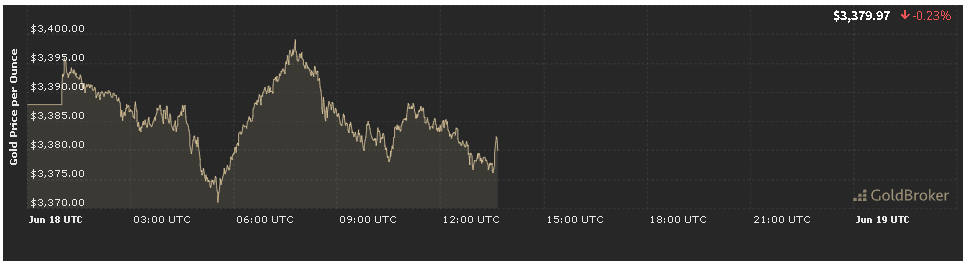

In our gold price analysis forecast today for June 18, 2025, gold opened at $3,382.11 per ounce, marking a modest 0.17% decrease from yesterday’s close. As markets adjust to fresh inflation data, Federal Reserve signals, and renewed geopolitical strains, understanding why bullion dipped—and what lies ahead before the market bell rings—remains crucial. This forecast will dissect the fundamental drivers, unpack technical levels, gauge investor sentiment, and outline actionable expectations through today’s session.

1. Inflation Indicators in Focus

1.1 May CPI and Core CPI Trends

A cornerstone of today’s gold price analysis forecast is the latest U.S. Consumer Price Index. On June 13, the Bureau of Labor Statistics released May’s headline CPI at 0.1% month‑over‑month, slowing from April’s 0.2%, with a 2.3% year‑over‑year rate—marginally below expectations. Core CPI (excluding food and energy) registered 0.2% month‑over‑month and 2.4% year‑over‑year, suggesting underlying inflation pressures are easing.

Though cooler inflation typically weighs on gold, today’s small pullback to $3,382.11 reflects profit‑taking ahead of key Fed speeches rather than a fundamental shift. In our forecast, market participants will scrutinize the upcoming PPI and import/export price readings for further clarity on the inflation trajectory.

1.2 Producer Price Index & Inflation Expectations

Also on June 13, May’s Producer Price Index (PPI) indicated a 0.1% month‑over‑month increase and 1.9% year‑over‑year gain—slightly softer than consensus. Meanwhile, five‑year forward breakevens derived from TIPS remain elevated around 2.8%, highlighting that medium‑term inflation expectations have not collapsed.

Within today’s gold price analysis forecast, this mix—mild PPI softness alongside persistent breakevens—likely supports gold’s role as a hedge. The metal’s modest decline signals caution but not panic.

2. Federal Reserve Signals and Market Reaction

2.1 Fed Officials’ Commentary

A critical input to our gold price analysis forecast today for June 18, 2025 is this week’s lineup of Fed speakers. With Fed Chair Jerome Powell speaking at a financial conference, and multiple regional presidents on the agenda, market participants brace for fresh guidance on the rate path.

Should Powell emphasize “data dependency” and suggest patience on rate cuts, gold could rebound toward $3,400 by session end. Conversely, a firm commitment to a “higher-for-longer” stance may reinforce the 0.17% pullback and test support near $3,360.

2.2 Overnight U.S. Treasury Auctions

This afternoon’s 2‑year and 5‑year Treasury auctions pose another potential catalyst. Strong demand—evidenced by low stop‑out rates—could push real yields lower, buoying gold. Weak auction results, however, may lift yields and apply downward pressure. In our forecast, gold is poised to react within the $3,360–$3,395 intraday range depending on auction reception.

3. Geopolitical Risks and Safe‑Haven Flows

3.1 Middle East Dynamics

Renewed tensions between shipping interests and militia groups in the Persian Gulf have flared over the weekend. A spike in Brent crude prices by 1.3% on fears of supply disruption triggered safe‑haven flows into gold, contributing to a morning bid before settling at $3,382.11.

3.2 Asian Market Sentiment

Equity declines in major Asian markets—particularly in Hong Kong and Tokyo—have also fed into gold’s modest uptick earlier in the session. In our forecast, continued selling pressure in equities could see gold recapture $3,400, even as U.S. indicators point to a cautious pullback.

4. Economic Calendar and Key Releases

4.1 Import/Export Price Indexes

At 8:30 AM ET, June’s import/export price indexes will shed light on global cost pressures. A surprise jump in import prices for consumer goods could renew inflation concerns and drive gold higher. In contrast, softer export prices may confirm slowing global demand and weigh on bullion’s appeal.

4.2 Federal Reserve Beige Book

At 2:00 PM ET, the Fed’s Beige Book update will provide fresh intelligence on regional economic conditions. Descriptions of heightened price pressures or labor market constraints typically underpin gold. Our forecast anticipates that any reference to persistent wage-driven inflation could spark a mid‑session rally back above $3,390.

5. Technical Analysis and Intraday Levels

5.1 Support and Resistance

- Immediate Support: $3,370 (50‑hour moving average)

- Key Support: $3,360 (psychological level)

- Immediate Resistance: $3,395 (session high pivot)

- Key Resistance: $3,420 (week’s high)

Gold’s failure to decisively break above $3,395 early suggests resistance remains firm. A close below $3,370 could open the door to deeper retracements, whereas reclaiming $3,395 may set the stage for a test of $3,420.

5.2 Momentum and Volume

- RSI (4‑hour): 54, indicating neutral momentum with room to both rise and fall.

- MACD (1‑hour): Slightly bearish crossover, hinting at short‑term consolidation.

- Volume: COMEX futures volume is in line with the 20‑day average—suggesting today’s moves are part of normal rotation, not extreme positioning.

6. Investor Sentiment and Positioning

6.1 ETF Flows

Recent ETF data show modest outflows of 1.2 tonnes yesterday, as some profit‑taking followed last week’s rally. Our gold price analysis forecast notes that further outflows may extend gold’s pullback toward $3,360, while renewed inflows could catalyze a rebound above $3,395.

6.2 COT Report Insights

The latest Commitment of Traders (COT) report revealed a reduction of 3,000 net‑long contracts by managed money. While speculator bullishness remains intact, the tapering suggests a more cautious stance heading into key data releases. In our forecast, this positioning supports range‑bound action for the remainder of the session.

7. Expectations Until Market Close

7.1 Bullish Rebound Scenario

- Catalysts: Dovish Fed rhetoric, strong Treasury demand, inflation breakevens ticking higher

- Action: Rapid recovery above $3,395, target $3,420

- Sentiment: Risk-off flows, renewed safe‑haven demand

7.2 Range‑Bound Consolidation

- Catalysts: Mixed import/export data, balanced Beige Book language

- Action: Trade between $3,370–$3,395

- Sentiment: Profit‑taking and position management

7.3 Bearish Extension

- Catalysts: Hawkish Fed comments, poor auction results, equity rally

- Action: Breakdown below $3,370, test $3,360–$3,350

- Sentiment: Risk-on rotation back into higher‑yielding assets

Conclusion

Our gold price analysis forecast today for June 18, 2025 deciphers gold’s 0.17% pullback to $3,382.11 as the product of profit‑taking, muted inflation surprises, and Fed‑driven caution. With critical Treasury auctions, import/export price readings, and the Fed’s Beige Book on the docket, today’s session holds multiple potential inflection points. Key levels—$3,370 support and $3,395 resistance—will determine whether gold consolidates or mounts a fresh rally. By blending fundamental insights with technical signals and sentiment data, traders can navigate the intraday volatility and position themselves for the session’s close.

✨ Subscribe to “Daily Gold Edge” for real‑time updates, expert charts, and actionable analysis to stay at the forefront of the bullion market.