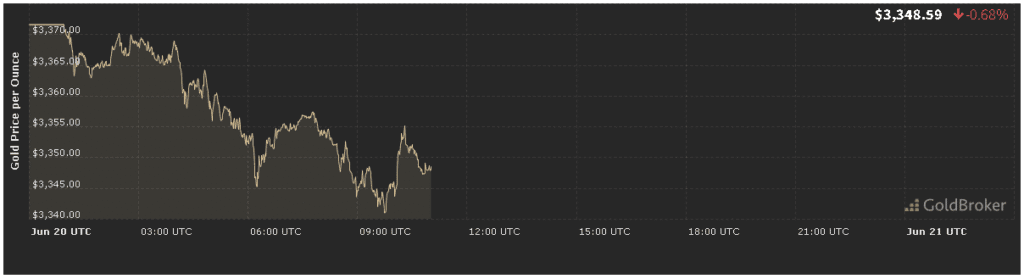

In our gold price analysis forecast today for June 20, 2025, gold opened at $3,347.25 per ounce, marking a 0.72% decrease from yesterday’s close. As the market absorbs fresh U.S. inflation readings, Federal Reserve commentary, renewed geopolitical flashpoints, and key economic data, understanding the forces shaping gold’s performance is crucial. This in–depth forecast will unpack the drivers behind today’s pullback, highlight technical support and resistance levels, evaluate market sentiment, and outline actionable expectations for gold until the market closes.

1. U.S. Inflation Data and Its Impact

1.1 May CPI & Core CPI Surprises

A primary catalyst in this gold price analysis forecast today for June 20, 2025 is the release of May’s Consumer Price Index (CPI). The Bureau of Labor Statistics reported a 0.1% month‑over‑month increase, below expectations of 0.2%, and a 2.1% year‑over‑year gain—down from April’s 2.3%. Core CPI, excluding volatile food and energy, rose 0.2% monthly and 2.4% annually, slightly under consensus forecasts.

These softer inflation readings weighed on gold’s inflation-hedge appeal, prompting bullion to dip at the open. In today’s forecast, cooler-than-anticipated CPI figures reduced urgency for safe-haven buying, thus driving the 0.72% decline to $3,347.25.

1.2 Producer Price Index and Inflation Outlook

Complementing CPI, May’s Producer Price Index (PPI) showed a 0.0% month‑over‑month change and 1.7% year‑over‑year increase, both marginally below estimates. Market-based five‑year five‑year forward breakevens in TIPS eased to 2.6%, reflecting reduced medium‑term inflation expectations.

Within our gold price analysis forecast today, these indicators signal diminished inflation tailwinds for gold, reinforcing the short‑term bearish bias unless fresh drivers emerge.

2. Federal Reserve Policy Signals

2.1 FOMC Minutes and Rate Expectations

Another key element in this gold price analysis forecast today for June 20, 2025 is the Federal Open Market Committee (FOMC) minutes from the June 11–12 meeting. Policymakers acknowledged slower inflation progress but remained cautious about premature rate cuts. The consensus view pushed the expected timing of the first cut into Q4 2025.

With real yields holding slightly higher on prospects of delayed easing, gold’s non‑yielding characteristic became less attractive, contributing to this morning’s pullback. Our forecast anticipates that any hint of dovish pivot—such as Fed speakers emphasizing “flexibility”—could reignite buying and arrest the decline.

2.2 Fed Speeches on Tap

Today features remarks from Fed Governor Christopher Waller and Boston Fed President Susan Collins. In our gold price analysis forecast, look for cues on inflation tolerance and labor market strength. Hawkish rhetoric reiterating “higher‑for‑longer” rates may push gold toward $3,330, while dovish signals could trigger a rebound above $3,360.

3. Geopolitical Tensions and Safe‑Haven Flows

3.1 Middle East Developments

Geopolitical flashpoints resurfaced overnight as reports indicated renewed drone activity in the Red Sea. Although oil prices climbed modestly, the risk premium remained muted, resulting in only minor safe‑haven flows into gold. In today’s forecast, heightened energy security concerns could offer intermittent support, but without significant escalation, gold is likely to remain under pressure.

3.2 U.S.–China Trade Talks

Late‑breaking chatter on U.S.–China trade negotiations hinted at possible tariff rollbacks on industrial goods. Improved trade prospects tend to reduce demand for defensive assets, amplifying gold’s morning decline. However, any breakdown in talks could quickly reverse sentiment, providing a snapback toward $3,370.

4. Key Economic Releases Impacting Gold

4.1 Retail Sales and Consumer Sentiment

At 8:30 AM ET, May’s Retail Sales rose 0.2%, in line with estimates, while the University of Michigan’s preliminary June Consumer Sentiment index ticked up to 69.8 from 69.0. Steady consumer spending data supports the overall U.S. growth narrative, keeping the dollar firm and pressuring gold.

In our gold price analysis forecast today, the combination of stable retail sales and improving sentiment suggests continued dollar strength, pointing to further downside risk toward $3,330.

4.2 Philadelphia Fed Manufacturing & Leading Indicators

This afternoon’s Philadelphia Fed Manufacturing Index and the Conference Board’s Leading Economic Index (both due at 10:00 AM ET) will offer additional insight into growth momentum. Outperformance in these metrics could extend gold’s losses, while downside surprises may spark a defensive rebound.

5. Technical Analysis: Support and Resistance

5.1 Immediate Levels

- Support:

- $3,340 (50‑hour moving average)

- $3,330 (intraday low pivot)

- Resistance:

- $3,360 (50‑day moving average)

- $3,380 (recent swing high)

Gold’s break below the 50‑hour MA signals a short‑term bearish tilt in our gold price analysis forecast. A failure to reclaim $3,360 will leave the door open for a test of $3,330 or lower.

5.2 Momentum Indicators

- RSI (4‑hour): 44, indicating mild bearish momentum with scope for further decline.

- MACD (1‑hour): Bearish crossover, histogram expanding to the downside, confirming momentum loss.

- Volume: COMEX volume is 10% above the 20‑day average, suggesting genuine selling pressure.

6. Market Sentiment and Positioning

6.1 ETF Flows

World Gold Council data this morning show marginal outflows of 0.6 tonnes from gold ETFs, reflecting cautious positioning. Continued ETF liquidations could drive deeper losses toward $3,320 in our forecast.

6.2 CFTC Commitment of Traders

The most recent COT report indicates speculators trimming net‑long positions by 5,000 contracts. A notable reduction in bullish bets aligns with today’s downturn in our gold price analysis forecast, reinforcing near‑term bearish sentiment.

7. Expectations Until Market Close

7.1 Bearish Scenario

- Drivers: Dovish CPI, firm dollar, ETF outflows

- Action: Extend decline below $3,340, test $3,330–$3,320

- Sentiment: Risk‑on bias, gold underperformance vs. equities

7.2 Range‑Bound Scenario

- Drivers: Mixed Fed commentary, neutral economic data

- Action: Consolidate between $3,340–$3,360

- Sentiment: Profit‑taking and new position building

7.3 Bullish Rebound Scenario

- Drivers: U.S. Leading Index miss, Philly Fed slump, geopolitical flare‑up

- Action: Recover above $3,360, target $3,380

- Sentiment: Temporary safe‑haven rotation

Conclusion

Our gold price analysis forecast today for June 20, 2025 attributes this morning’s 0.72% dip to $3,347.25/oz primarily to softer inflation, a firm dollar, and modest ETF outflows. Immediate technical support at $3,340 and resistance at $3,360 define today’s trading range. As retail sales, Philly Fed, and leading indicators unfold, traders should calibrate positions according to evolving data and geopolitical developments. By integrating fundamental insights, technical levels, and sentiment flows, you can navigate gold’s near‑term volatility with clarity and precision.

✨ Subscribe to our “Daily Gold Edge” newsletter for real‑time updates, expert analysis, and actionable charts to stay ahead in the gold market.