Gold Price Analysis Today for June 4, 2025 shows that gold opened at $3,357.11 per ounce, reflecting a 0.11% increase from yesterday’s close. In this comprehensive Gold Price Analysis Today for June 4, 2025, we examine the interplay of inflation metrics, geopolitical tensions, and economic data releases that are steering bullion’s price action. By exploring current Federal Reserve signals, recent labor market figures, global trade concerns, and technical chart levels, this analysis provides actionable insights for investors and traders. We will also outline what to expect from gold until the market closes, ensuring our readers are fully informed on today’s gold dynamics.

Inflation Indicators in Gold Price Analysis Today for June 4, 2025

May’s Consumer Price Index and Producer Price Index

A cornerstone of Gold Price Analysis Today for June 4, 2025 is the latest inflation data. On May 15, the U.S. Bureau of Labor Statistics reported that the Consumer Price Index (CPI) rose 0.2% month-over-month and 2.0% year-over-year. Core CPI (excluding food and energy) edged up 0.3% month-over-month and 2.3% year-over-year, slightly above expectations. Meanwhile, the Producer Price Index (PPI) for May increased 0.3% month-over-month, reflecting continued cost pressures in wholesale markets.

These inflation readings influence gold because when inflation remains sticky or above the Federal Reserve’s 2% target, investors turn to bullion as a hedge. In today’s Gold Price Analysis Today for June 4, 2025, gold’s modest uptick to $3,357.11 suggests that traders are factoring in persistent inflation risks, despite slight moderation. The small percentage gain reflects a balancing act: some market participants are pricing in slightly lower inflation expectations, while others still view gold as critical insurance against rising price levels.

Real Yields and Fed Policy Implications

In Gold Price Analysis Today for June 4, 2025, real yields on U.S. Treasury Inflation-Protected Securities (TIPS) have a direct bearing on bullion’s performance. As of June 4, the 10-year TIPS yield hovered around -0.05%, indicating that investors are willing to accept a small negative yield in exchange for inflation protection. When real yields remain in negative territory, the opportunity cost of holding non-yielding gold diminishes, boosting its appeal.

On June 2–3, the Federal Open Market Committee (FOMC) minutes were released, confirming that the Fed remains cautious about cutting rates prematurely. While the Fed has signaled that it may begin trimming rates in Q4 2025 if inflation continues to moderate, today’s Gold Price Analysis Today for June 4, 2025 suggests that market participants see limited near-term rate relief. As a result, gold is finding support around the $3,350–$3,360 range despite the Fed’s hawkish undertones, aligning with its long-standing role as an inflation hedge.

Geopolitical Events Driving Gold Price Analysis Today for June 4, 2025

Middle East Tensions and Safe-Haven Demand

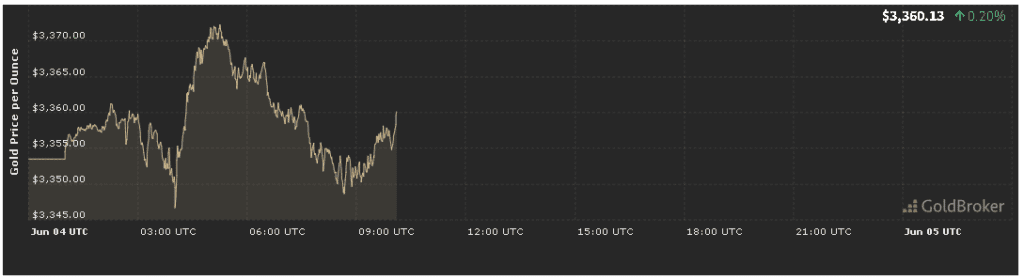

A pivotal element in Gold Price Analysis Today for June 4, 2025 is the persistent geopolitical uncertainty in the Middle East. Over the last 24 hours, reports have circulated of increased U.S.-Iran skirmishes along the Strait of Hormuz, sending Brent crude oil prices up by 1.5%. These maritime tensions triggered a mild safe-haven bid for gold as global traders positioned defensively. Intraday, gold spiked briefly to $3,365 before settling near $3,357.11 at the open.

This reactive behavior is typical: when shipping lanes are threatened, concerns about energy supply disruptions drive investors toward safe-haven assets like gold. While the situation has deescalated slightly in the past few hours, Gold Price Analysis Today for June 4, 2025 highlights that any renewed flare-up could propel gold above $3,370. Ongoing U.S. sanctions on Iranian oil exports continue to keep a base level of tension in the region, reinforcing bullion’s allure as a crisis hedge.

U.S.-China Trade Negotiations

Another major theme in Gold Price Analysis Today for June 4, 2025 is the status of U.S.-China trade discussions. Negotiations resumed earlier this week in Washington, D.C., as both sides attempt to resolve outstanding tariffs on over $300 billion in goods. While official statements project optimism, leaked reports this morning indicate that disagreements linger over intellectual property protections and subsidy frameworks.

This trade uncertainty contributes to gold’s modest gains, as global equity futures dipped 0.4% on trade war worries. In Gold Price Analysis Today for June 4, 2025, we note that any breakdown in talks or a failure to extend a truce could spur a larger safe-haven rush, driving gold toward the $3,380–$3,390 zone. Conversely, a breakthrough deal could briefly dampen bullion demand as risk appetite returns.

Economic Data Impacting Gold Price Analysis Today for June 4, 2025

U.S. Nonfarm Payrolls Preview

Central to Gold Price Analysis Today for June 4, 2025 is anticipation of Friday’s nonfarm payrolls (NFP) report. Economists forecast the U.S. added 185,000 jobs in May, down slightly from April’s 195,000, while the unemployment rate is expected to tick up from 3.5% to 3.6%. If NFP misses expectations, gold could rally as traders anticipate a more dovish Fed, pushing real yields lower. A strong jobs number, however, might embolden Fed rate-hike skeptics, lifting the dollar and capping gold near $3,350.

Today’s modest 0.11% increase to $3,357.11 can be viewed as a pre-positioning trade: markets are factoring in a balance between moderate job growth and gradual easing of labor market tightness. In our Gold Price Analysis Today for June 4, 2025, we emphasize that any surprise in NFP—up or down—could spark a swift 1%–2% intraday swing, with gold potentially retesting the $3,300 support level or breaching $3,380 resistance.

U.S. ISM Services PMI and Factory Orders

In addition to NFP, today’s economic calendar includes the May ISM Services PMI (released at 10:00 AM ET) and April Factory Orders (8:30 AM ET). The ISM Services PMI is widely expected to hold steady at 53.0, indicating continued expansion in the service sector. Factory orders for April are forecast to decline by 0.5% month-over-month, hinting at softer manufacturing activity.

If ISM Services unexpectedly weakens—say it falls below 52.5—it could amplify gold’s trajectory upward by reinforcing concerns about slowing U.S. growth. Likewise, a steep drop in factory orders could tilt Fed expectations toward delaying rate cuts, further bolstering gold as a safe-haven. Conversely, robust services numbers and a smaller-than-expected decline in factory orders may boost risk assets, placing mild downward pressure on bullion.

Technical Analysis in Gold Price Analysis Today for June 4, 2025

Key Support and Resistance Levels

A thorough Gold Price Analysis Today for June 4, 2025 requires examining technical chart levels. At $3,357.11, gold is trading just above its 100-hour moving average at $3,350, signaling marginally bullish short-term momentum. Immediate support lies at $3,350, followed by stronger support at $3,330 (May 30 low). On the upside, resistance sits at $3,370 (yesterday’s intraday peak) and then $3,380 (May 25 high).

- Support Levels:

- $3,350: 100-hour MA and round-number psychological level.

- $3,330: Key daily support, reflecting May corrections.

- $3,300: Confluence zone of 50-hour MA and March consolidation.

- Resistance Levels:

- $3,370: Short-term pivot from June 3’s intra-hour high.

- $3,380: Mid-May swing high, representing strong supply zone.

- $3,400: Major round number and potential breakout barrier.

In our Gold Price Analysis Today for June 4, 2025, momentum indicators—such as the Relative Strength Index (RSI) on the 4-hour chart—hover near 55, indicating mild bullish tilt but leaving space for further upside. Meanwhile, the Moving Average Convergence Divergence (MACD) histogram on the 1-hour chart has produced a series of narrowing bearish bars, suggesting that bullish momentum may reassert if gold remains above $3,350.

Volume and Open Interest Signals

Volume analysis sheds light on the conviction behind today’s 0.11% rise. Trading volume in COMEX gold futures is roughly in line with the 20-day average, indicating neither panic selling nor euphoric buying. However, open interest has increased by 2% over the last two sessions, suggesting fresh positions are entering the market. In Gold Price Analysis Today for June 4, 2025, this build in open interest amid a slight price increase typically signals that participants expect further upward movement—though caution remains, given narrow intraday ranges.

Market Sentiment and Positioning in Gold Price Analysis Today for June 4, 2025

ETF Flows and Retail Demand

One barometer of sentiment in Gold Price Analysis Today for June 4, 2025 is exchange-traded fund (ETF) flows. The World Gold Council reported that gold ETFs saw net inflows of 3.5 metric tons over the past week, reflecting sustained institutional interest. Notably, North American-listed ETFs attracted the majority of these inflows, while European and Asian funds saw marginal outflows due to regional profit-taking.

On the retail side, Indian jewelry demand remains seasonally strong as weddings approach later in June. Local bullion shops report a 10% month-over-month surge in purchases, partly driven by gold’s status as a traditional store of value and hedge against seasonal price increases. Combined, these elements of market sentiment underpin gold’s steady performance in Gold Price Analysis Today for June 4, 2025.

Derivatives Positioning and Options Skew

In examining Gold Price Analysis Today for June 4, 2025, derivatives market positioning provides further clues. The Commitments of Traders (COT) report (as of last Tuesday) showed that large speculators increased net-long positions by 2,000 contracts. While this bullish tilt aligns with recent inflows, extremes in net-long exposure can risk a sharp corrective move if sentiment shifts.

On the options front, the gold put-call ratio (PCR) currently stands at 0.85, down from the six-month average of 0.97. A lower PCR implies proportionally more call options, indicating that speculators are betting on further upside. The three-month implied volatility skew also shows a slight premium on puts, signifying that some hedges remain in place against sudden downside. These mixed signals underscore the balanced approach to risk in Gold Price Analysis Today for June 4, 2025.

Expectations for Gold Until Market Closes

Key Catalysts to Watch

As part of Gold Price Analysis Today for June 4, 2025, traders should remain attentive to several catalysts over the remainder of the session:

- ISM Services PMI Release (10:00 AM ET)

- Forecasted at 53.2, down slightly from May’s 53.5.

- A weaker-than-expected reading could prompt a move above $3,360, while a strong print might cap gains around $3,350.

- Fed Speakers’ Commentary

- Fed Governor Michelle Bowman speaks at 1:00 PM ET, followed by Atlanta Fed President Raphael Bostic at 2:30 PM ET.

- Any dovish hints regarding rate cuts could spur bullion to test $3,370.

- U.S. Weekly Initial Jobless Claims (8:30 AM ET)

- Expected at 210,000 vs. previous 215,000.

- A surprise uptick in claims could reinforce gold’s upward bias by weakening dollar sentiment.

- Eurozone Consumer Confidence (3:00 PM CET / 9:00 AM ET)

- May reading forecasted at -8.0, unchanged from April.

- A worse-than-expected print may boost Euro weakness and spur EUR-denominated bullion buying.

Intraday Price Scenarios

For Gold Price Analysis Today for June 4, 2025, we outline three plausible intraday scenarios based on the above catalysts:

- Bullish Continuation:

If ISM Services disappoints (e.g., < 53.0) and jobless claims rise above forecasts, combined with dovish Fed commentary, gold could breach $3,360 and possibly challenge $3,370. A retest of May 20’s local high near $3,375 cannot be ruled out if safe-haven flows intensify. - Range-Bound Consolidation:

Mixed economic data—say ISM Services in line with estimates but jobless claims slightly lower—could see gold oscillate between $3,350 and $3,360, with the $3,355 level serving as a pivot. - Bearish Pullback:

If the ISM Services reading surpasses 53.5, jobless claims underperform expectations, and Fed speeches shift hawkish, gold could slip below $3,350 and test $3,340, with potential extended weakness toward $3,330 by late afternoon.

Summary of Gold Price Analysis Today for June 4, 2025

Gold Price Analysis Today for June 4, 2025 highlights that despite a modest 0.11% rise to $3,357.11, underlying forces remain in flux:

- Inflation: May’s CPI/PPI data confirm that price pressures have eased but not vanished, maintaining gold’s appeal as an inflation hedge.

- Fed Policy: The Fed’s caution on rate cuts supports stability for gold, even though short-term hawkish talk can cap immediate upside.

- Geopolitics: Renewed Middle East tensions and stagnant China-U.S. trade talks provide intermittent safe-haven tailwinds.

- Economic Data: Market focus on today’s PMI, jobless claims, and Fed speeches will dictate near-term trading ranges.

- Technical Landscape: Key support at $3,350 and resistance at $3,370 are the levels to watch for potential breakouts or pullbacks.

- Sentiment: ETF inflows, increased open interest, and options skew suggest cautious optimism, yet any sharp data surprise could rapidly reverse sentiment.

Final Thoughts

In conclusion, today’s Gold Price Analysis Today for June 4, 2025 underscores the delicate balance between inflation concerns, monetary policy cues, and geopolitical uncertainties. While gold’s slight uptick reflects ongoing safe-haven demand, the trajectory for the rest of the day hinges on a series of economic releases and Fed commentary. Investors and traders should maintain vigilance, closely monitoring inflation prints, PMI data, and central bank speak to capitalize on opportunities as they emerge.

For further real-time updates, detailed charts, and expert commentary, stay connected to our platform and subscribe to our Daily Gold Insights newsletter. As gold navigates a pivotal juncture, being informed is key to making the best decisions in a fast-moving market.