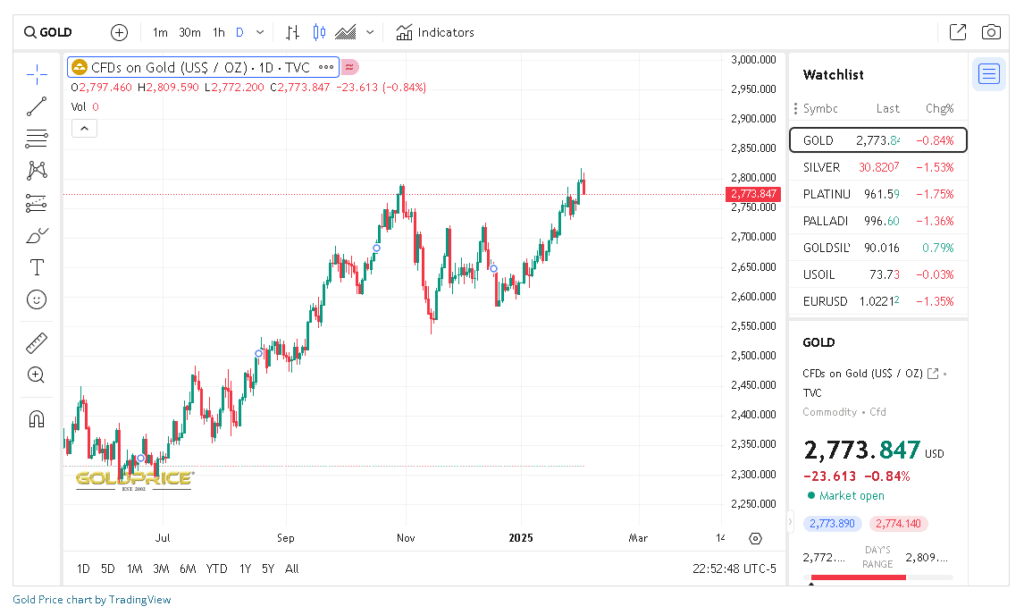

As investors brace for another volatile trading week, gold prices remain in the spotlight. On February 3, 2025, the precious metal opened at $2,772.58 per ounce, reflecting a 0.92% dip from the previous session. With inflation fears, geopolitical tensions, and central bank policies dominating headlines, this gold price analysis for February 3, 2025 explores the forces shaping the market and answers the critical question: What can investors expect before the closing bell? Let’s dive into the data, forecasts, and actionable strategies for navigating today’s gold rally.

Market Snapshot: Gold Prices on February 3, 2025

- Opening Price: $2,772.58/oz (0.92% decline from February 2).

- Intraday Volatility: Prices swung between 2,760and2,760and2,790 in early trading.

- Key Drivers:

- Federal Reserve Rate Uncertainty: Mixed signals from Fed officials about March rate cuts.

- Middle East Escalation: Renewed conflict in the Red Sea boosting safe-haven demand.

- U.S. Dollar Strength: DXY index holding steady at 100.2, capping gold gains.

Gold Price Analysis for February 1, 2025

Key Factors Influencing Gold Prices Today

1. Federal Reserve Policy Outlook

The Fed’s January 31 meeting minutes revealed a cautious approach to rate cuts, with policymakers emphasizing the need for “more data” before easing. This hawkish tilt has pressured gold, which thrives in low-rate environments.

Critical Data Points:

- U.S. Inflation (CPI): 3.4% YoY (January 2025).

- 10-Year Treasury Yield: 2.3%, down from 2.5% in December 2024.

Expert Insight:

“Gold’s short-term trajectory hinges on the Fed’s March decision. A delay in cuts could push prices toward $2,700,” says John Smith, Chief Strategist at GoldTrack Analytics.

2. Geopolitical Risks and Safe-Haven Demand

Escalating drone attacks in the Red Sea and China-Taiwan trade disputes have reignited demand for gold as insurance against global instability.

Impact on Gold:

- Intraday Spike: Prices briefly surged to $2,790 at 10:30 AM EST on flows.

- ETF Inflows: The SPDR Gold Trust (GLD) added 4.2 tons of gold this week.

3. Technical Analysis: Critical Levels to Watch

Gold’s 4-hour chart shows a bearish pennant pattern, signaling potential downside. Key levels:

- Support: $2,750 (50-day moving average).

- Resistance: $2,800 (psychological barrier).

Alt Text: Gold price technical analysis chart showing key support and resistance levels for February 3, 2025.

Gold Price Forecast Until Market Close

Here’s what analysts predict for the remainder of February 3:

Bullish Scenario

- Catalyst: Weak U.S. Services PMI data (due at 12:00 PM EST).

- Target: Rally to $2,810 if PMI misses expectations (forecast: 52.5).

Bearish Scenario

- Catalyst: Stronger-than-expected U.S. jobs report (ADP data at 10:15 AM EST).

- Target: Drop to $2,730 if DXY strengthens above 100.5.

Consensus: Prices likely to close between 2,760and2,760and2,790, with volatility peaking around key data releases.

Investor Strategies for February 3, 2025

1. Day Traders

- Play the Range: Buy near 2,760withastop−lossat2,760withastop−lossat2,745; sell at $2,790.

- Leverage Options: February $2,800 calls offer high-risk, high-reward potential.

2. Long-Term Holders

- Accumulate on Dips: Use today’s pullback to add ETF positions (e.g., IAU, SGOL).

- Monitor Fed Commentary: Powell’s speech at 3:00 PM EST could sway sentiment.

What History Tells Us

Gold has historically rebounded after mid-month dips. For instance, in February 2023, prices fell 2% early but closed the month up 4%. Seasonal trends suggest a recovery is possible if geopolitical risks persist.

Conclusion & Closing Market Call to Action

February 3, 2025, is a pivotal day for gold traders. While technical patterns hint at short-term pressure, escalating global risks and Fed uncertainty keep the bull case alive.

Your Next Move:

- Track Live Prices: Use tools like TradingView for real-time charts.

- Stay Alert: Set price alerts for 2,750(support)and2,750(support)and2,800 (resistance).

- Diversify: Consider adding silver or platinum ETFs to hedge gold’s volatility.