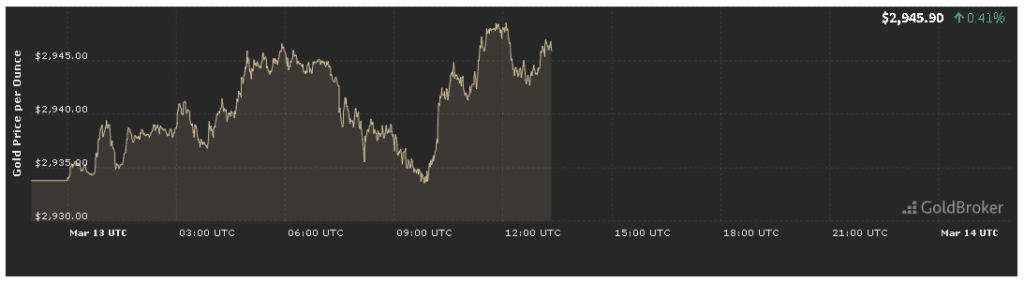

Gold remains one of the most sought-after assets for investors seeking stability and a hedge against economic fluctuations. On March 13, 2025, gold opened at $2,946.34 per ounce, marking an increase of 0.43% from the previous trading session. This uptick signals renewed investor interest, driven by global economic conditions, inflation concerns, and ongoing geopolitical developments.

In this Gold Price Analysis for March 13, 2025, we will examine the key factors behind this price movement, analyze technical indicators, and provide insights into expectations for the remainder of the trading day. Whether you’re a seasoned investor or new to gold trading, this comprehensive guide will help you navigate today’s gold market.

Economic Factors Influencing Gold Prices

Gold prices are influenced by a combination of macroeconomic indicators, monetary policies, and market sentiment. Let’s explore the key factors driving today’s price increase.

1. Inflation and Interest Rates: Gold’s Role as an Inflation Hedge

Inflation remains a critical factor impacting gold prices. Historically, gold has been used as a hedge against inflation, as its value tends to rise when the purchasing power of fiat currencies declines.

- Current Inflation Trends:

Recent economic reports indicate that inflation levels are stabilizing but remain above pre-pandemic averages. This persistent inflation has led investors to increase their gold holdings to protect against currency devaluation. - Interest Rate Policy:

The U.S. Federal Reserve and other central banks continue to balance interest rate hikes with the need for economic growth. While rate hikes typically dampen gold demand by making yield-bearing assets like bonds more attractive, a potential slowdown in rate hikes has renewed gold’s appeal.

Today’s 0.43% increase in gold prices may reflect market expectations that central banks will adopt a more dovish stance in upcoming policy decisions.

2. The Strength of the U.S. Dollar and Treasury Yields

Gold prices often move inversely to the U.S. dollar and Treasury yields.

- U.S. Dollar Index:

The U.S. dollar has shown slight weakness today, making gold more affordable for international buyers. A weaker dollar tends to boost gold demand, contributing to today’s price increase. - Bond Yields:

Treasury yields remain relatively stable, but a lack of strong returns on bonds has encouraged investors to diversify into gold, reinforcing its upward momentum.

If the dollar weakens further or Treasury yields decline, gold prices could continue rising throughout the day.

3. Geopolitical Events and Market Sentiment

Geopolitical instability often pushes investors toward safe-haven assets like gold. Several key global events continue to shape market sentiment:

- Tensions in Eastern Europe: While diplomatic efforts are ongoing, uncertainty regarding political conflicts in Ukraine and Russia continues to influence investor behavior.

- Middle East Developments: Regional instability has added to market caution, prompting increased demand for gold.

- Global Trade Concerns: Unresolved U.S.-China trade negotiations and supply chain disruptions are reinforcing gold’s role as a store of value.

The modest 0.43% price rise suggests that while gold remains a preferred safe-haven asset, investors are carefully monitoring these geopolitical developments.

Technical Analysis: Key Gold Price Levels

To understand where gold prices might head next, we examine key technical indicators and support/resistance levels.

1. Support and Resistance Levels

- Support Level: $2,920 per ounce – If gold declines, this level could attract buying interest from investors looking for entry points.

- Resistance Level: $2,970 per ounce – A breakout above this level could indicate further bullish momentum, pushing gold toward $3,000 per ounce.

2. Moving Averages and Trend Analysis

- 50-Day Moving Average: Positioned near $2,935 per ounce, providing short-term support.

- 200-Day Moving Average: Still bullish, suggesting that gold’s long-term upward trend remains intact.

- Relative Strength Index (RSI): Currently around 52-55, indicating that gold is in a neutral zone, leaving room for potential price movement in either direction.

If trading volume increases, it may confirm whether gold will break through resistance or remain range-bound.

Expectations for Gold Until Market Close

Given today’s economic indicators and technical analysis, here are three possible scenarios for gold’s price movement by market close.

1. Bullish Scenario: Further Upside Toward $2,970-$2,980

If safe-haven demand remains strong and the U.S. dollar weakens further:

- Gold could break above $2,970 per ounce, triggering a short-term rally.

- Key catalysts include weaker inflation data, central bank policy shifts, or increased geopolitical uncertainty.

- A surge in trading volume could push gold toward $2,980 per ounce before the market closes.

2. Range-Bound Scenario: Consolidation Between $2,920 and $2,970

If market sentiment remains stable but cautious, gold may trade sideways within today’s range.

- Investors will watch for key economic reports from the U.S. and Europe that could shift sentiment.

- Short-term traders may capitalize on price fluctuations within this range, buying near support and selling near resistance.

- Low volatility could limit any major price movement.

3. Bearish Scenario: A Drop Below $2,920

If economic optimism increases or bond yields rise:

- Gold could decline below $2,920 per ounce, triggering additional selling pressure.

- Possible catalysts include strong economic data, hawkish Fed commentary, or continued dollar strength.

- In this scenario, gold may test lower support levels near $2,900 per ounce.

Key Takeaways for Investors

- Short-Term Traders: Watch $2,970 as resistance and $2,920 as support for possible breakout opportunities.

- Long-Term Investors: Despite short-term fluctuations, gold remains a strong hedge against inflation and market uncertainty.

- Risk Factors to Monitor: Upcoming U.S. economic reports, Federal Reserve statements, and geopolitical developments could drive price movements.

Conclusion: Gold Market Remains Strong Amid Economic Uncertainty

The Gold Price Analysis for March 13, 2025, highlights a 0.43% increase, bringing gold to $2,946.34 per ounce at market open. This moderate rise reflects a combination of inflation concerns, U.S. dollar movements, and geopolitical uncertainties that continue to drive investor demand for gold.

Looking ahead, gold’s price trajectory will depend on economic data, central bank policy shifts, and global risk factors.

- If safe-haven demand rises, gold could break through $2,970 per ounce and trend higher.

- If economic optimism prevails, gold may remain range-bound or decline below $2,920 per ounce.

Regardless of short-term fluctuations, gold remains a key asset for portfolio diversification and wealth preservation. Investors should stay informed, monitor market trends, and adjust their strategies accordingly.

🔔 Stay updated on gold market trends and economic developments to make well-informed investment decisions. Happy trading!