation evidence. Soft CPI data is typically gold‑positive, but mixed surveys can keep traders on the sidelines.

- Real Yields Watch: Should CPI undershoot estimates, real yields on TIPS could fall, reducing the opportunity cost of gold and potentially triggering a recovery.

May Producer Price Index (PPI)

Earlier, the Bureau of Labor Statistics reported April’s PPI for final demand rose 0.1%, in line with estimates. However, core wholesale prices (ex-food and energy) were unchanged, hinting at diminishing upstream price pressures.

- Economic Analysis Note: A stagnating core PPI supports the view that inflationary pressures are easing—a theme we highlighted in this economic analysis of the gold price May 28, 2025. Yet without clear CPI confirmation, gold remains range‑bound.

Federal Reserve Commentary: Patience and Prudence

Fed Speakers Signal Data‑Dependency

This week’s Fed speeches have underscored a cautious approach. Governors and regional presidents emphasized that rate decisions remain “data‑dependent” and that substantial further progress on inflation goals is needed before any cuts.

- Market Pricing Shift: Markets currently price in a single 25‑basis‑point rate cut by Q4 2025—down from two cuts just a month ago. This tempered easing outlook weighed on gold’s opening.

- Dollar Dynamics: The U.S. Dollar Index rallied 0.3% on the back of firmer rate‑cut timelines, marginally pressuring dollar‑denominated gold.

FOMC Minutes on the Horizon

Traders are preparing for Thursday’s release of the May 6–7 FOMC minutes. Any dovish nuance—concerns over sticky rents or service‑sector inflation—could spark a gold rally. Conversely, reaffirmed hawkish caution may keep prices subdued.

Geopolitical Developments and Safe‑Haven Demand

Middle East Shipping Risks

Persistent security threats in the Red Sea shipping lanes flared overnight, nudging oil prices higher and offering a brief safe‑haven boost to gold. However, as military escorts restored some calm, bullion relinquished its gains.

- Analysis Insight: This fleeting reaction underscores gold’s dual role: an inflation hedge and a geopolitical “insurance policy.” We explore these dynamics in our economic analysis of the gold price May 28, 2025.

Asia‑Pacific Political Tensions

Heightened political tensions around trade negotiations in the Asia‑Pacific region added to a cautious risk tone. While not significant enough to reverse today’s slide, these uncertainties underpin a baseline level of gold demand.

Technical Analysis: Charting Gold’s Near‑Term Trajectory

Key Support & Resistance Levels

In any robust economic analysis of the gold price May 28, 2025, technical thresholds guide tactical decisions:

- Immediate Support: $3,295 (today’s low and the 50‑hour moving average)

- Secondary Support: $3,270 (early‑May consolidation floor)

- Immediate Resistance: $3,320 (yesterday’s high)

- Critical Pivot: $3,350 (May 23 swing top)

Holding above $3,295 is vital to prevent a slide toward $3,270, while a break above $3,320 could signal renewed upside momentum.

Momentum Indicators

- RSI (4‑hour): Measures 47, suggesting mild bearish bias but not yet oversold.

- MACD: The histogram has shrunk below zero, confirming the short‑term downtrend illuminated in today’s economic analysis.

Market Sentiment and Positioning

ETF Flows

World Gold Council data revealed 1.8 tonnes of net outflows from gold ETFs last week—a modest shift that aligns with today’s minor decline.

- Analysis Takeaway: Outflows signal profit‑taking in the face of mixed macro cues, a pattern highlighted in our economic analysis of the gold price May 28, 2025.

Commitments of Traders (COT) Snapshot

As of May 20, the CFTC’s COT report showed:

- Large speculators trimmed net‑long positions by 2,100 COMEX contracts.

- Commercial hedgers boosted short hedges slightly, reflecting defensive positioning.

This modest repositioning corroborates the cautious stance seen in both futures and cash markets.

Economic Events Ahead & Expectations Until Market Close

Data Releases to Watch

- Pending CPI (8:30 AM ET):

- Below consensus: Likely sparks a gold rally toward $3,320.

- Above consensus: May push gold back down to $3,295 or lower.

- Durable Goods Orders (10:00 AM ET):

- Weak orders: Fuel safe‑haven flows.

- Strong orders: Boost dollar, hurt gold.

- Fed Speakers:

- Dovish tone: Triggers relief rally above $3,320.

- Hawkish nuance: Tests support at $3,295.

Intraday Scenarios

- Bearish Continuation: Hot inflation data + hawkish Fed tone → test $3,295 and then $3,270.

- Sideways Range: Mixed signals → trade between $3,295–$3,320.

- Relief Bounce: Soft CPI or fresh geopolitical risk → rebound to $3,350.

These scenarios define expectations for gold until the market closes, guiding risk management and profit targets.

Conclusion

Our economic analysis of the gold price May 28, 2025 shows that today’s 0.14% dip to $3,305.44 stemmed from cautious Fed rate‑cut expectations, mixed inflation signals, fleeting geopolitical safe‑haven bids, and modest ETF outflows. Key takeaways for traders and investors:

- Monitor CPI and PPI for definitive inflation cues.

- Track FOMC minutes and Fed speeches for policy hints.

- Use $3,295 and $3,320 as tactical support/resistance.

- Follow ETF flows and COT data to gauge sentiment shifts.

✨ For live updates, detailed charts, and our full Daily Gold Report, bookmark our platform and subscribe to expert alerts. Navigate today’s dynamic gold market with confidence and precision!