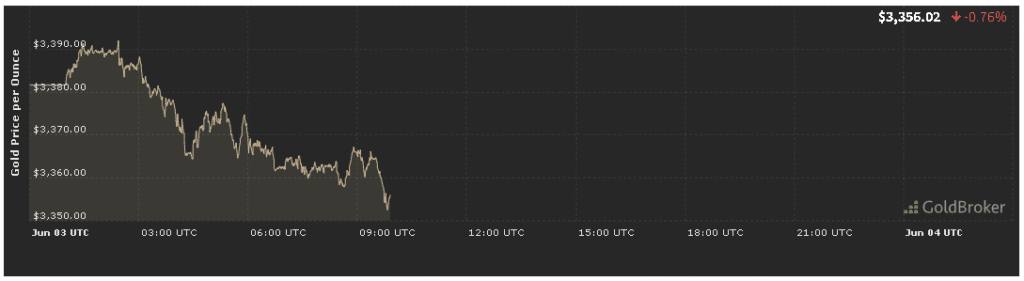

Today’s financial markets opened with a notable adjustment in the gold sector. As of June 3, 2025, gold opened at $3,355.37 per ounce, marking a 0.78% decrease. This dip has attracted the attention of traders, investors, and analysts alike, prompting discussions about the key factors contributing to the change and the expectations for the rest of the trading day. In this comprehensive gold price analysis for June 3, 2025, we’ll delve into the underlying economic, geopolitical, and inflationary trends shaping today’s price movement.

Gold Price Analysis: Understanding the Market Dip

The drop of 0.78% in gold price is relatively moderate but meaningful in a market that has been sensitive to inflationary pressures and central bank policies. Let’s explore the forces at play.

1. Inflation Trends and Monetary Policy

Inflation continues to be a primary driver in the gold market. While the U.S. inflation rate has cooled slightly to 4.1% year-over-year in May 2025, it remains above the Federal Reserve’s 2% target. The Fed’s firm stance on maintaining higher interest rates for a longer period has led to a stronger U.S. dollar, reducing gold’s appeal as a non-yielding asset.

In this context, today’s decline in gold can be partially attributed to rising treasury yields and a robust dollar index, which often inversely correlate with gold prices. Investors may be reallocating capital from gold into interest-bearing instruments, especially short-term Treasury bills.

2. Geopolitical Events

Despite ongoing geopolitical tensions in Eastern Europe and the South China Sea, there have been no new major escalations in the past 24 hours. As a result, the safe-haven demand for gold has momentarily softened, causing minor corrections in price.

That said, the overall global landscape remains tense, and any sudden developments could reverse this downtrend. Investors remain watchful of military updates and international sanctions that could rattle markets.

3. Economic Indicators Released Today

Key economic data released early today includes:

- U.S. manufacturing PMI rose slightly to 51.2, signaling expansion.

- Eurozone unemployment remained steady at 6.5%, indicating labor market resilience.

- Chinese export data beat expectations, fueling optimism in global trade recovery.

These signals of economic health contribute to greater confidence in risk assets and equities, diminishing the short-term demand for gold.

Investor Sentiment and Speculative Activity

Gold as a Speculative Asset

Today’s trading patterns show that some short-term investors are liquidating gold positions to take profits after May’s sharp rally. Gold had approached near-record highs just a week ago, prompting natural corrections from speculative highs.

Technical indicators like the Relative Strength Index (RSI) suggest gold was briefly in overbought territory. This technical retracement is normal and often precedes consolidation or further directional movement based on macro data.

Market Volume and Open Interest

Data from CME Group indicates a 2.3% drop in open interest for gold futures today, alongside modestly lower volume. This suggests reduced enthusiasm in the short term, though not a large-scale shift in overall sentiment.

The Role of Central Banks

Central banks have been significant players in the gold market over the past year. Countries such as China, India, and Turkey have been steadily increasing gold reserves, supporting long-term demand.

However, in today’s session, there have been no major announcements of central bank activity. This neutral stance contributes to market calm and reflects a wait-and-see approach as policymakers monitor inflation and economic growth data.

Gold vs. Other Assets Today

| Asset Class | Price Movement (June 3, 2025) | Notes |

|---|---|---|

| Gold (Spot) | -0.78% | Opened at $3,355.37 |

| Silver | -0.95% | Reflecting similar speculative cooling |

| S&P 500 Index | +0.62% | Market confidence returns |

| U.S. Dollar Index | +0.48% | Stronger dollar pressures gold |

| Bitcoin | +1.20% | Risk appetite shifts to crypto |

The relative strength in equities and cryptocurrencies today reflects a moderate risk-on sentiment, pulling some capital out of safe-haven assets like gold.

Technical Outlook: What’s Next for Gold?

From a charting perspective:

- Support level: $3,320 per ounce

- Resistance level: $3,390 per ounce

- 50-day moving average: $3,290 (still trending upward)

The price remains within a bullish consolidation pattern, and today’s dip may simply be a technical pause before the next move upward—especially if inflation resurges or geopolitical risks intensify.

Expectations Until Market Close

Analysts are forecasting mild price stabilization for the rest of the trading session unless unexpected economic or geopolitical news breaks. Here’s what we expect:

- Short-term outlook: Sideways trading between $3,320 and $3,360

- Upside catalysts: Any dovish language from Fed officials, new geopolitical developments, or inflation surprises

- Downside risks: Stronger-than-expected job market data or dollar surge

Day traders are advised to watch the 2:00 PM ET speech from the Federal Reserve Vice Chair, which may give clues on upcoming monetary policy shifts.

Key Takeaways

- Gold opened at $3,355.37 per ounce, marking a 0.78% decline as of June 3, 2025.

- Stronger dollar, reduced safe-haven demand, and technical profit-taking are driving the dip.

- Inflation and central bank policies remain the dominant themes.

- Despite the pullback, long-term fundamentals for gold remain strong, particularly if inflation stays sticky or global tensions rise.

- For the rest of the day, expect tight trading ranges with potential movement around major economic commentary.

Final Thoughts

In summary, today’s gold price analysis for June 3, 2025, reflects a nuanced market influenced by macroeconomic resilience, speculative adjustments, and ongoing geopolitical uncertainty. While the short-term movement may show a downturn, savvy investors understand that gold’s role as a strategic long-term hedge remains intact.

If you’re evaluating gold as part of your portfolio, today’s pullback may offer a timely opportunity to reassess entry points based on your broader investment goals.