Gold Market Opens Lower Amid Mounting Economic Concerns

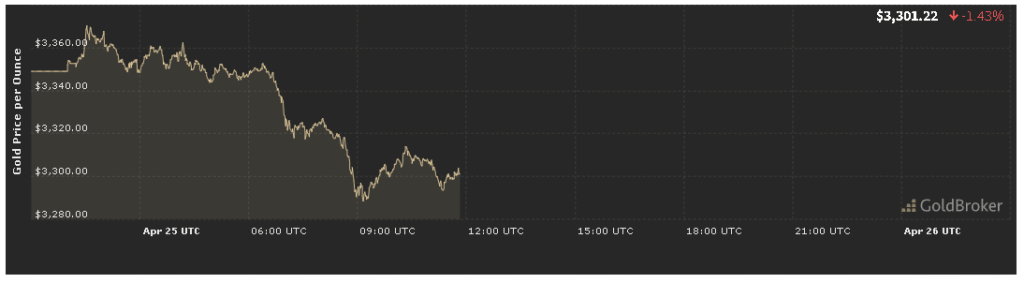

On April 25, 2025, gold opened at $3,301.22 per ounce, marking a 1.43% decrease from the previous session. This notable drop has drawn significant attention from analysts and investors as several key macroeconomic indicators and geopolitical developments converge to shape gold’s trajectory. With gold often regarded as a safe-haven asset, fluctuations like these signal shifting sentiment in the broader financial markets.

Factors Influencing Gold Prices on April 25, 2025

1. Inflationary Pressure and Fed Policies

One of the primary drivers of gold prices in 2025 continues to be inflation. Despite aggressive tightening by the Federal Reserve throughout 2024, core inflation remains sticky, particularly in the energy and food sectors. The U.S. Consumer Price Index (CPI) showed a modest uptick in April, unsettling markets and increasing speculation that the Federal Reserve might hold interest rates higher for longer.

Higher interest rates typically strengthen the dollar and increase yields on bonds, which in turn reduces the appeal of non-yielding assets like gold. This dynamic has put downward pressure on gold this week, contributing to its current decline.

2. Geopolitical Tensions Add Volatility

Tensions between Russia and NATO over Eastern Europe, along with the ongoing instability in the Middle East, have added to global market volatility. While such developments usually support gold, the market has already priced in much of the geopolitical risk, leading to a more muted reaction than expected.

Furthermore, talks of a potential peace agreement in one of the major regional conflicts brought a brief sense of optimism, which eased safe-haven demand for gold—a factor playing into the decline in price on April 25.

3. Economic Growth and Currency Fluctuations

Sluggish growth in the Eurozone and mixed economic data from China have caused uncertainty around global demand. In contrast, the U.S. economy showed stronger-than-expected GDP growth in Q1 2025, bolstering the U.S. dollar.

As gold is priced in dollars, a stronger dollar typically makes gold more expensive for foreign buyers, reducing international demand. This inverse relationship has been especially clear this week, further weakening gold’s position.

4. Technical Indicators and Market Sentiment

Technical analysis of the gold charts for April 25, 2025, indicates that gold is currently testing a key support level near $3,295 per ounce. A sustained break below this level could trigger additional selling, while a bounce could set the stage for short-term recovery.

The Relative Strength Index (RSI) is approaching the oversold zone, suggesting that gold might be nearing a temporary bottom. However, volume trends indicate that bearish sentiment remains strong, and investor caution prevails.

Gold Price Forecast: What to Expect by Market Close

Looking ahead to the remainder of April 25, gold prices may remain under pressure unless a surprise catalyst emerges. Analysts expect prices to trade between $3,280 and $3,320 per ounce, with possible tests of lower support if U.S. Treasury yields continue to climb or if the dollar strengthens further.

Several institutional investors are watching closely for:

- Any unexpected Federal Reserve statements or economic data releases.

- New developments in geopolitical flashpoints that could reignite safe-haven demand.

- Shifts in investor appetite as markets respond to earnings reports and macro indicators.

Short-term expectations lean bearish, but many still see potential upside in the medium to long term, particularly if inflation remains elevated or if economic conditions deteriorate.

Broader Trends in Gold for 2025

Gold’s Long-Term Support from Central Bank Demand

Despite the short-term dip, central banks worldwide continue to accumulate gold, with India, China, and Turkey leading purchases in Q1 2025. This underlying demand provides a solid long-term floor for prices, even in the face of temporary corrections.

As global reserves diversify away from the U.S. dollar, gold remains a strategic asset in the portfolios of many nations, lending fundamental support to its long-term value.

ETFs and Institutional Investment Patterns

Gold-backed ETFs have seen modest outflows over the past week, reflecting a reduction in institutional demand amid rising confidence in risk assets like equities. However, some hedge funds are maintaining or increasing their long positions, anticipating a resurgence in gold once market volatility returns.

This push and pull between risk-on and risk-off positioning will likely define gold’s performance throughout the second quarter of 2025.

Conclusion: Navigating Gold’s Volatile Path

As of April 25, 2025, the gold market is at a pivotal juncture. A combination of macroeconomic uncertainty, geopolitical risks, and technical market movements has caused prices to retreat from recent highs. While a 1.43% drop may not seem catastrophic in isolation, it signals a shift in short-term sentiment.

We believe investors should stay attuned to:

- Inflation data and the Fed’s response.

- Ongoing geopolitical developments.

- The direction of the U.S. dollar and treasury yields.

Gold may remain range-bound in the short term, but the underlying fundamentals—especially inflation and central bank demand—continue to support a bullish outlook over the longer horizon.