Introduction: Gold Price Analysis Forecast Today for June 27, 2025

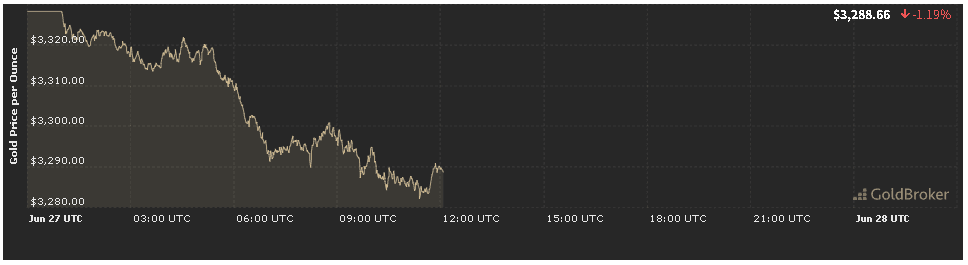

In our gold price analysis forecast today for June 27, 2025, spot gold opened at $3,288.66 per ounce, down 1.19% from Friday’s close. This marks gold’s sharpest single-day drop in a month as risk sentiment improved on a Middle East ceasefire and progress in U.S.-China trade talks. Yet, with U.S. inflation data looming and central banks remaining net buyers, the metal faces a tug-of-war between reduced safe-haven demand and enduring macro uncertainties. This article dissects each driver, assesses technical ranges, and outlines what to watch for through today’s market close.

Current Market Overview in Gold Price Analysis Forecast Today for June 27, 2025

Friday’s session saw spot gold plunge nearly 1.2% to trade around $3,288.55, contributing to a 2.3% weekly loss reuters.com. U.S. gold futures on Comex fell to $3,300.40, pressured by improved appetite for risk assets as a ceasefire between Israel and Iran eased geopolitical jitters and a tentative U.S.-China agreement on rare-earth shipments bolstered sentiment. Despite this pullback, bullion remains well above the psychologically critical $3,000 level, setting the stage for an eventful session driven by key data releases and technical tests.

Inflation Indicators in Our Gold Price Analysis Forecast Today for June 27, 2025

U.S. PCE on Deck

Investors’ focus turns to today’s Personal Consumption Expenditures (PCE) Price Index—the Fed’s preferred inflation gauge—expected to show a 0.1% monthly gain and 2.6% year-on-year increase for May. If realized, these figures would mirror April’s readings and reinforce the case for a Fed hold at 5.00%–5.25% into Q3.

- Core PCE, excluding food and energy, is forecast to rise 0.1% month-on-month and 2.6% annually.

Tamer than anticipated inflation typically cools gold’s safe-haven appeal, as it limits upside pressure on real yields. However, if PCE readings underperform expectations, a renewed gold rally could emerge as traders anticipate delayed rate cuts.

Geopolitical Events Shaping Gold Price Analysis Forecast Today for June 27, 2025

Ceasefire Eases, But Risks Linger

The weekend ceasefire between Israel and Iran removed a key near-term support pillar for gold, prompting Friday’s 1.19% drop. Still, underlying tensions persist: Iran’s parliament recently voted to ban oil exports through the Strait of Hormuz, reminding markets that any flare-up could swiftly restore gold’s safe-haven premium.

Key Point: Gold traders must remain vigilant for any reversal in the truce, as renewed strikes or shipping-lane disruptions could trigger a sharp reversal back toward $3,350–$3,375.

Central Bank Trends in Gold Price Analysis Forecast Today for June 27, 2025

Steady Institutional Demand

Despite retail outflows, 2025 has seen robust central-bank buying. A June 17 survey by the World Gold Council found that 95% of reserve managers plan to increase gold holdings over the next 12 months, while 44% are now actively trading their bullion allocations—up from 37% in 2024.

This institutional interest provides a price floor near $3,250–$3,300, as sovereign vaults view gold as a portfolio diversifier amid lingering economic and political risks. Any signs of slowing on-chain demand are likely to be offset by continued official sector purchases.

Economic Events Influencing Today’s Gold Price Analysis Forecast Today for June 27, 2025

European PMI Rebound vs. U.S. Data Deluge

- Germany Flash Composite PMI (June): Rose to 50.4 from 48.5 in May, suggesting a tentative recovery in Europe’s largest economy.

- Euro-Zone Flash PMI: Stalled at 50.0 in June, barely avoiding contraction but below expectations, underscoring uneven growth.

In the U.S., beyond today’s PCE readings, markets will watch:

- Chicago Fed National Activity Index (May) at 9:45 a.m. ET—a gauge of broad economic activity.

- Durable Goods Orders (May) at 10:00 a.m. ET—insights into business investment.

Implication: Stronger U.S. data could tilt sentiment back toward risk assets and pressure gold, while softer prints may rekindle safe-haven flows.

Technical Outlook in Our Gold Price Analysis Forecast Today for June 27, 2025

Gold remains wedged within a clearly defined consolidation:

- Immediate Support: $3,270–$3,280, aligned with last Thursday’s lows.

- Major Support: $3,250, the lower boundary of May–June range.

- Initial Resistance: $3,315–$3,320, Friday’s opening zone.

- Key Resistance: $3,350–$3,375, where sellers capped rallies last week.

Momentum indicators show the 14-day Relative Strength Index (RSI) around 40—approaching oversold but not yet extreme reuters.com. A decisive close below $3,270 could trigger stop-runs down to $3,250, while a rebound above $3,320 may invite short-covering rallies back toward $3,350.

Expectations Until Market Close: Intraday Roadmap for Traders

Based on today’s news and technical levels, here’s our gold price analysis forecast today for June 27, 2025:

- Early U.S. Session (8:30–10:00 a.m. ET):

- PCE Print & Durable Goods:

- Dovish Surprise: Spot gold could spike toward $3,305–$3,315.

- Hawkish Surprise: Expect a slide into $3,260–$3,270.

- PCE Print & Durable Goods:

- Midday Trade (10:00 a.m.–2:30 p.m. ET):

- Markets digest Chicago Fed data and reposition ahead of any Fed-speaker remarks.

- Likely range: $3,270–$3,300 absent fresh catalysts.

- Pre-Close (2:30 p.m. ET onward):

- Watch for further commentaries from Fed officials.

- With no surprises, bullion may settle near $3,280–$3,290.

Tactical Tip: Intraday momentum traders should use the 30-minute VWAP as a guide, scaling into dips around $3,280–$3,275 and taking profits near $3,315. Long-term holders can view today’s pullback toward $3,250 as a potential accumulation zone, given supportive seasonality entering the summer.

Conclusion: Balancing Inflation, Geopolitics, and Technicals in Today’s Gold Forecast

Our gold price analysis forecast today for June 27, 2025 highlights a market contending with softened U.S. inflation, eased Middle East tensions, persistent central-bank demand, and mixed global growth readings. Technically, gold sits at a critical junction—either finding support near $3,270 before reclaiming $3,320–$3,350, or risking a deeper retreat toward $3,250.

Key Takeaways:

- Open: $3,288.66 (–1.19%) reuters.com

- Inflation: PCE likely +0.1% M/M, +2.6% Y/Y; core PCE +0.1%

- Geopolitics: Israel-Iran ceasefire reduces risk premium, but Strait of Hormuz tensions endure

- Central Banks: 95% of reserve managers to buy more gold; 44% actively trading morningstar.comtradingeconomics.com

- Global Growth Gauges: German PMI at 50.4; euro-zone flash PMI flat at 50.0

Stay nimble through today’s economic releases and technical tests—each could tip the balance between a sharp rebound or deeper correction. Trade wisely and monitor key levels as the session unfolds.