Introduction: Gold Price Analysis Forecast Today for July 4, 2025

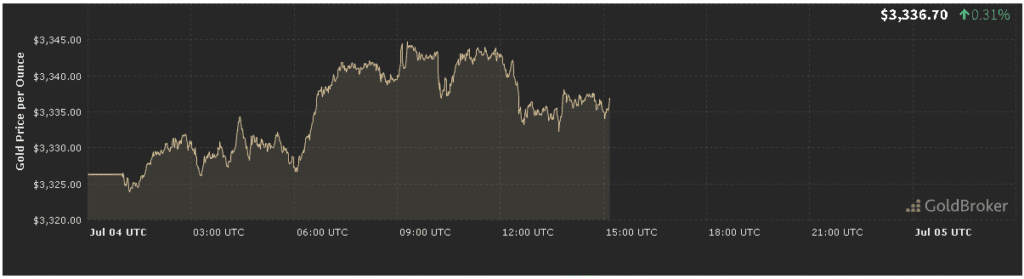

In our gold price analysis forecast today for July 4, 2025, spot gold opened at $3,335.83 per ounce, up 0.29% from yesterday’s close. This modest gain reflects a continued balance between softer U.S. inflation signals, easing Middle East tensions, and ongoing central‑bank buying. As traders prepare for U.S. Independence Day with a light economic calendar, this exclusive report will unpack the real drivers behind gold’s moves, analyze key technical indicators, and outline expectations through today’s closing bell.

Market Overview

Yesterday’s session saw gold trade narrowly between $3,325 and $3,340 before closing near $3,326. Today’s morning open received mild support from equity profit‑taking and a slight dip in risk appetite ahead of the holiday. In Asian trading, gold fluctuated in a tight $3,330–$3,338 range, while U.S. Comex futures slid marginally before tomorrow’s holiday. Our gold price analysis forecast today for July 4, 2025 suggests that today’s moves will hinge largely on technical developments and psychological support around $3,330.

Inflation Indicators

CPI and PCE Data

- Consumer Price Index (CPI): On June 30, the U.S. Bureau of Labor Statistics reported a 0.1% month‑on‑month rise in June, with the annual rate holding at 2.4%, down slightly from 2.5% in May.

- Personal Consumption Expenditures (PCE) Index: Core PCE (excluding food and energy) is due next Thursday, with forecasts of +0.1% month‑on‑month and +2.6% year‑on‑year.

Implication: Slower headline inflation bolsters expectations that the Fed will hold rates in the 5.00%–5.25% range for longer, capping real‑yield gains and supporting gold’s role as an inflation hedge.

Geopolitical Developments

Middle East Tensions and Gold’s Safe‑Haven Appeal

Recent weeks have seen flare‑ups and de‑escalations between Israel and Iran, including a temporary truce and diplomatic talks. Yet threats to oil tankers in the Gulf of Oman and Red Sea continue to underpin safe‑haven demand for gold.

- Watchpoint: Any breakdown of the truce or new attacks on commercial shipping could drive gold up to $3,360–$3,380.

- Risk Premium: Market analysts estimate current geopolitical risk is adding $10–$12 per ounce to gold’s spot price.

Central Bank Trends

Steady Official Sector Buying

Central banks continue to accumulate gold at a brisk pace. A mid‑June World Gold Council poll found 89% of reserve managers plan to increase or maintain their gold allocations over the next 12 months.

- Recent Purchases: The People’s Bank of China and the Reserve Bank of India added approximately 70 tonnes in H1 2025.

- Structural Support: Ongoing official buying creates a strong price floor near $3,300, limiting chances of sharp declines.

Economic Releases

U.S. Retail Sales and Industrial Production

Although today’s calendar is light, watch for:

- Retail Sales (June): Expected at +0.3% month‑on‑month, following a +0.4% gain in May.

- Industrial Production (June): Forecast to rise 0.1%, after stalling in May.

Why It Matters:

- Weaker‑than‑expected figures could heighten economic slowdown concerns and boost gold.

- Strong data may push yields higher, weighing on bullion.

Technical Outlook

Support and Resistance Levels

Gold is trading within a well‑defined technical range:

- Immediate Support:

- $3,330–$3,335 (today’s open and Asian session lows)

- $3,300 (psychological floor and official‑buying support)

- Initial Resistance: $3,360 (last week’s high)

- Secondary Resistance: $3,380 (key psychological and technical level)

The 14‑day RSI sits at 55, indicating moderate momentum with room to rally before reaching overbought levels.

Intraday Expectations

Based on today’s mix of catalysts, our gold price analysis forecast today for July 4, 2025 outlines:

- Morning Session (Asia & Europe):

- Expected range $3,330–$3,345 as markets digest early retail‑sales data.

- U.S. Midday (After Releases):

- Bearish Scenario: Retail Sales miss expectations → Gold rises to $3,350–$3,360.

- Bullish Scenario: Strong Retail Sales → Price retraces toward $3,320–$3,330.

- Afternoon & Pre‑Close:

- Monitor U.S. Treasury yields on the 10‑year note.

- In absence of surprises, bullion may settle near $3,340–$3,350.

Tactical Tip: Use the 30‑minute VWAP as dynamic intraday support and resistance—scale into dips close to $3,330 and trim positions near $3,360.

Conclusion

Our gold price analysis forecast today for July 4, 2025 highlights a market balanced between cooling inflation, intermittent geopolitical risks, robust central‑bank demand, and mixed U.S. economic data. Technically, gold remains bound by $3,330 support and $3,360 resistance, with today’s retail‑sales and production figures poised to break the stalemate. Day traders can target entries around these pivot points, while longer‑term investors may view any dip toward $3,330 as a tactical buying opportunity given the solid fundamental backdrop. Trade wisely!