Introduction: Gold Price Analysis Forecast Today for June 30, 2025

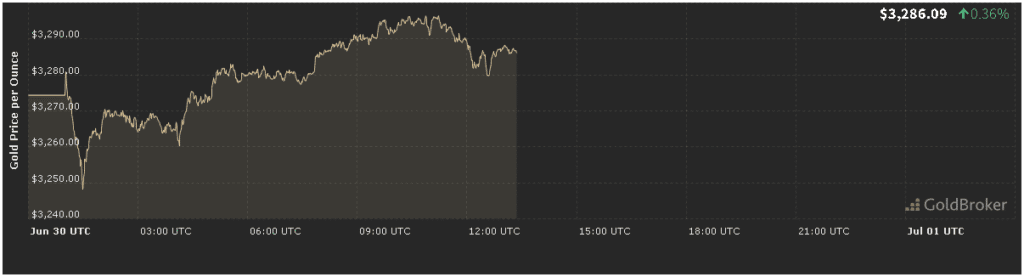

In our gold price analysis forecast today for June 30, 2025, spot gold opened at $3,286.71 per ounce, down 0.38% from Friday’s settlement. As traders assess fresh economic prints, fading Middle East tensions, and ongoing central‑bank demand, bullion finds itself in a delicate tug‑of‑war between safe‑haven appeal and yield‑seeking assets. This report dissects the major catalysts—ranging from U.S. inflation signals to global manufacturing PMIs—outlines critical technical thresholds, and maps out expectations for gold until the market close.

Gold Price Analysis Forecast Today for June 30, 2025 – Market Overview

Friday’s trading session saw gold briefly rally toward $3,300 before profit‑taking pushed prices back below $3,290 . Overnight Asian trade was subdued, with bulls and bears evenly matched at the $3,285–$3,295 range. U.S. gold futures on Comex trended 0.4% lower as equities eked out modest gains, reflecting a slight shift back into risk assets amid easing Middle East flare‑ups and anticipation of this week’s U.S. non‑farm payrolls report. With bullion hovering near its June lows, today’s session may hinge on economic releases and technical support levels around $3,280.

Gold Price Analysis Forecast Today for June 30, 2025 – Inflation Indicators

Inflation remains gold’s primary macro driver. On June 28, the U.S. Personal Consumption Expenditures (PCE) Price Index—Federal Reserve’s preferred gauge—rose 0.2% month‑on‑month in May, matching April’s reading and holding the annual rate at 2.7% . Core PCE, excluding food and energy, also climbed 0.2%, nudging the annual reading to 2.8%.

- Implication: These steady inflation prints reinforce Fed expectations of a prolonged pause at 5.00%–5.25%, keeping real yields modestly positive.

- Gold Reaction: Tepid PCE tends to support gold by capping Treasury yield upside—but markets may require fresh data surprises to spark decisive moves.

Gold Price Analysis Forecast Today for June 30, 2025 – Geopolitical Events

Diminishing Middle East Risk Premium

Recent reports indicate a de‑escalation between Israel and Iran, following diplomatic back‑channel talks that curtailed weekend airstrikes . As a result, safe‑haven flows into gold softened, contributing to Friday’s pullback.

- Watchpoint: Should tensions reignite—particularly disruptions in Gulf shipping lanes—gold could swiftly reclaim premiums and test $3,320 resistance.

- Current Premium Estimate: Analysts peg the geopolitical risk premium at approximately $10–$15 per ounce, down from $25 in early June.

Gold Price Analysis Forecast Today for June 30, 2025 – Central Bank Trends

Central banks continue to underpin gold demand as strategic reserve managers. A World Gold Council survey (June 17) found 93% of central banks plan to maintain or raise gold reserves over the next year, citing diversification needs amid uncertain growth prospects .

- Incremental Buying: Recent bullion purchases by the Turkish and Kazakh central banks have totaled an estimated 80 tonnes in H1 2025, adding floor support near $3,250.

- Forecast Impact: Ongoing official sector buying argues against sustained breakdowns below $3,250, even if speculative interest wanes.

Gold Price Analysis Forecast Today for June 30, 2025 – Economic Events

Flash PMI and ISM Data

Today’s economic calendar features key global manufacturing and services PMIs, as well as the U.S. ISM Manufacturing Index:

- Eurozone Flash Composite PMI (June): Forecast at 52.1, signaling modest expansion after May’s 51.2 .

- U.S. ISM Manufacturing (June): Expected at 49.5, potentially marking a third straight contraction .

Why It Matters:

- Strong PMIs can tilt sentiment toward risk assets, weighing on gold.

- Soft U.S. ISM data may reinforce a dovish Fed outlook, boosting bullion.

Gold Price Analysis Forecast Today for June 30, 2025 – Technical Outlook

From a chart perspective, gold trades within a defined intra‑day range:

- Support Levels:

- $3,280: Friday’s intra‑day low.

- $3,260: June 25/26 swing lows.

- Resistance Levels:

- $3,300: June 27 opening high.

- $3,320: June 19 peak.

- Momentum Indicators: The 14‑day Relative Strength Index (RSI) sits near 42, suggesting room for both downside and upside before oversold/overbought extremes .

Trading Signals:

- A sustained close below $3,280 could trigger stops toward $3,260.

- A reclaim of $3,300 may invite short‑covering rallies back to $3,320.

Gold Price Analysis Forecast Today for June 30, 2025 – Expectations Until Market Close

Based on the confluence of drivers, here’s our gold price analysis forecast today for June 30, 2025:

- Morning Session (Asia & Europe):

- Likely range: $3,280–$3,295 as markets digest global PMI prints.

- U.S. Midday Session (ISM Release at 10:00 a.m. ET):

- Scenario A – Soft ISM (<49.0): Gold may surge toward $3,305–$3,310.

- Scenario B – Strong ISM (>50.0): Expect a pullback to $3,265–$3,275.

- Afternoon Session & Close:

- Watch for Eurodollar futures reaction to Fed Fund Rate odds and any Fed‑speaker commentary.

- Absent surprises, bullion could settle near $3,285–$3,290.

Tactical Tip:

Intraday traders should monitor the 30‑minute VWAP as dynamic support/resistance and align entry/exit levels within today’s defined range.

Conclusion: Summarizing Our Gold Price Analysis Forecast Today for June 30, 2025

Our gold price analysis forecast today for June 30, 2025 highlights a market balancing steady inflation readings, fading geopolitical jitters, robust central‑bank demand, and mixed economic indicators. Technically, gold remains range‑bound between $3,260 and $3,320, with today’s PMIs and ISM Manufacturing Index likely to dictate the next directional leg. Traders can capitalize on intraday volatility by aligning with these critical levels, while longer‑term investors may view dips toward $3,260 as tactical buying opportunities, given the strong fundamental backdrop.

Key Takeaways:

- Open: $3,286.71 (–0.38%)

- Inflation: May PCE +0.2% M/M, +2.7% Y/Y

- Geopolitics: Eased Israel‑Iran tensions cut safe‑haven premium

- Central Banks: 93% to maintain/increase gold reserves

- Economic Catalysts: Eurozone PMI, U.S. ISM Manufacturing at 10:00 a.m. ET

- Technical Range: $3,280–$3,320; watch RSI 42 for momentum clues

Stay agile through today’s data releases and technical tests—each could tip the balance between a short‑term rally or deeper consolidation. Trade wisely!