In today’s dynamic precious metals landscape, understanding the interplay between the gold loan and leasing markets and spot prices is crucial for market participants. While many investors focus on physical demand, ETF flows, and central bank purchases, the often-overlooked world of gold lending and leasing plays a pivotal role in shaping daily price movements.

This article dives deep into the mechanics of the gold loan and leasing markets, explores how they feed into supply and demand for immediate delivery, and examines their direct and indirect impacts on spot gold prices. Whether you’re an institutional trader, a private investor, or simply curious about bullion market dynamics, this comprehensive guide offers actionable insights to enhance your understanding and strategy.

1. Overview of the Gold Loan and Leasing Markets

1.1 What Are Gold Loans?

A gold loan occurs when a holder of physical gold—often a central bank, a bullion bank, or a major gold producer—lends metal to another market participant in exchange for collateral (typically cash or other high-quality assets) and a lending fee, known as the lease rate. These transactions usually take place over short to medium durations, ranging from overnight to several months. Gold loans enable lenders to earn additional income on idle metal and borrowers to obtain physical gold without immediate mining or purchase costs.

1.2 What Is Gold Leasing?

Gold leasing is closely related to gold loans but often involves longer-term arrangements, sometimes up to a year or more. The lessee pays a periodic lease fee, analogous to an interest rate, for the right to use the gold. Lease contracts are standardized through bodies such as the London Bullion Market Association (LBMA), which publishes daily gold lease rates, providing transparency and benchmarks for participants.

1.3 Key Players in Gold Lending and Leasing

- Central Banks: Often major lenders, using gold loans to generate returns on reserves.

- Bullion Banks: Act as intermediaries, borrowing from some entities and lending to others, profiting from the spread between deposit and lending rates.

- Gold Producers: Lease portions of forward output to secure financing and stabilize cash flows.

- Hedge Funds and Industrial Users: Borrow gold for short-selling, coin minting, or industrial applications.

2. Mechanics of Gold Loans and Their Effects on Supply

2.1 The Gold Loan Workflow

- Initiation: Lender offers gold and borrower agrees on quantity, duration, and rate.

- Collateral Exchange: Borrower posts collateral, often in USD or G10 currencies.

- Transfer of Metal: Actual metal moves into borrower’s vault, increasing available spot supply.

- Lease Fee Payments: Periodic fees accrue, settled either in metal or cash.

- Return and Settlement: At maturity, borrower returns equivalent metal, collateral is released, and net fees settled.

2.2 Impact on Immediate Metal Availability

When gold is lent into the market, the recipient can choose to:

- Sell Immediately: Adding to spot market supply and temporarily pressuring prices.

- Hold for Delivery: Fulfilling forward contracts or ETF redemptions without drawing from mine output.

This dynamic means that spikes in gold loan volumes often correlate with increased spot liquidity, which can mute upward price pressure, especially during times of heightened demand.

3. Gold Lease Rates and Their Significance

3.1 Understanding the Gold Lease Rate

The gold lease rate functions like an interest rate for borrowing gold. Quoted annually, it represents the cost per ounce per year to lease bullion. The LBMA publishes the average lease rate each business day, reflecting prevailing market conditions.

3.2 Interpreting Lease Rate Movements

- Rising Lease Rates: Signal tighter availability of lendable gold. Higher costs may deter new borrowing, reduce immediate spot supply, and support higher spot prices.

- Falling Lease Rates: Indicate abundant lendable metal, encouraging more gold loans, boosting spot supply, and potentially capping price rallies.

3.3 Drivers of Lease Rate Fluctuations

- Central Bank Behavior: Large lenders reducing their loan programs can push rates up.

- Global Liquidity Conditions: When dollar liquidity strains emerge, borrowers may prefer to hold cash, reducing gold loans and raising rates.

- Mining Production: Unexpected increases in mine output can enlarge lending pools, lowering lease rates.

4. Interaction with the Spot Market

4.1 Spot Price Determination

The spot gold price represents the cost for immediate delivery, based on real-time supply and demand. Key inputs include:

- Physical Selling: Banks converting leased gold to cash.

- ETF Rebalancing: ETFs redeeming or issuing shares impacting daily metal flows.

- Miners’ Hedging: Producers borrowing gold for forward sales, influencing short-term supply.

4.2 Hedging and Arbitrage Opportunities

Sophisticated traders monitor lease rate–spot price relationships to exploit arbitrage:

- Cash-and-Carry Arbitrage: When lease rates are low, borrow gold cheaply and sell spot, invest proceeds at higher interest—locking in risk-free profit.

- Reverse Cash-and-Carry: When lease rates spike, buy spot metal and lease it out, capturing high lease fees.

These arbitrage activities smooth out extreme deviations between lease and spot markets, reinforcing the linkage between the two.

5. Case Studies: Lease Market Shocks and Spot Price Reactions

5.1 2008 Financial Crisis

During the 2008 crisis, global liquidity pressures caused gold lease rates to skyrocket, briefly exceeding 10% annually as banks hoarded physical bullion. Spot prices initially dipped on forced selling but soon surged as investors sought safe-haven assets. The turmoil demonstrated how constraints in the gold lending market can translate into reduced spot liquidity and higher prices.

5.2 COVID-19 Pandemic

In early 2020, sudden demand for cash and disruptions in vault logistics led to tightness in gold lease availability. Lease rates turned sharply negative—meaning borrowers received payment to take gold—while spot gold rallied from $1,500 to $2,050 per ounce. The episode underscored the dramatic interplay between lease market stress and spot price appreciation.

6. Central Bank Gold Leasing and Monetary Policy

6.1 Reserve Management Strategies

Central banks that lease gold generate non-interest income on reserves, but they must balance:

- Income Needs: Higher lease volumes raise revenue.

- Market Signaling: Excessive leasing during turbulent times can destabilize prices.

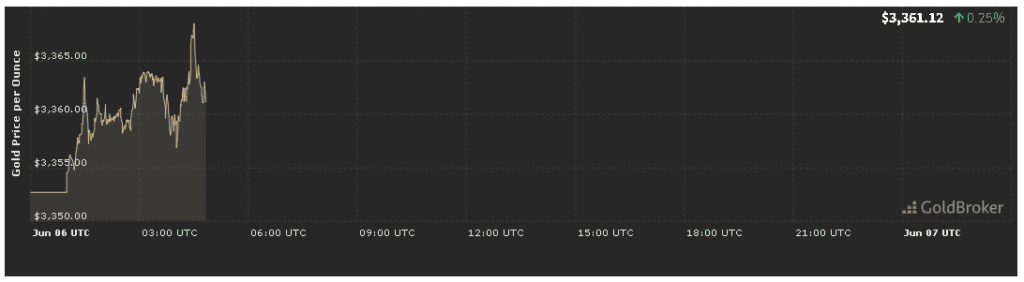

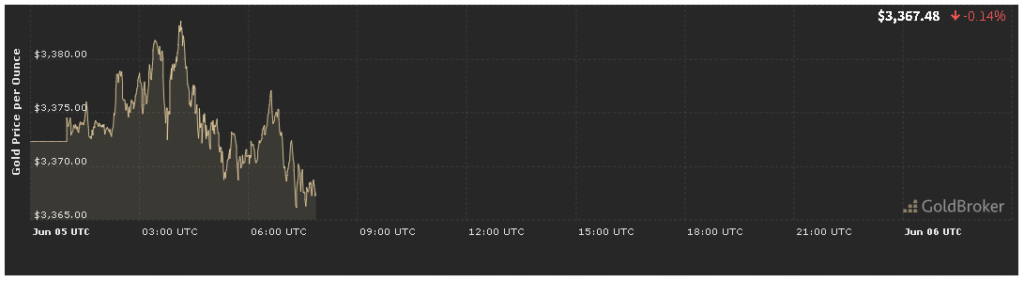

As Gold Price Analysis Today for June 6, 2025 highlights, policymakers may throttle leasing to avoid exacerbating spot volatility.

6.2 Gold Swaps vs. Leases

A related tool is the gold swap, wherein a central bank exchanges gold for foreign currency with an agreement to reverse the transaction later. These swaps differ from pure leases but similarly affect spot availability. During periods of FX market stress, gold swaps can flood the spot market with extra metal, influencing daily price movements.

7. Practical Implications for Traders and Investors

7.1 Monitoring Lease Rate Indicators

Active gold traders should track daily LBMA lease rates alongside:

- Commitments of Traders (COT) Reports: To gauge speculative positioning.

- ETF Flow Data: Spot inflows/outflows hint at physical demand.

- Mining Production Reports: For shifts in lendable supply.

7.2 Integrating Lease Dynamics into Trading Strategies

- Trend Confirmation: Rising lease rates concurrent with spot breakouts signal robust bullish momentum.

- Mean Reversion Plays: Excessively high lease rates often revert as arbitrageurs enter the market, leading to spot pullbacks—presentation of shorting opportunities.

7.3 Long-Term Allocation Considerations

For long-term investors, understanding the stability of the lending market—indicated by consistent, moderate lease rates—provides confidence in gold’s ability to act as a store of value without unexpected supply shocks.

8. Future Outlook for Gold Loan, Leasing, and Spot Markets

8.1 Digital Gold Lending Platforms

Emerging fintech solutions now offer peer-to-peer digital gold lending, increasing transparency and broadening participation. While still nascent, these platforms may eventually feed into traditional lease markets, altering supply dynamics and potentially compressing lease rate volatility.

8.2 Central Bank Digital Currencies (CBDCs) and Gold

The advent of CBDCs could reshape cross-border gold swaps and lending by offering new collateral mechanisms. As Gold Price Analysis Today for June 6, 2025 suggests, evolving monetary frameworks may introduce fresh correlations between digital liquidity and gold lease availability.

8.3 Environmental, Social, and Governance (ESG) Trends

With rising ESG scrutiny, counterparties may seek “green” collateral options, reducing gold’s role in window-dressing balance sheets. This shift could tighten lendable metal inventories, pushing lease rates—and by extension, spot prices—higher during ESG-driven portfolio rotations.

Conclusion

The gold loan and leasing markets are indispensable yet underappreciated drivers of spot gold prices. Through loans, leases, swaps, and arbitrage, these markets dictate short-term supply, influence liquidity, and shape investor behavior. By mastering the nuances of lease rate movements, central bank strategies, and the mechanics of gold borrowing, traders and investors can better anticipate spot price trends and capitalize on arbitrage opportunities. As the financial landscape evolves—with digital lending, CBDCs, and ESG considerations—understanding the gold lending ecosystem will remain vital for navigating bullion markets successfully.

Stay informed, monitor lease rates daily, and integrate these insights into your gold strategy to truly leverage the power of the loan and leasing markets in shaping spot prices.