Introduction: Gold Price Analysis Forecast Today for June 23, 2025

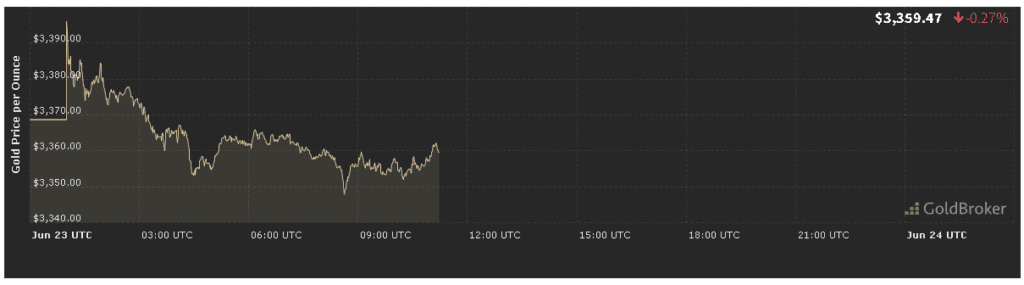

Our gold price analysis forecast today for June 23, 2025 opens with gold trading at $3,359.77 per ounce, down 0.26% from Friday’s settlement. As bullion retreats from last week’s highs near $3,400, investors are balancing three key forces: moderating inflation, persistent geopolitical risks, and a slate of economic releases that could reshape Fed expectations. In this article, we’ll unpack each driver, examine technical levels, and outline what to watch for ahead of today’s market close.

Current Market Overview in Today’s Gold Price Analysis Forecast Today for June 23, 2025

Gold futures on Comex dipped to $3,359.50 in early Asian trade—just below the stated open—before recovering marginally in European hours. That modest pullback follows a nearly 3% weekly decline, a technical correction after April’s record spikes above $3,500 fxleaders.com. Meanwhile, U.S. spot contracts show choppy range-bound action between $3,345 and $3,375 as traders weigh fresh data flows. With bullion still perched well above the $3,000 “new normal,” today’s session may hinge on the interplay between headline news and technical support levels.

Inflation Indicators in Our Gold Price Analysis Forecast Today for June 23, 2025

Inflation trends remain a central catalyst for gold’s safe-haven appeal. On June 20, U.S. consumer prices rose 0.1% month-on-month in May, moderating from April’s 0.3% gain, while the annual rate eased to 3.4% . Core CPI, stripping out food and energy, also ticked up a muted 0.1%, holding the year-on-year rate at 3.6% . Those subdued readings have dampened inflation fears and bolstered expectations that the Federal Reserve will maintain its current 5.00%–5.25% policy range well into Q3—an environment that typically allows gold to retain value as real yields remain low.

Geopolitical Events Shaping Today’s Gold Price Analysis Forecast Today for June 23, 2025

Ongoing tensions in the Middle East continue to underpin gold’s bid. Analysts at RBC warn that any escalation—particularly between Israel and Iran—could spark broader market sell-offs and drive renewed safe-haven flows into gold businessinsider.com. Last week’s cross-border air strikes briefly lifted gold to its April peak, and while prices have since retreated, the risk premium remains elevated. In the absence of a diplomatic breakthrough, further flare-ups could test the $3,375 resistance level in intra-day trading.

Central Bank Trends in Today’s Gold Price Analysis Forecast Today for June 23, 2025

Central banks have emerged as major incremental buyers in 2025, seeking to diversify reserves amid lingering economic uncertainties. A June 17 World Gold Council report found that 95% of reserve managers plan to boost gold holdings over the next 12 months—citing geopolitical risk and financial stability concerns economictimes.indiatimes.com.

That institutional demand has helped prop up gold above multi-year averages, even as retail and speculative flows ebb and flow. Watch for any bank disclosures this week; new buying announcements could provide fresh support around today’s key technical zones.

Economic Events Influencing Today’s Gold Price Analysis Forecast Today for June 23, 2025

Today’s economic calendar contains several data points that markets will parse for clues on growth and Fed policy:

- German Flash Manufacturing PMI (June): A gauge of Eurozone industrial health that could sway global risk sentiment.

- U.S. Personal Consumption Expenditures (PCE) Price Index (May): The Fed’s preferred inflation metric; stronger-than-expected PCE could nudge real yields higher, pressuring gold.

- Chicago Fed National Activity Index (May): A broad measure of U.S. economic activity that influences growth forecasts.

As Fabien Yip of IG notes, “Central banks remain dovish, but PMI and PCE figures this week will be crucial in guiding policy expectations” ig.com. Any surprise uptick in U.S. PCE could tighten financial conditions—and test gold’s recent range lows—whereas softer prints may reinforce bullion’s safe-haven bid.

Technical Outlook in Our Gold Price Analysis Forecast Today for June 23, 2025

From a chart-based perspective, gold is trading within a clearly defined band:

- Immediate Support: $3,345–$3,348, near last Thursday’s intraday lows.

- Key Resistance: $3,375, the level where last week’s bounce stalled.

- Momentum Indicators: The 14-day RSI sits at 45, suggesting neither overbought nor oversold conditions.

Trend-following traders may look for a decisive close above $3,375 to signal a fresh leg higher, potentially targeting $3,400. Conversely, a breakdown below $3,345 could open the door to a drop toward $3,300—the lower bound of the current consolidation zone. Volume has been light, so moves above average session volumes may offer the most reliable breakout signals.

Expectations for Gold Until Market Close

Given subdued inflation, elevated geopolitical risk, and today’s key releases, here’s our gold price analysis forecast today for June 23, 2025:

- Morning Session (Asia & Europe): Likely range-bound between $3,345 and $3,360 as markets digest early PMI readings.

- U.S. Afternoon Session: PCE data due at 8:30 a.m. ET will be the primary catalyst—soft PCE could spark a rally toward $3,370, while a hawkish print might drag prices below $3,340.

- Pre-Close: Expect volatility around ECB minutes (2:30 p.m. ET) and Fed speeches; absent surprises, bullion may settle near $3,355–$3,360.

Intraday traders should monitor the 30-minute VWAP and keep stops tight around technical levels. Longer-term holders can use dips below $3,345 to scale into positions, given the constructive seasonal backdrop for gold entering summer months.

Conclusion

Our gold price analysis forecast today for June 23, 2025 highlights a market balancing lower U.S. inflation, central-bank buying, and persistent geopolitical tensions. Technically, gold is navigating a consolidation between $3,345 and $3,375, with today’s U.S. PCE release likely to provide the next directional catalyst. Traders can capitalize on this range by aligning entry and exit points with these support and resistance zones. Meanwhile, longer-term investors should remain constructive, as central-bank demand and safe-haven flows underpin bullion’s value proposition in an uncertain world.

Key Takeaways:

- Open: $3,359.77 (–0.26%)

- Support: $3,345–$3,348

- Resistance: $3,375

- Catalysts: U.S. PCE (8:30 a.m. ET), ECB minutes (2:30 p.m. ET)

- Geopolitical Risk: Israel-Iran tensions remain a wild card

Stay alert for today’s data prints and geopolitical headlines—each has the power to shift gold’s intraday narrative. Trade wisely!