By: (Exclusive Analysis for Dhbna Research Desk)

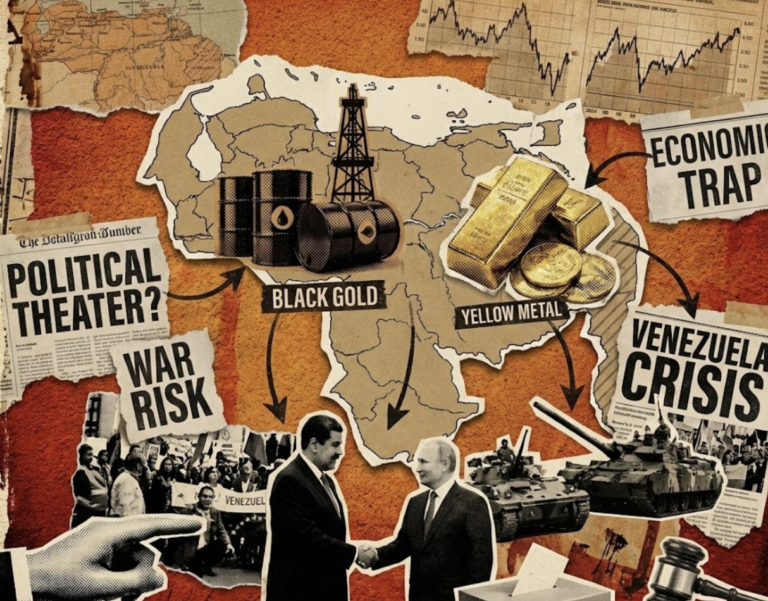

In the world of high finance, flashy headlines are often the “traps” set by market makers to ensnare the herd. Today, all eyes are fixated on Venezuela, that sleeping oil giant, amidst a media frenzy suggesting that the U.S. has effectively seized 40% of the world’s oil with the stroke of a pen.

But, away from the noise of breaking news, let us read between the lines. How do the threads of this geopolitical game intertwine with the path of Gold, the realities of the construction sector, and the truth about looming inflation?

1. The Illusion of Numbers vs. Geological Reality

Financial markets do not recognize reserves sleeping underground; they only respect the “barrel flowing through the pipeline.” While it is true that Venezuela floats on an ocean of oil, economic realism tells us that this oil is currently “comatose.” Years of mismanagement, crushing sanctions, and decaying infrastructure have made extracting this treasure a mission requiring years, not days. To claim that the U.S. has “instantly acquired” this oil is economic naïveté. Major players like ExxonMobil are not charities; they know that re-entering Caracas requires a legal framework and an investment climate that has not yet matured.

The Bottom Line: Oil supply will not flood the markets tomorrow. We are looking at a “long-term project,” not an immediate “supply shock.”

2. The U.S. Maneuver: Control Does Not Mean Ownership

What the White House is orchestrating now is not a commercial acquisition, but rather “Geopolitical Engineering.” The goal is to manage revenues and direct exports to serve U.S. interests. This move places a “heavy hand” on the energy spigot, but it does not mean prices will collapse overnight. It is an attempt to control the rhythm of future inflation. However, as every professional trader knows: “Markets price intentions, but they move on facts.”

3. Gold: The Silent Winner in the Game of Chaos

This is the crux of the matter, and the core of our focus at Dhbna. Some assume, superficially, that the equation is linear: (US controls oil = Cheap energy = Low inflation = Gold crash). This linear logic fails in the face of current market complexities:

- Gold Thrives on Tension: Political intervention of this magnitude creates a state of “Uncertainty.” Gold is the enemy of stability and the best friend of anxiety. The geopolitical risks inherent in this file make gold the primary Safe Haven for major portfolios fearing uncalculated reactions.

- The Dollar & Inflation Game: If the U.S. succeeds in lowering energy prices, inflation might dip temporarily. However, the cost of rebuilding Venezuela’s oil sector implies “money printing” or massive capital expenditure (CAPEX). This injects new liquidity into the system, and excess liquidity is historically gold’s fuel.

- Monetary Independence: Gold is an independent monetary asset. Even if oil retreats, concerns over global debt and the erosion of fiat currencies keep the yellow metal’s luster bright.

4. The Real Economy: Construction & Infrastructure

We cannot separate gold from the economic cycle. Rehabilitating Venezuelan fields means opening a “Global Workshop.”

- Construction & Infrastructure: This sector stands to be the biggest beneficiary. Oil service companies and construction firms could see a boom if the gates truly open.

- The Ripple Effect on Gold: Kickstarting the global economy might draw some liquidity from “safe havens” (Gold) toward “risk assets” (Equities/Real Estate) in the short term. However, any stumble in this massive project will send capital fleeing back to the warmth of gold.

Conclusion… The Dhbna Verdict

Do not be swept away by headlines portraying this as the “End of the Energy Crisis.” We are running a marathon, not a 100-meter sprint.

- Do not sell your gold based on an oil headline: Gold moves on “Real Rates” and “Fear,” and both are still very much present.

- Venezuela is a Long Story: It will not alter the inflation equation tomorrow. Therefore, do not expect an immediate collapse in commodities that drags gold down sharply.

- Hedging is King: In this tangle of oil, politics, and sanctions, gold remains the “Anchor” in your portfolio.

Final Word: Markets may fluctuate with every statement, but major trends only shift when facts on the ground change. And Gold, so far, is reading the room intelligently, holding onto its gains, waiting for a slip from the Federal Reserve, not a barrel from Caracas.

✦ Dhbna Research Desk View This analysis aligns with our core methodology: Geopolitical events are merely “catalysts,” not “trend changers,” unless accompanied by a structural monetary shift. Gold remains a vital strategic hedge amidst this fog.