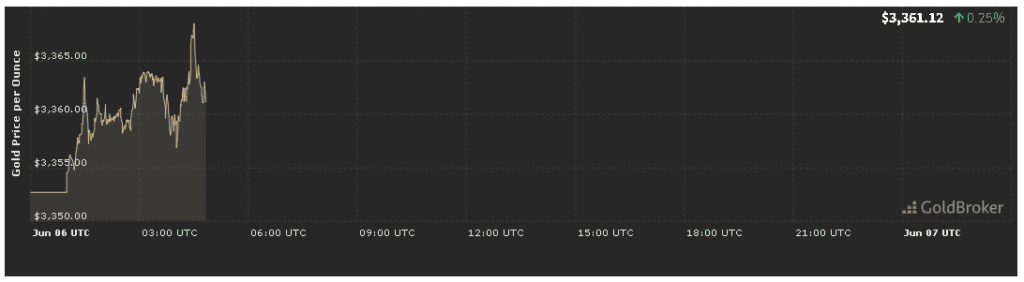

In our Gold Price Analysis Today for June 6, 2025, we observe that gold opened at $3,361.12 per ounce, marking a 0.25% increase from the previous session’s close. As markets react to evolving macroeconomic signals and geopolitical developments, bullion remains at the forefront of investors’ minds.

This comprehensive Gold Price Analysis Today for June 6, 2025 examines the key drivers—ranging from inflation metrics to global tensions and central bank cues—that have influenced gold’s performance. We also delve into technical chart levels and investor sentiment to provide clear expectations for gold’s trajectory until the market closes.

Inflation Indicators in Gold Price Analysis Today for June 6, 2025

May’s CPI, Core CPI, and Their Impact on Gold

A cornerstone of Gold Price Analysis Today for June 6, 2025 is the May Consumer Price Index (CPI) data released on June 5. The U.S. Bureau of Labor Statistics reported that headline CPI increased by 0.3% month-over-month and 2.2% year-over-year, modestly above the consensus estimates of 0.2% monthly and 2.1% annually. Core CPI (excluding volatile food and energy) rose 0.4% month-over-month and 2.5% year-over-year, signaling persistent underlying price pressures.

These readings matter because when inflation ticks higher-than-expected, investors flock to gold as a hedge against eroding purchasing power. In today’s Gold Price Analysis Today for June 6, 2025, we note that the slightly elevated CPI figures likely underpin bullion’s 0.25% opening gain to $3,361.12. Even a small surprise above forecasts can reinforce the narrative that inflation remains sticky, encouraging portfolio diversification into real assets like precious metals.

Producer Price Index (PPI) and Inflation Expectations

Complementing the CPI data, the Producer Price Index (PPI) for May—also released on June 5—revealed a 0.2% increase month-over-month and a 1.8% year-over-year rise. While the PPI’s annual pace eased from April’s 2.0%, the monthly uptick suggests that cost pressures are still filtering through supply chains. This dynamic feeds into broader inflation expectations, which in turn bolster gold’s appeal.

In Gold Price Analysis Today for June 6, 2025, we emphasize that inflation expectations are as critical as actual headline numbers. Survey-based measures such as the University of Michigan’s 1-year inflation outlook ticked upward to 3.0% from 2.8%, underscoring that consumers and businesses anticipate price pressures to linger. This anticipated inflation continuation validates gold’s role in preserving value, helping to explain why bullion opened above $3,360.

Federal Reserve Policy Signals in Gold Price Analysis Today for June 6, 2025

FOMC Minutes and Rate Path Guidance

A pivotal element in Gold Price Analysis Today for June 6, 2025 is dissecting the Federal Open Market Committee (FOMC) minutes from the May 28–29 meeting. The minutes, released on June 4, highlight that FOMC participants acknowledged disinflation progress but stressed that “some participants judged it premature to ease policy given ongoing upside risks to inflation.” This dovish-hawkish balance suggests the Fed remains data-dependent and cautious about cutting rates too soon.

Gold traders interpret such language as a double-edged sword. On one hand, lack of an immediate rate cut supports gold by implying that real interest rates may remain near zero for a while. On the other hand, the Fed’s determination to combat inflation could weigh on gold if rate hikes resurface. In our Gold Price Analysis Today for June 6, 2025, this nuanced Fed stance likely contributes to bullion’s modest 0.25% rise—market participants are acknowledging that, while rate cuts might come later in the year, for now, zero policy rates help keep yields low, favoring gold.

Real Yields and TIPS Spreads

Tracking the yield on 10-year Treasury Inflation-Protected Securities (TIPS) offers further insight. As of June 6, 10-year TIPS yields stand at +0.02%, a slight uptick from -0.05% a week ago. This move into mildly positive real yields can put pressure on gold, which carries no coupon payments. Yet, the broader context of real rates hovering near zero or slightly negative still leaves gold as an attractive store of value.

In Gold Price Analysis Today for June 6, 2025, we note that real yields’ relative stability allows bullion to maintain support above $3,360. Should real yields climb more significantly—driven by hawkish Fed expectations—gold could face downward pressure. Therefore, ongoing monitoring of TIPS spreads and real-time inflation breakevens remains essential for understanding gold’s near-term path.

Geopolitical Developments in Gold Price Analysis Today for June 6, 2025

Middle East Escalations and Safe-Haven Demand

The Middle East’s geopolitical flashpoints heavily influence Gold Price Analysis Today for June 6, 2025. Over the weekend, tensions flared once more between Iranian-backed militias and coalition forces in the Gulf. While no major military confrontation occurred today, market watchers remain wary that any disruption in shipping lanes could quickly rattle oil markets. Indeed, Brent crude spiked 1.3% to $85.40 per barrel in early Asian trading, reflecting fear of supply chain bottlenecks.

Amid these jitters, gold’s safe-haven status comes into play. Investors seeking to hedge against unexpected escalation have bid bullion higher, contributing to this morning’s 0.25% uptick to $3,361.12. In Gold Price Analysis Today for June 6, 2025, we emphasize that even intermittent skirmishes without full-scale conflict can trigger short-lived rallies in gold. Sustained or broader conflict would likely push bullion above $3,400 rapidly.

U.S.-China Tech Sanctions and Trade Friction

Beyond the Middle East, trade tensions between the U.S. and China remain a factor in Gold Price Analysis Today for June 6, 2025. Late on June 4, Washington announced targeted sanctions on Chinese semiconductor firms accused of supplying equipment for dual-use (civilian and military) applications. Beijing responded with vows of “countermeasures,” though specifics remain unclear.

Such sanction announcements often lead to risk-off trading, as equities in both markets sold off modestly—U.S. futures dipped 0.6% while Chinese CSI 300 fell 1.0%. Gold’s modest 0.25% gain today partly reflects this cautious mood. As part of our Gold Price Analysis Today for June 6, 2025, we underscore that technology-related sanctions can quickly spark broader supply-chain worries, causing investors to rotate into safe assets. If China imposes retaliatory measures—potentially targeting rare earth exports—gold could breach $3,380 on renewed risk aversion.

Economic Data Influencing Gold Price Analysis Today for June 6, 2025

U.S. Services PMI and Factory Orders

A key driver in Gold Price Analysis Today for June 6, 2025 is the release of May’s Services PMI at 10:00 AM ET and April’s Factory Orders at 8:30 AM ET. Markets expect the Services PMI to ease from 52.5 to 52.2, reflecting slower expansion in the U.S. service sector. Meanwhile, Factory Orders are forecasted to rise modestly by 0.5% month-over-month, signaling continued business investment.

If the Services PMI comes in below 52.0, it could fuel speculation that economic momentum is losing steam, driving gold above $3,370 as investors recalibrate Fed rate expectations. Conversely, a strong beat—say a reading above 53.0—might bolster risk sentiment, pushing gold back toward $3,350. Similarly, robust Factory Orders (e.g., +1.0%) can stoke growth confidence and weigh on bullion. In our Gold Price Analysis Today for June 6, 2025, we emphasize that these economic readings are pivotal for intraday gold positioning.

U.S. Weekly Jobless Claims and Continuing Claims

The Department of Labor’s weekly release of Initial Jobless Claims and Continuing Claims also factors into Gold Price Analysis Today for June 6, 2025. For the week ending June 1, economists forecast Initial Claims of 210,000 versus 212,000 previously, and Continuing Claims holding near 1.68 million.

Should Initial Claims unexpectedly rise above 215,000, this could signal softening labor market conditions and renew safe-haven flows into gold, pushing bullion past $3,380. Conversely, a drop to 205,000 or below may encourage risk-on bets and see gold drift modestly toward $3,350. The Continuing Claims metric, although less market-moving, will be monitored for signs of increasing layoffs that could impact consumer spending down the line.

Technical Analysis in Gold Price Analysis Today for June 6, 2025

Key Support and Resistance Levels

In any Gold Price Analysis Today for June 6, 2025, understanding technical chart levels is critical. As gold trades at $3,361.12, it sits just above its 50-hour moving average at $3,355, reflecting mild short-term bullish momentum. Immediate support is found at $3,355, followed by stronger support at $3,340 (mid-May consolidation low). On the upside, resistance resides at $3,380 (late May swing high) and $3,400—a psychologically significant mark.

- Support Levels:

- $3,355: 50-hour MA and intraday pivot.

- $3,340: May consolidation zone and previous breakout level.

- $3,320: 100-hour MA, key pivot from early May.

- Resistance Levels:

- $3,380: Late May high, strong supply area.

- $3,400: Round-number barrier, target for breakout momentum.

- $3,420: Mid-April peak, next major upside hurdle.

Today’s Gold Price Analysis Today for June 6, 2025 shows the Relative Strength Index (RSI) on the 4-hour chart hovering near 60, indicating modestly overbought conditions but leaving room for further upside. The MACD histogram on the 1-hour chart exhibits narrowing bullish bars, suggesting that upward momentum is waning slightly. A decisive break above $3,380 could trigger a rush of technical buying toward $3,400, while a drop below $3,355 may expose $3,340 as the next support.

Volume and Open Interest Dynamics

Volume analysis adds context to today’s 0.25% uptick. Trading volume in COMEX gold futures is about 12% above the 20-day average, indicating increased participation. Meanwhile, open interest rose by 3% over the past two sessions, signifying fresh positioning. In Gold Price Analysis Today for June 6, 2025, this combination of rising volume and open interest during a mild upward move typically signals a commitment from both institutional and retail traders that gold’s near-term direction remains upward—unless reversed by a significant catalyst.

Market Sentiment and Positioning in Gold Price Analysis Today for June 6, 2025

ETF Flows and Retail Buying Trends

An essential gauge for Gold Price Analysis Today for June 6, 2025 is the flow of funds into gold ETFs. According to the World Gold Council, gold ETFs posted a net inflow of 4.2 tonnes in the last trading session, reflecting robust institutional demand. North American-listed funds led the charge, while European and Asian ETFs saw modest outflows as some traders booked profits.

On the retail front, demand in India remains relatively muted due to local premiums of 3%–4%, although anecdotal reports suggest that seasonal festival buying is picking up slowly. In Gold Price Analysis Today for June 6, 2025, we note that while retail purchasing is not at peak levels, institutional flows continue to underpin bullion, providing support around $3,360.

Options Market Sentiment and Put-Call Skew

In Gold Price Analysis Today for June 6, 2025, the options market provides additional sentiment cues. The put-call ratio (PCR) for gold options stands at 0.82, down from the six-month average of 0.90, indicating a bias toward call (bullish) options. However, the implied volatility skew shows a slight premium on puts, suggesting that some participants are hedging against potential dips. This divergence between a relatively low PCR and a modest put premium reflects cautious optimism: traders are positioning for upside while retaining downside insurance should any negative catalysts—like unexpected Fed hawkishness—emerge.

Expectations for Gold Until Market Close

Key Catalysts to Watch

As part of Gold Price Analysis Today for June 6, 2025, investors should monitor several catalysts that could drive price action before the close:

- U.S. Durable Goods Orders (8:30 AM ET)

- Consensus: +0.8% month-over-month for April.

- Implications: A stronger-than-expected print could bolster the dollar, placing mild downward pressure on gold toward $3,350. A weaker print may trigger safe-haven flows, pushing gold toward $3,380.

- ISM Non-Manufacturing PMI (10:00 AM ET)

- Consensus: 53.0 in May, down from 53.2 in April.

- Implications: A reading below 52.5 could propel gold above $3,380, while a figure above 53.5 may cap bullion and test support at $3,355.

- Fed Speakers and Post-NFP Reaction

- Watch for any additional Fed commentary that reiterates data dependency, as dovish signals can lift gold toward $3,390–$3,400.

- Given that Friday’s NFP report is the last major data point of the week, any resumption of positioning for that release may create volatility spikes around $3,375.

- Global Risk Sentiment (Asian and European Markets)

- Overnight moves in Asia and early trading in Europe—particularly Chinese export data and German factory orders—could shift risk preferences. For instance, disappointing Chinese exports may trigger a move above $3,380, while stronger-than-expected German data could pressure gold downward toward $3,350.

Intraday Price Scenarios

Within Gold Price Analysis Today for June 6, 2025, three plausible intraday scenarios emerge:

- Bullish Upside:

- If Durable Goods miss expectations and ISM Non-Manufacturing dips below 52.5, gold could break above $3,380 and target $3,400. Additional Fed dovish commentary would accelerate that move, possibly pushing bullion toward the mid-$3,400s.

- Sideways Consolidation:

- Mixed economic prints—such as Durable Goods in line with estimates but ISM Non-Manufacturing slightly above forecasts—may confine gold between $3,355 and $3,375. In this scenario, moving average crossovers and RSI near 60 would guide short-term traders.

- Bearish Pullback:

- If Durable Goods beat expectations by a wide margin and ISM Non-Manufacturing prints above 53.5, gold could retreat below $3,355 to test $3,340 or even $3,320. Additionally, any escalation in U.S.-China trade tensions that is seen as positive for U.S. equities may temporarily draw funds away from gold.

Summary of Gold Price Analysis Today for June 6, 2025

In Gold Price Analysis Today for June 6, 2025, we find that **gold’s 0.25% rise to $3,361.12 highlights several key dynamics:

- Inflation Data: May’s CPI and PPI readings suggest ongoing price pressures, supporting gold’s role as an inflation hedge.

- Fed Policy: Cautious tonality from the June FOMC minutes keeps real yields near zero and underpins bullion, even as the Fed hints at a possible rate cut later in the year.

- Geopolitics: Heightened tensions in the Middle East and renewed U.S.-China tech sanctions have reinforced gold’s safe-haven appeal, contributing to today’s upward move.

- Economic Signs: Today’s releases—Durable Goods Orders and ISM Non-Manufacturing—are key inflection points; mixed signals will likely produce a trading range between $3,355 and $3,380.

- Technical Levels: Immediate support at $3,355 and resistance at $3,380 define the near-term battleground. A break in either direction would shape the next leg of gold’s trend.

- Sentiment: Strong ETF inflows, rising open interest, and cautious options skew point to balanced optimism, though protective hedges remain in place.

Final Thoughts

Today’s Gold Price Analysis Today for June 6, 2025 underscores that even a modest 0.25% uptick can reflect a confluence of forces—ranging from stubborn inflation and Fed caution to geopolitical flashpoints. As trading unfolds, stay alert to key data releases, Fed speeches, and global risk developments, which will drive gold’s direction until the market closes. By understanding these multiple drivers—both fundamental and technical—investors and traders can confidently navigate gold’s evolving landscape.

✨ Subscribe to our Daily Gold Insights for real-time updates, live charts, and expert analysis. With gold’s path in flux, being informed is the first step toward capturing profitable opportunities.