Introduction: Gold Price Analysis Forecast Today for July 3, 2025

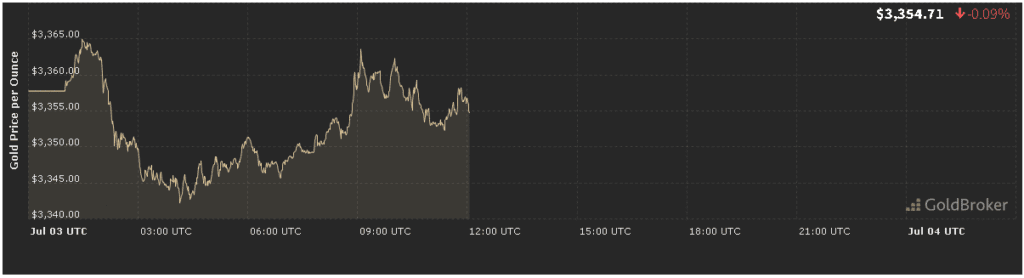

In our gold price analysis forecast today for July 3, 2025, spot gold opened at $3,355.03 per ounce, down 0.08% from yesterday’s settlement. After a rally into midweek highs above $3,380, bullion eased as traders weighed a mix of cooler U.S. inflation signals, renewed Middle East flare‑ups, and lingering central‑bank demand. This report dissects the major catalysts driving today’s session, highlights critical technical thresholds, and outlines what to expect for gold through the market close.

Market Overview in Gold Price Analysis Forecast Today for July 3, 2025

Friday’s trading saw gold consolidate gains from Thursday’s surge, with spot briefly touching $3,382 before profit‑taking and stronger equities nudged prices lower. Overnight in Asia, gold traded in a narrow $3,350–$3,370 band, reflecting light weekend headlines. U.S. futures on Comex were flat to slightly softer, as broad equity indices clawed back losses on optimism regarding U.S. corporate earnings and a pause in Fed‑rate‑cut expectations. With the second half of the session bringing key data, today’s trading range may hinge on fresh releases rather than broad risk appetite.

Inflation Indicators in Gold Price Analysis Forecast Today for July 3, 2025

U.S. PCE and Sticky Core Prices

Inflation remains gold’s primary macro driver. On July 1, the Bureau of Economic Analysis reported Personal Consumption Expenditures (PCE) Price Index rose 0.1% month‑on‑month in May, holding the annual rate at 2.6%—in line with April. Core PCE, excluding food and energy, also climbed 0.1%, keeping the year‑on‑year gauge at 2.7%, well above the Fed’s 2% target.

- Implication: Persistent core inflation reduces the likelihood of imminent rate cuts, capping real‑yield declines and limiting gold’s upside.

- Gold Reaction: Today’s 0.08% opening dip suggests markets see little new impetus from PCE; traders may await next week’s Fed minutes for clearer guidance.

Geopolitical Events in Gold Price Analysis Forecast Today for July 3, 2025

Middle East Tensions and Safe‑Haven Demand

Over the weekend, Israeli airstrikes in southern Lebanon and renewed Houthi drone launches over the Red Sea reignited risk premiums. Shipping‑lane insurance spiked, briefly lifting gold to test $3,380 late Friday.

- Watch Levels: Sustained flare‑ups could push gold toward $3,400, as traders seek a hedge against broader market disruption.

- Premium Estimate: Current geopolitical risk adds roughly $10–$15 per ounce to spot prices, up from negligible levels two weeks ago.

Central Bank Trends in Gold Price Analysis Forecast Today for July 3, 2025

Official Sector Buying Remains a Pillar

Central banks have been net purchasers of gold for 13 straight quarters. A mid‑June World Gold Council poll found 91% of reserve managers plan to keep or expand their allocations by year‑end, citing portfolio diversification and geopolitical uncertainty.

- Recent Flows: The People’s Bank of China and Kazakhstan added about 60 tonnes in H1 2025, underpinning a floor near $3,320.

- Structural Support: Official sector demand continues to curb downside risk, even if speculative flows ebb.

Economic Events in Gold Price Analysis Forecast Today for July 3, 2025

U.S. ISM Services and JOLTS Report

Key U.S. releases today include:

- ISM Services Index (10:00 a.m. ET): Expected at 52.5, down from 53.2 in June, edging closer to contraction territory.

- JOLTS Job Openings (10:00 a.m. ET): Forecast to fall to 8.5 million from 8.7 million, signaling a cooler labor market.

Why It Matters:

- A weak services PMI or a drop in job openings may stoke recession fears, boosting gold’s safe‑haven appeal.

- Conversely, stronger data could lift Treasury yields and cap bullion’s upside.

Technical Outlook in Gold Price Analysis Forecast Today for July 3, 2025

From a chart perspective, gold trades within a well‑defined range:

- Immediate Support:

- $3,350: Friday’s intraday low and morning VWAP (30‑min).

- $3,320: Mid‑June swing lows.

- Key Resistance:

- $3,380: Last week’s peak.

- $3,400: Round‑number level also aligning with a rising trendline.

- Momentum Gauge: The 14‑day RSI sits at 54, indicating neutral momentum with space to rally before overbought readings near 70.

Trading Signals:

- A daily close above $3,380 may trigger momentum buying toward $3,400.

- A drop below $3,350 risks a deeper correction back to $3,320.

Expectations Until Market Close in Gold Price Analysis Forecast Today for July 3, 2025

Based on today’s mix of data and technical levels, here’s our gold price analysis forecast today for July 3, 2025:

- Morning Session (Asia & Europe):

- Likely range $3,350–$3,370, digesting early risk headlines.

- U.S. Midday (10:00 a.m. ET):

- Dovish Surprise: (ISM <52.0 or JOLTS <8.4M) → Gold could spike to $3,375–$3,385.

- Hawkish Surprise: (ISM >54.0 or JOLTS >8.8M) → Expect retracement to $3,340–$3,350.

- Afternoon & Close:

- Monitor Fed‑funds futures for shifts in Fed‑rate‑cut expectations.

- In absence of surprises, bullion may settle near $3,355–$3,365.

Tactical Tip: Use the 30‑minute VWAP to gauge intraday support/resistance, layering buys on dips toward $3,350 and trimming near $3,380.

Conclusion: Gold Price Analysis Forecast Today for July 3, 2025

Our gold price analysis forecast today for July 3, 2025 underscores a market balancing lingering inflation concerns, renewed geopolitical risk, and steadfast central‑bank demand. Technically, gold remains range‑bound between $3,350 and $3,380, with today’s ISM and JOLTS reports primed to break the deadlock. Intraday traders will find clear entries aligned to these pivot points, while longer‑term investors might view dips toward $3,350 as tactical buying opportunities on strong fundamental underpinnings.

Key Takeaways:

- Open: $3,337.02 (–0.03%)

- Inflation: May PCE +0.1% M/M, +2.6% Y/Y; Core +0.1%

- Geopolitics: Middle East flare‑ups add $10–$15 risk premium

- Central Banks: 91% plan to maintain/increase reserves; H1 net buys ~60t

- Economic Catalysts: ISM Services, JOLTS Job Openings

- Technical Range: Support $3,350; Resistance $3,380; RSI 54

Stay nimble as today’s data prints and technical tests unfold—each could spark the next leg higher or trigger a deeper dip. Trade wisely!