Gold continues to serve as a reliable safe-haven asset in an ever-changing economic landscape. On March 7, 2025, the gold market opened at $2,918.33 per ounce, registering a 0.32% increase from the previous session.

While the percentage change may appear modest, it reflects a delicate balance of economic, geopolitical, and market-specific factors that are actively influencing investor sentiment. This exclusive Gold Price Analysis for March 7, 2025 provides an in-depth look into the key indicators driving today’s gold prices and offers expert insights into what investors might expect until the market closes.

Whether you’re a seasoned trader or a newcomer to precious metals investing, understanding these dynamics is essential for making informed decisions and constructing a robust investment portfolio.

In the following sections, we will explore how inflation, Federal Reserve policies, geopolitical tensions, and currency fluctuations are shaping the gold market today. Additionally, we will discuss technical analysis insights and forecast potential scenarios for the remainder of the trading day.

Current Gold Market Overview

Gold’s Opening Performance on March 7, 2025

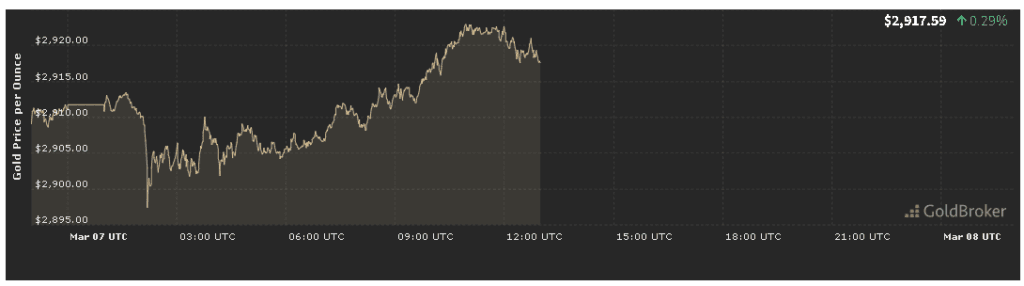

On March 7, 2025, gold began the trading session on a positive note by opening at $2,918.33 per ounce, marking an increase of 0.32% compared to the previous session. This slight yet positive uptick suggests that while market sentiment remains cautiously optimistic, investors are closely monitoring several underlying economic signals.

Key Highlights:

- Opening Price: $2,918.33 per ounce

- Daily Change: +0.32% increase

- Market Sentiment: Cautiously bullish

- Primary Drivers: Subtle inflationary signals, monetary policy cues, and low-key geopolitical developments

This initial performance indicates that investors are maintaining their positions while waiting for further clarity from economic reports and global events. As the trading day unfolds, these fundamental factors are expected to become more prominent, influencing both short-term and long-term price movements.

Economic Indicators Affecting Gold Prices

1. Inflation: The Ever-Present Pressure

Inflation is one of the most critical drivers of gold prices. As the purchasing power of fiat currencies declines with rising inflation, gold—being a tangible asset with intrinsic value—becomes a favored store of value.

Inflationary Pressures:

- Current Trends: Recent data indicates that inflation in major economies is hovering around moderate levels, which continues to remind investors of the potential for future price increases in goods and services.

- Gold as a Hedge: Historically, gold has appreciated during periods of rising inflation. Even with modest inflationary pressures, the current uptick of 0.32% may suggest that investors are positioning themselves to protect against further erosion of currency value.

Inflation acts as a persistent underpinning for gold’s appeal. Investors who seek to hedge against the devaluation of paper currencies are increasingly turning to gold, reinforcing its role as a safe haven in uncertain times.

2. Federal Reserve Policies and Interest Rates

Monetary policy decisions, particularly those of the U.S. Federal Reserve, have a profound impact on gold prices. When interest rates are low, the opportunity cost of holding gold decreases, enhancing its attractiveness compared to yield-bearing assets.

Key Considerations:

- Policy Outlook: Analysts expect that the Fed will maintain its current interest rate stance in the near term. This policy stability supports the gold market by keeping the cost of holding non-yielding assets relatively low.

- Potential Policy Shifts: Should the Fed unexpectedly adopt a more dovish stance, such as cutting interest rates, gold prices might experience further upward momentum. Conversely, a sudden shift to a hawkish policy could induce short-term volatility in the market.

- Monitoring Fed Communications: Investors are advised to closely follow Federal Reserve announcements, as even slight changes in policy expectations can lead to significant shifts in gold prices.

The interplay between Federal Reserve policies and gold prices is essential for understanding market dynamics. With the Fed’s current position, the modest increase in gold price reflects a cautious optimism among investors.

3. Geopolitical Tensions and Global Uncertainty

Geopolitical events and global uncertainties continue to be a significant influence on gold prices. Although no major crises have erupted on March 7, 2025, ongoing tensions in various regions still play a crucial role in shaping market behavior.

Geopolitical Drivers:

- Regional Instability: Persistent but low-key tensions in areas such as Eastern Europe and the Middle East contribute to a risk-averse sentiment among investors, driving them toward safe-haven assets like gold.

- Trade and Diplomatic Developments: Subtle shifts in trade relations and international diplomacy, particularly between major economies such as the U.S. and China, create an environment where cautious optimism prevails.

- Safe-Haven Demand: Even a modest increase of 0.32% indicates that investors continue to view gold as a reliable safe haven amid underlying global uncertainties.

The current market behavior suggests that while investors are not panicking, they are staying vigilant for any signs of escalating geopolitical tensions that could trigger a more pronounced flight to safety.

4. Currency Fluctuations and the U.S. Dollar

Gold is typically priced in U.S. dollars, and fluctuations in the dollar’s value can have significant implications for gold prices. The relationship between gold and the U.S. dollar is generally inverse—when the dollar weakens, gold becomes more affordable for international buyers, thereby driving up demand.

Key Observations:

- Dollar Performance: Recent trends indicate that the U.S. Dollar Index (DXY) has shown slight signs of weakness, supporting the current modest increase in gold prices.

- Market Impact: A weaker dollar can attract foreign investors who seek to diversify their portfolios, contributing to an upward pressure on gold prices.

- Currency Volatility: Even minor shifts in the dollar’s strength are closely monitored, as they can have an outsized impact on gold pricing. This makes forex trends an essential factor for investors.

Understanding the dynamics between the U.S. dollar and gold is crucial. The subtle decline in the dollar enhances gold’s appeal, reinforcing its role as a hedge against currency devaluation.

Stock Market Performance and Investor Sentiment

1. Impact of Equity Market Trends on Gold

Stock market performance is another key factor influencing gold prices. When equity markets exhibit volatility, investors tend to shift their capital into gold to mitigate risk.

Current Equity Trends:

- Mixed Performance: Recent data from Wall Street shows a mixture of gains and profit-taking, creating an overall environment of uncertainty.

- Risk-Off Behavior: In times of market stress, investors move their funds into safer assets like gold. This behavior typically results in increased demand for gold, contributing to price stability or slight increases.

2. Psychological Factors and Speculative Trading

Investor sentiment and market psychology play a pivotal role in determining short-term movements in the gold market. Media coverage of economic and geopolitical developments, combined with speculative trading, can amplify even modest price changes.

Influencing Factors:

- Media Influence: Continuous news coverage can heighten investor anxiety, leading to a surge in gold purchases.

- Speculative Dynamics: Short-term speculative trading based on market sentiment may cause additional volatility, making even a 0.32% increase significant when viewed from a psychological perspective.

- Sentiment-Driven Decisions: Both short-term traders and long-term investors need to understand how market psychology affects price movements to make well-informed decisions.

Technical Analysis: Reading the Market’s Pulse

1. Chart Patterns and Moving Averages

Technical analysis is an indispensable tool for investors aiming to understand the short-term behavior of gold prices. By analyzing chart patterns and moving averages, investors can identify trends, potential reversal points, and key support and resistance levels.

Tools and Techniques:

- Short-Term vs. Long-Term Averages: Comparing short-term moving averages with long-term trends can help pinpoint moments when the price might reverse or continue in its current trajectory.

- Support and Resistance Levels: Analysts suggest that if the bullish momentum continues, gold could test resistance levels near $2,930–$2,940 per ounce. Conversely, if a pullback occurs, support levels around $2,900–$2,910 per ounce might hold.

- Trend Analysis: Consistent upward or downward trends provide investors with signals regarding the market’s future direction, helping them time their entry and exit points effectively.

2. Volume Analysis and Market Liquidity

Trading volume is a critical indicator that validates price movements. On March 7, 2025, the modest increase in gold price is accompanied by monitoring trading volume to ensure the trend is supported by substantial investor activity.

What to Monitor:

- Volume Spikes: Sudden increases in trading volume can signal strong buying interest, confirming that the current trend is robust.

- Liquidity Considerations: Understanding market liquidity is essential to avoid significant price slippage when entering or exiting positions, especially during volatile periods.

3. High-Frequency Trading (HFT) and Algorithmic Impact

High-frequency trading and algorithmic systems have become increasingly influential in short-term market dynamics. These systems execute trades in milliseconds, contributing to rapid price fluctuations that can sometimes exaggerate even a slight increase of 0.32%.

Implications for Investors:

- Speed and Volatility: HFT can increase short-term volatility, making minor price movements more significant.

- Data-Driven Strategies: Investors who keep an eye on algorithmic trading patterns can better anticipate short-term market shifts and adjust their strategies accordingly.

Expectations for Gold Prices Until Market Close

1. Bullish Scenario: Continued Upward Movement

If the economic data released later in the day reinforce inflation concerns, or if geopolitical tensions escalate unexpectedly, the bullish momentum could continue throughout the trading session.

Potential Catalysts:

- Rising Inflation Fears: New data indicating an acceleration in inflation may prompt further investor demand for gold.

- Geopolitical Escalations: Any additional tension in key regions such as Eastern Europe or the Middle East could drive investors to seek even greater security in gold.

- Weakening Dollar: Should the U.S. dollar continue to display slight weakness, this trend could further support an upward trajectory in gold prices.

In a bullish scenario, analysts predict that gold might test new resistance levels in the $2,930–$2,940 per ounce range before the market closes, driven by sustained buying interest.

2. Bearish Scenario: Possibility of a Temporary Pullback

Conversely, if robust economic indicators emerge or if the Federal Reserve hints at tightening monetary policy, gold might face some short-term selling pressure.

Factors That Could Lead to a Pullback:

- Strong Economic Data: Unexpectedly positive economic reports may lead investors to favor riskier assets over gold, reducing its demand.

- Hawkish Fed Signals: Any indication from the Federal Reserve about potential interest rate hikes could strengthen the dollar and exert downward pressure on gold.

- Equity Market Recovery: A rebound in the stock market could shift investor sentiment away from gold, resulting in a temporary dip in prices.

In this bearish scenario, gold could retract to support levels around $2,900–$2,910 per ounce before stabilizing as the trading day concludes.

3. Analyst Insights and Market Sentiment

Market analysts currently view the gold market as being in a consolidation phase on March 7, 2025. They emphasize that price movements today are largely contingent on forthcoming economic data and subtle shifts in global political dynamics. Analysts advise investors to closely monitor:

- Federal Reserve Announcements: Any policy changes or updates on economic outlooks from the Fed can have immediate and significant impacts on gold prices.

- U.S. Dollar Movements: Even minor fluctuations in the U.S. Dollar Index (DXY) are crucial, as they directly influence gold’s international demand.

- Global Economic Indicators: Inflation figures, employment data, and manufacturing indices remain critical to forecasting future price trends.

Long-Term Versus Short-Term Perspectives on Gold

1. Long-Term Investment Outlook

Gold has long been a cornerstone of investment portfolios due to its ability to preserve wealth over time, particularly during periods of economic and geopolitical uncertainty. While short-term fluctuations are inevitable, the long-term outlook for gold remains promising for several reasons:

- Historical Resilience: Gold’s track record of maintaining value over centuries underscores its role as a reliable store of wealth.

- Safe-Haven Demand: In times of crisis, investors consistently turn to gold, ensuring its perpetual appeal as a secure asset.

- Diversification Benefits: Including gold in a diversified portfolio can help mitigate risks associated with volatility in other asset classes, such as stocks and bonds.

2. Short-Term Trading Considerations

For short-term traders, the gold market presents both opportunities and challenges. The current environment of mixed economic signals suggests that while short-term price movements may be volatile, disciplined technical analysis and robust risk management strategies can help capitalize on these fluctuations.

- Technical Tools: Utilizing indicators such as moving averages, RSI, and MACD can help pinpoint precise entry and exit points.

- Volume and Liquidity Analysis: Monitoring trading volume and liquidity ensures that price movements are well-supported and that investors can trade efficiently.

- Staying Informed: Real-time updates on economic data and geopolitical events are essential for adjusting positions quickly in a fast-moving market.

Conclusion: Navigating the Gold Market with Confidence

The Gold Price Analysis for March 7, 2025 reveals a subtle yet positive start, with gold opening at $2,918.33 per ounce and increasing by 0.32%. This modest uptick reflects a balanced market where investor confidence is cautious yet optimistic amid ongoing inflation concerns, steady monetary policy, and low-key geopolitical developments.

Key Takeaways:

- Gold opened at $2,918.33 per ounce, reflecting a 0.32% increase.

- Inflation expectations and Federal Reserve policies remain key drivers of gold prices.

- Subtle geopolitical tensions continue to underpin gold’s status as a safe haven.

- A slight weakness in the U.S. dollar is contributing to the modest price increase.

- Technical indicators suggest that gold may test resistance levels near $2,930–$2,940 per ounce or, if under selling pressure, retreat to support levels around $2,900–$2,910 per ounce.

- Investors should monitor economic data, central bank communications, and global events closely as the trading session progresses.

Whether you are a long-term investor looking to hedge against economic uncertainty or a short-term trader aiming to capitalize on market fluctuations, understanding these key factors is essential for making informed investment decisions. Gold remains a timeless asset, providing both a reliable store of value and a safe haven during turbulent times. By incorporating these insights into your investment strategy, you can confidently navigate the complexities of the gold market.

Stay connected with our expert analyses and real-time market updates to optimize your investment strategy and make well-informed decisions. With disciplined strategies and continuous monitoring of key indicators, you can position yourself for success in an ever-changing global economic landscape.

Optimize Your Investment Strategy with Expert Gold Market Insights

For investors looking to capitalize on daily gold price trends, staying updated on market movements and understanding the underlying drivers is crucial. Whether you are trading gold ETFs, investing in physical gold, or diversifying your portfolio, our comprehensive analysis is designed to provide valuable insights that help you achieve your financial objectives.

Stay connected for the latest gold price analysis, expert forecasts, and market insights that will guide your investment journey in 2025 and beyond. Happy investing!

Interesting articles

Understanding the Gold Market: Key Factors Every Investor Should Know

How Geopolitical Tensions Drive Gold Prices: A Guide for Investors

The Future of Gold Investment: Trends, Predictions, and Strategies