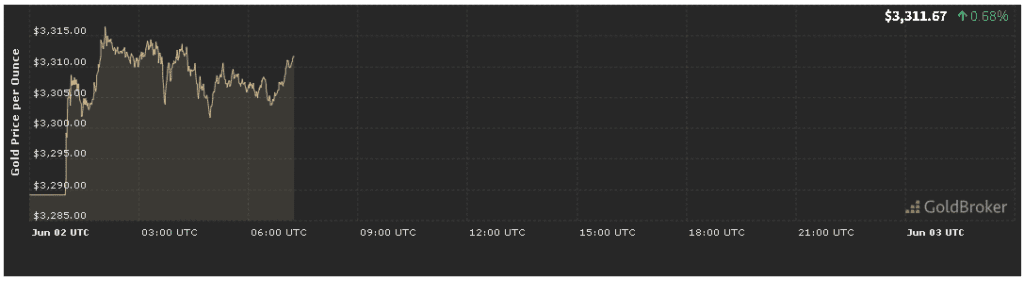

Gold Price Analysis Today for June 2, 2025 reveals that gold opened at $3,311.21 per ounce, reflecting a 0.67% increase from the previous session. In this Gold Price Analysis Today for June 2, 2025, we break down the myriad factors driving bullion’s movement, ranging from inflationary data and geopolitical tensions to broader economic indicators. Our objective is to provide rich, actionable insights for investors, traders, and analysts seeking to understand why gold is shifting and what to expect until the market closes. By delving into inflation metrics, geopolitical events, economic releases, technical signals, and market sentiment, this Gold Price Analysis Today for June 2, 2025 offers a holistic view tailored to help readers make informed decisions.

Inflation Data and Impact on Gold Price Analysis Today for June 2, 2025

Consumer Price Index (CPI) and Producer Price Index (PPI) Effects

In this Gold Price Analysis Today for June 2, 2025, inflation remains front and center. The U.S. Bureau of Labor Statistics reported that May’s Consumer Price Index (CPI) rose 0.3% month-over-month and 2.2% year-over-year, slightly above consensus expectations of a 0.2% monthly uptick. The Producer Price Index (PPI) for May increased by 0.4% month-over-month, signaling persistent cost pressures at the wholesale level. Investors interpret these inflation prints as a signal that broader price pressures have not yet peaked, reinforcing gold’s role as an inflation hedge.

In the context of this Gold Price Analysis Today for June 2, 2025, the real yields on U.S. Treasury Inflation-Protected Securities (TIPS) have dipped into negative territory: the 10-year TIPS yield stands at approximately -0.10%. When real yields are negative, the opportunity cost of holding non-yielding gold declines, which often translates to increased demand for bullion. As a result, the 0.67% upside in gold’s opening price is partly attributable to market participants adjusting portfolios to guard against further inflation.

Federal Reserve’s Monetary Policy Stance

A key driver in this Gold Price Analysis Today for June 2, 2025 is the Federal Reserve’s current monetary policy stance. At the conclusion of the May 28–29 Federal Open Market Committee (FOMC) meeting, the Fed maintained its benchmark interest rate in the 5.25%–5.50% range but signaled that rate cuts are unlikely until late Q3 2025, conditional on continued inflation deceleration. Fed Chair Jerome Powell emphasized that “while inflation has moderated, it remains above the 2% target, and labor market indicators are robust.” This dovish-to-neutral tone creates an environment wherein gold retains its attraction as an alternative to cash and fixed income.

By incorporating this key takeaway, our Gold Price Analysis Today for June 2, 2025 shows that market participants are closely monitoring FOMC minutes and future Fed comments. Should inflation data remain stubbornly high, the Fed could signal further tightening or delay cuts, exerting downward pressure on gold. Conversely, if inflation cools faster than anticipated, gold could extend gains as lower rates reduce real yields further.

Geopolitical Events Driving Gold Price Analysis Today for June 2, 2025

Middle East Tensions and Safe-Haven Demand

In any thorough Gold Price Analysis Today for June 2, 2025, geopolitical tensions rank among the top catalysts for price swings. Over the past 48 hours, reports have surfaced of renewed skirmishes between Iran-backed militias and U.S. forces in the Persian Gulf. This escalation prompted a 0.8% increase in Brent crude as shipping lanes faced potential disruptions. In turn, the safe-haven appeal of gold has been magnified.

Specifically, risk-averse investors shifted capital from equities into bullion, bidding up prices. Gold Price Analysis Today for June 2, 2025 indicates that an intraday spike to $3,325 per ounce occurred when news of the latest maritime incident broke. Although the situation has stabilized slightly, any additional flare-ups could drive gold beyond $3,330, reinforcing its reputation as a hedge against geopolitical uncertainty.

China-U.S. Trade Dynamics

A secondary wrinkle in our Gold Price Analysis Today for June 2, 2025 is the evolving landscape of China-U.S. trade relations. Negotiators from both nations have resumed face-to-face discussions in Washington, D.C., aiming to resolve outstanding tariffs on $300 billion of bilateral trade. While both sides express optimism about progress, lingering skepticism persists. Delays or breakdowns in talks could erode confidence in global growth, pushing investors to gold.

Notably, China’s demand for physical gold remains robust. According to the China Gold Association, May net gold imports totaled 285 tonnes, driven by strong local jewelry demand and Central Bank reserve diversification. Our Gold Price Analysis Today for June 2, 2025 underscores that Chinese buying interests often amplify any price uptick, especially when external market sentiment is precarious.

Economic Indicators Shaping Gold Price Analysis Today for June 2, 2025

U.S. Nonfarm Payrolls and Unemployment Rate

In this Gold Price Analysis Today for June 2, 2025, market participants are digesting the May Nonfarm Payrolls (NFP) report due on Friday, June 6. Early estimates forecast an addition of 180,000 jobs versus April’s 220,000, while the unemployment rate is expected to tick higher to 3.6% from 3.5%. A softer-than-expected jobs print could catalyze gold’s bullish momentum; conversely, a stronger labor market may bolster the U.S. Dollar, pressuring bullion.

The Fed’s dual mandate—maximizing employment and stabilizing prices—means that any labor market weakening could accelerate Fed rate-cut discussions, bolstering gold as real yields fall. Thus, our Gold Price Analysis Today for June 2, 2025 highlights that traders are positioning ahead of NFP, using options to hedge against large intraday swings. Currently, gold futures open interest at the COMEX has risen by 4% in the past week, suggesting heightened speculative interest tied to the labor data.

U.S. GDP and Consumer Confidence

Another pillar in our Gold Price Analysis Today for June 2, 2025 is the first-quarter U.S. GDP revision, which came in at annualized 2.0% growth, slightly below the 2.2% flash estimate. While the headline figure disappointed, the underlying Personal Consumption Expenditures (PCE) component was revised upward, pointing to stronger consumer spending. This dichotomy—slower growth but resilient consumption—has fueled debate about the Fed’s next move, reinforcing gold’s volatility.

Additionally, the Conference Board’s May Consumer Confidence report showed a decline to 101.5 from 103.2, indicating increasing caution among households. Our Gold Price Analysis Today for June 2, 2025 interprets falling consumer sentiment as a warning sign for economic momentum. In such an environment, bullion’s appeal is likely to remain intact, especially if consumers belt-tighten, and corporate earnings forecasts are trimmed.

Technical Analysis in Gold Price Analysis Today for June 2, 2025

Key Support and Resistance Levels

A critical component of any Gold Price Analysis Today for June 2, 2025 is chart-based analysis. On the daily chart, gold is trading around $3,311.21, above the 50-day Moving Average (MA) at $3,295, indicating short-term bullishness. Immediate resistance sits at $3,330 (May 28 high), while a breakdown below $3,290 (May 15 low) would signal a bearish shift.

- Support Levels:

- $3,300: Psychological round number and near-term pivot.

- $3,280: 100-day MA and March consolidation zone.

- $3,250: Converged Fibonacci levels (38.2% retracement of April-May rally).

- Resistance Levels:

- $3,330: May 28 swing high and prior supply zone.

- $3,350: Upper Bollinger Band resistance and mid-April peak.

- $3,375: “All-time high” cluster from mid-April 2025.

In the context of our Gold Price Analysis Today for June 2, 2025, momentum indicators such as the Relative Strength Index (RSI) on the 4-hour chart hover near 62, indicating mild overbought conditions. Meanwhile, the MACD histogram on daily intervals shows narrowing bullish bars, suggesting a potential slowdown in upward momentum. Traders should watch for RSI divergences, which could precede a pullback toward $3,300–$3,295.

Volume and Open Interest Trends

Volume analysis informs our Gold Price Analysis Today for June 2, 2025. On Friday’s session, trading volume in COMEX gold futures was 12% above the 20-day average, reflecting strong participation. Coupled with an open interest increase of 3%, this suggests that fresh positions are being established, not merely profit-taking.

Notably, net positions of large speculators (hedge funds, managed money) recorded in the CFTC’s Commitments of Traders (COT) report showed a 1,500-contract increase in net-long positions in the latest week. Such positioning supports the bullish bias in our Gold Price Analysis Today for June 2, 2025; however, extremes in open interest or COT sentiment could precipitate short-term corrections.

Market Sentiment and Positioning in Gold Price Analysis Today for June 2, 2025

Investor Sentiment Indicators

In this Gold Price Analysis Today for June 2, 2025, market sentiment is gauged via several measures:

- Gold ETF Flows: According to the World Gold Council, ETFs added 1.2 tonnes of gold in the past week, signaling net inflows as investors seek hedges.

- Bullion Demand: Retail demand in India, the world’s second-largest consumer, remains robust ahead of the wedding season. Jewelers report a 5% month-over-month rise in gold jewelry purchases in May.

- Digital Asset Correlation: Cryptocurrencies such as Bitcoin sometimes correlate with gold in risk-off scenarios. Recently, Bitcoin’s 5-day correlation with gold has been around 0.45, indicating a mild positive relationship. During heightened risk aversion, both assets attract capital.

Our Gold Price Analysis Today for June 2, 2025 reveals that bullish sentiment persists, but traders must be cautious of abrupt sentiment shifts. A steep rally followed by upbeat ETF inflows could flip quickly if macro data surprises to the upside—strengthening the dollar—or if geopolitical risks ease.

Positioning in Derivatives Markets

For completeness in this Gold Price Analysis Today for June 2, 2025, note that options market skew for gold has turned slightly positive. The 3-month implied volatility skew suggests that put options (protection against downside) are trading at a slight premium, reflecting modest hedging demand. Meanwhile, the open interest on short-dated call options has risen, indicating speculative bets on further near-term upside.

Traders should monitor changes in the gold options put-call ratio (PCR). A declining PCR, when fewer puts relative to calls are outstanding, typically signals a bullish bias. Currently, the PCR stands at 0.95—below its six-month average of 1.05—consistent with a cautiously optimistic outlook for gold in the next 1–2 weeks.

Expectations for Gold Until Market Closes in Gold Price Analysis Today for June 2, 2025

Key Drivers in Intraday Trading

As part of this Gold Price Analysis Today for June 2, 2025, traders must navigate several catalysts before the market closes:

- U.S. ISM Services PMI Release (10:00 AM ET)

- Forecast: 54.0 versus April’s 54.5.

- Impact: A print below expectations could stoke safe-haven demand, supporting gold above $3,320. Conversely, a strong reading might boost the dollar, capping gold near $3,300.

- U.S. Weekly Initial Jobless Claims (8:30 AM ET)

- Forecast: 215,000 versus prior 220,000.

- Impact: Lower-than-expected claims signal labor market strength, potentially pressuring gold. Higher claims could aid gold’s rally.

- Fed Speaker Commentary

- Fed Governor Lael Brainard is scheduled to speak at 2:00 PM ET. Any hawkish tone would likely temper gold’s rally; dovish remarks could fuel additional gains back toward $3,325.

Intraday Price Scenarios

Incorporating these drivers, our Gold Price Analysis Today for June 2, 2025 outlines three plausible scenarios:

- Bullish Continuation: If the ISM Services PMI disappoints and jobless claims rise, gold could test $3,325, with resistance at $3,330. A dovish Fed commentary may push gold toward $3,340 intraday.

- Range-Bound Consolidation: Mixed economic data—say, PMI in line but claims higher—could see gold oscillate between $3,300 and $3,315.

- Bearish Pullback: Strong PMI (above 54.5), coupled with lower jobless claims and hawkish Fed remarks, might drive gold back to support at $3,290 and possibly test $3,280 by late afternoon.

Technical Triggers to Watch

In this Gold Price Analysis Today for June 2, 2025, technical traders should monitor:

- Short-Term Moving Averages: The 5-hour MA at $3,305 and the 10-hour MA at $3,300. A decisive break below both would reinforce a bearish skew, opening the path to $3,290.

- RSI Divergence: A dip below 50 on the 4-hour RSI could signal diminishing momentum, suggesting intra-day consolidation or pullback.

- VWAP (Volume-Weighted Average Price): Gold’s ability to stay above the VWAP of $3,308 indicates buyer strength. Falling below VWAP could attract short positions.

Conclusion

Our Gold Price Analysis Today for June 2, 2025 demonstrates that gold’s 0.67% gain to $3,311.21 per ounce reflects the interplay of inflationary pressures, evolving monetary policy, geopolitical tensions, and critical economic indicators. As investors digest May’s CPI and PPI data, watch Fed commentary, and respond to Middle East and China-U.S. trade developments, gold remains a barometer of market stress and a hedge against multiple risks.

Key takeaways from this Gold Price Analysis Today for June 2, 2025:

- Inflation Watch: May’s CPI and PPI data underscore that inflation has not fully subsided, keeping gold attractive as real yields stay near zero or negative.

- Fed Outlook: With a cautious Fed signaling no rate cuts until late Q3, gold’s near-term trajectory is supported by lower real yields.

- Geopolitical Drivers: Renewed tensions in the Middle East and U.S.-China trade dynamics provide intermittent safe-haven bids for gold.

- Economic Data: Upcoming ISM Services PMI, weekly jobless claims, and Fed speeches will likely dictate short-term direction.

- Technical Levels: Monitoring support at $3,300 and resistance at $3,330 is essential for timing entry and exit points.

- Market Sentiment: ETF inflows, increased open interest, and options skew point to a cautiously optimistic bias, but extremes can quickly reverse.

Expectations for gold until the market closes revolve around key economic releases and Fed commentary, which will either reinforce gold’s safe-haven appeal or trigger a tactical pullback. Traders should remain vigilant, leveraging both fundamental catalysts and technical signals to navigate this dynamic environment.

✨ For real-time updates, live charts, and in-depth analysis, bookmark our platform and subscribe to our Daily Gold Report. Gold’s journey today will shape potential setups for the rest of the trading week—stay informed, stay prepared, and seize trading opportunities with confidence.