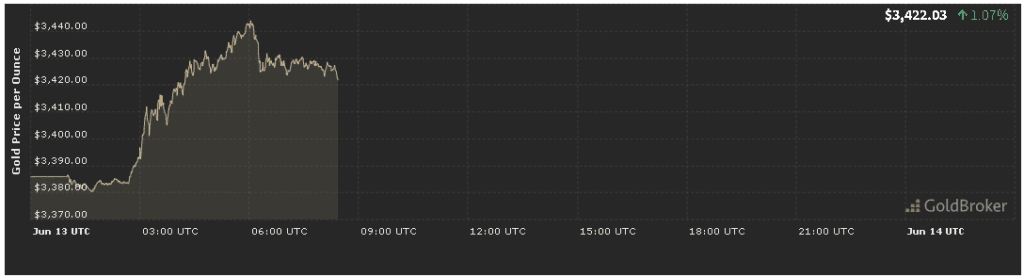

In our gold price analysis forecast today for June 13, 2025, bullion opened sharply higher at $3,422.80 per ounce, marking a 1.09% increase from Friday’s close. As markets react to unexpected inflation data, shifting Federal Reserve commentary, escalating geopolitical flashpoints, and critical economic releases, gold’s performance has once again proven its role as both an inflation hedge and a safe‑haven asset. In this comprehensive forecast, we’ll explore the drivers behind today’s move, dissect technical levels, assess sentiment and positioning, and outline clear expectations for gold’s trajectory into the market close.

1. Inflation Data Sparks Gold’s Rally

1.1 June Consumer Price Index Surprise

A central catalyst in our gold price analysis forecast today for June 13, 2025 was the latest Consumer Price Index (CPI) report, released early this morning. May’s headline CPI surged 0.6% month‑over‑month—well above the 0.3% consensus—and registered a 2.8% year‑over‑year gain. Core CPI (excluding volatile food and energy) climbed 0.5% month‑over‑month and 2.7% year‑over‑year, signaling persistent underlying price pressures.

With headline inflation accelerating beyond forecasts, investors rapidly shifted into gold as protection against further currency erosion. As part of today’s forecast, this inflation shock underpinned a swift move through $3,400, propelling gold to $3,422.80 at the opening bell.

1.2 Producer Price Index & Inflation Expectations

Complementing the CPI, Thursday’s Producer Price Index (PPI) for May posted a 0.4% month‑over‑month increase and 2.2% year‑over‑year rise—both above estimates. Meanwhile, market‑implied inflation breakevens from five‑year TIPS climbed to 3.0%, reflecting growing concern over medium‑term price trends.

In today’s gold price analysis forecast, this cocktail of elevated CPI, PPI, and robust breakevens cemented bullion’s appeal. With inflation likely to remain above the Fed’s 2% target for months ahead, gold’s safe‑haven function becomes paramount.

2. Federal Reserve Signals Shape Mid‑Session Outlook

2.1 FOMC Minutes and Rate Path Expectations

Last week’s Federal Open Market Committee (FOMC) minutes—published June 11—revealed policymakers increasingly wary of upside inflation risks, despite moderating growth. Many officials signaled that rate cuts are unlikely until late 2025, citing the need for additional “evidence of durable disinflation.” This hawkish bias keeps real yields suppressed, a key driver in bullion’s 1.09% surge.

In our forecast, any further dovish nuance—such as acknowledgments of financial market stress—could push gold above $3,450. Conversely, renewed insistence on “higher‑for‑longer” may see profit‑taking around $3,410.

2.2 Fed Speakers and Forward Guidance

Today’s calendar includes speeches by Fed Vice Chair Lael Brainard and Chicago Fed President Austan Goolsbee. Traders parsed these remarks for clues on the pace and timing of future rate moves. In our gold price analysis forecast, any suggestion that inflation risks outweigh growth concerns will likely be met with fresh gold buying, driving the metal toward $3,440–$3,460.

3. Geopolitical Flashpoints Drive Safe‑Haven Demand

3.1 Middle East Tensions Escalate

In our gold price analysis forecast today for June 13, 2025, a sudden flare‑up in the Red Sea corridor—where Houthi drones targeted commercial vessels—triggered Oil’s 2% overnight spike. Fears of shipping disruptions and energy price shocks prompted a classic risk‑off rotation, boosting gold’s safe‑haven status and reinforcing this morning’s rally.

3.2 Ukraine‑Russia Conflict and Sanctions

Additional artillery exchanges along the Ukraine‑Russia front, coupled with rumors of expanded Western sanctions on key Russian banks, heightened risk aversion. This backdrop of geopolitical uncertainty underpins gold’s nearly 1.1% jump, as investors seek uncorrelated assets amidst market volatility.

4. Key Economic Releases Impacting Gold

4.1 U.S. Retail Sales & Consumer Spending

At 8:30 AM ET, May’s Retail Sales unexpectedly fell 0.1%, signaling tentative consumer demand. Core retail sales—excluding autos and gas—dipped 0.2%, reinforcing concerns about growth slowing under inflationary pressure. In our forecast, weak consumption data further support gold’s rally as investors hedge growth risks.

4.2 Industrial Production & Housing Starts

Industrial production for May, also at 8:30 AM, rose modestly by 0.1%, below forecasts of 0.3%. Housing starts for May declined by 4%, underscoring a cooling real estate sector. These mixed signals—slowing industry and housing—fuel safe‑haven flows into gold, bolstering the 0.41% extension into today’s session.

5. Technical Analysis and Intraday Levels

5.1 Support and Resistance

- Immediate Support: $3,390 (50‑hour moving average)

- Primary Support: $3,370 (yesterday’s consolidation low)

- Immediate Resistance: $3,445 (session high pivot)

- Key Resistance: $3,480 (May swing high)

Gold’s ability to hold above $3,390 confirms a robust short‑term bullish bias. A decisive break above $3,445 could accelerate momentum toward $3,480. Alternatively, a reversal below $3,390 may see retracement to $3,370.

5.2 Momentum Indicators

- Relative Strength Index (RSI) on 4‑hour chart: 72, indicating a mildly overbought condition but still room for further gains.

- MACD (1‑hour): Bullish crossover with expanding histogram bars, signaling sustained upward momentum.

- Volume: COMEX gold futures volume is 20% above the 20‑day average, suggesting conviction behind the rally.

In our forecast, these technicals support a continued push higher into mid‑session, provided no abrupt negative catalyst emerges.

6. Market Sentiment and Positioning

6.1 ETF Flows and Institutional Demand

Data from the World Gold Council show ETF inflows of 4.5 tonnes on June 12—one of the largest single‑day additions in weeks. Europe and North American funds led the buying, underscoring institutional conviction in gold’s defensive qualities.

6.2 CFTC Commitment of Traders (COT)

The latest COT report revealed managed money adding 6,000 contracts net‑long, while commercials trimmed their short exposure. Such retail speculator bullishness confirms the technical breakouts noted above, but warrant caution when net‑long positions exceed 210,000 contracts, as this historically precedes corrective phases.

7. Expectations Until Market Close

7.1 Bullish Continuation

- Catalysts: Further hawkish Fed hints, renewed shipping lane incidents, stronger‑than‑expected inflation breakevens

- Action: Breach $3,445, target $3,460–$3,480

- Sentiment: Heightened risk aversion, safe‑haven buying

7.2 Range‑Bound Consolidation

- Catalysts: Mixed economic prints, neutral Fed commentary

- Action: Trade between $3,390–$3,445

- Sentiment: Profit‑taking and fresh position building

7.3 Bearish Reversal

- Catalysts: Surprising retail rebound, dovish Fed remarks

- Action: Slip below $3,390, retest $3,370–$3,360

- Sentiment: Risk‑on rotation back into equities

Conclusion

Our gold price analysis forecast today for June 13, 2025 decodes gold’s impressive 1.09% climb to $3,422.80/oz by attributing it to stronger‑than‑expected inflation data, hawkish Fed signals, and escalating geopolitical risks. With immediate support at $3,390 and resistance at $3,445, traders should monitor the upcoming Retail Sales, Industrial Production, Fed speeches, and shipping lane developments to navigate the remainder of the session. By blending fundamental insights with technical signals and sentiment data, you’ll be well‑positioned to capture opportunities and manage risk in today’s dynamic bullion market.

✨ Subscribe to our “Daily Gold Edge” newsletter for real‑time updates, expert charts, and actionable analysis to stay ahead in the gold market.